Investment appraisal techniques advantages and disadvantages pdf

5-2 Project Evaluation Methods Used by the Entities Surveyed (a) The aggregate percentage exceeds 100% because most respondents used more than one method of project evaluation.

INVESTMENT APPRAISAL TECHNIQUES – PAYBACK PERIOD, NPV, IRR, ARR. 1. Payback period The payback period is the time taken to recoup the initial investment (in cash terms) out of its earnings.

The focus is especially on the investment appraisal methods and the investment process participants influencing the investment decision-making, since previous research has given reason to assume that these could be some of the causes of the energy paradox (Jaffe & Stavins,

Features, advantages, disadvantages and decision rules of each of the following investment appraisal techniques: payback, net present value, internal rate of return, …

This paper introduces the real options method of investment appraisal and its evolution. It discusses the It discusses the advantages and disadvantages of real options with regard to other commonly used investment methods and

Payback period is the time in which the initial cash outflow of an investment is expected to be recovered from the cash inflows generated by the investment. It is one of the simplest investment appraisal techniques.

Advantage and disadvantage of Investment Appraisal Tools Problems make investment decisions for a business or company need to be evaluated and scrutinized by investors when investors always want to earn profits for themselves, but there are also risks losing.

model (CAPM). This article is the last in a series of three, and looks at the theory, advantages, and disadvantages of the CAPM. The first article, published in the January 2008 issue of student

Investment appraisal techniques Introduction Investment is a key part of building your business. New assets such as machinery can boost productivity, cut costs and give you a competitive edge. New assets such as machinery can boost productivity, cut costs and give you a competitive edge.

Advantages. Companies compare the profitability of potential projects before making investment decisions. The IRR method of investment appraisal helps with these comparisons by providing percentage rates of return for each project.

investment appraisal techniques (9 items), and major constraints on capital investment (3 items). Five point Likert scale was used to collect the dataere 1 was the highest level of agreement , wh and 5 was the least level of agreement and the scale was adapted from the research paper

There are different techniques you can use which help you to assess the effects that spending money will have on your business. This is sometimes called ‘capital budgeting’ or ‘investment appraisal’. This is sometimes called ‘capital budgeting’ or ‘investment appraisal’.

Alternatively, companies could use discounted cash flow techniques discussed on this page, such as Net Present Value (NPV) and Internal Rate of Return (IRR). Cash flows and relevant costs For all methods of investment appraisal, with the exception of …

The Diagnosis of Traditional Capital Investment Appraisal

“Advantages and Disadvantages of Capital Budgeting Techniques”

Abstract: This paper reviewed principally accepted methods applied to investment analysis. To describe every aspect of investment analysis To describe every aspect of investment analysis fully would require far more space than available here, so we highlight only of few of its aspects.

variety of investment appraisals. A distinction can be made between static and dynamic investment appraisals. Examples of static investment appraisals are the comparative cost method, the average return method and the payback rule. The method of accumulation of an annuity, the net present value method and the internal rate of return method are representative of the dynamic investment appraisal

Articles, reports and other resources that enable accountants in business to make a real difference to their organisations by providing them with practical information on the latest thinking in investment appraisal.

In order to solve the inherent flaws of the traditional investment appraisal techniques and to include an additional evaluation of advantages in enhancing the competitive strategy, it is possible to distinguish two basic approaches in the scientific literature which will be …

Investment Appraisal Techniques: A Brief Survey. The goal of financial management is to increase the value of the firm (Ross, Westerfield & Jaffe, 2010).

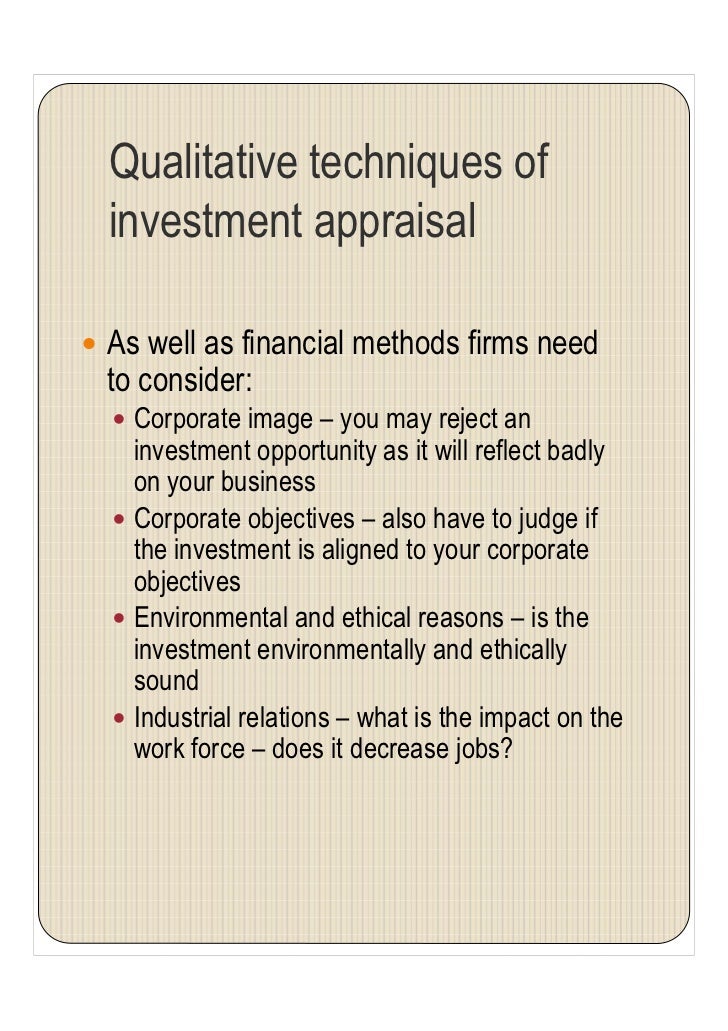

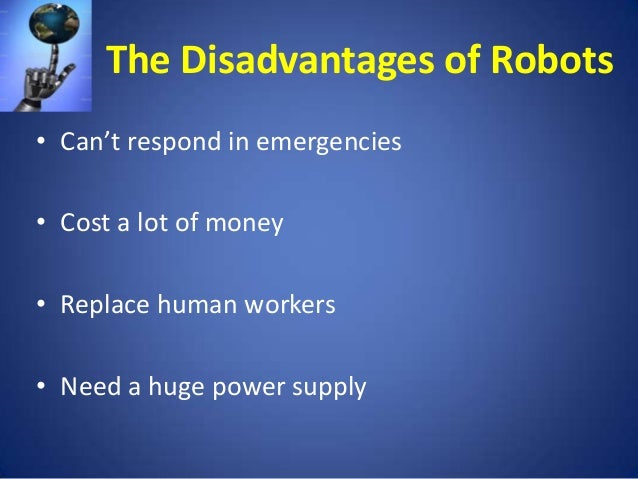

Investment appraisal should not be confined to financial appraisal and must take place within the overall strategy of the business. Managers should equip themselves to participate and contribute to all stages of the process. The investment appraisal process includes the generation of ideas, assessment and authorisation, implementation and control of the project. No appraisal technique can

Some of the major techniques used in capital budgeting are as follows: 1. Payback period 2. Accounting Rate of Return method 3. Net present value method 4. Internal Rate of Return Method 5. Profitability index.

4 Advantages & Disadvantages of Net Present Value in Project Selection Project appraisal methodologies are methods used to access a proposed project’s potential success and viability.

There are other more sophisticated methods of investment appraisal such as Advantages and disadvantages of ROCE . Advantages of ROCE as an investment appraisal technique include: simplicity . links with other accounting measures. Disadvantages include: no account is taken of project life . no account is taken of timing of cash flows . it varies depending on accounting policies . it may

CFA Level 1 – Advantages and Disadvantages of the NPV and IRR Methods. Learn the advantages and disadvantages to the NPV and IRR valuation methods. Explains why these two methods …

Study guide references E3(g), (h) and (i) refer explicitly to the Internal Rate of Return (IRR). Not only do candidates need to be able to perform the calculation, they need to be able to explain the concept of IRR, how the IRR can be used for project appraisal, and to consider the merits and problems of this method of investment appraisal.

26/06/2018 · Internal Rate of Return, or IRR, is an easy way to estimate the value of different projects, but it doesn’t account for other factors, like project size, that might be important.

Investment appraisal involves a series of techniques, which enable a business to financially appraise investment projects. Investment Appraisal It is a techniques use to determine if a particular investment is worthwhile.

investment appraisal, by the 1990s, Pike was reporting companies generally using four methods, up from the previous one or two, with far higher use of ‘sophisti- cated’ discounting methods.

However, traditional appraisal techniques are a powerful ways of appraising investment projects. There is a need though for all decision makers, when evaluating projects, to clearly understand of the pitfalls arising from the use of traditional appraisal techniques.

Methods of Investment Appraisal – Download as Word Doc (.doc), PDF File (.pdf), Text File (.txt) or read online. Scribd is the world’s largest social reading and publishing site. Search Search

Introduction to Investment Appraisal Techniques Firms throughout the world expand by starting projects and carrying out investments in different industries and sectors. An important building block in these investments is the analysis and later the evaluation of these projects on the basis of economic, cost and financial data.

Compared to other investment appraisal techniques such as the IRR and the discounted payback period, the NPV is viewed as the most reliable technique to support investment appraisal decisions. There are some disadvantages with the NPV approach. If there are several independent and mutually exclusive projects, the NPV method will rank projects in order of descending NPV values. However, a

https://youtube.com/watch?v=KraKeT_zgy8

Methods for investment appraisal Michael Rauch

The payback method does not take into account the time value of money. It does not consider the useful life of the assets and inflow of cash after payback period. For example, If two projects, project A and project B require an initial investment of ,000.

An organisation’s growth and its survival depend upon a continuous flow of new capital investment ideas. Firm prosperity depends more on the ability to generate profitable.

concepts used in investment appraisal (relevant cash flows and time value of money) and considers two particular techniques: the return on capital employed and the payback period. Chapter 2 – Advanced investment appraisal

Methods of Investment Appraisal Net Present Value

Capital investment appraisal techniques Advantages and disadvantages Advantages and disadvantages Types of capital investments: Internal capital investments External capital investments Traditional techniques: Accounting rate of return, Payback period Discounted cash flow techniques: Discounted payback period, Net present value, Internal rate of return. 5 1. Introduction (1) Capital

Investment appraisal is crucial to a business due to: Large sums are necessary to invest in projects and therefore care needs to be taken with the decisions, as they are difficult to reverse. It is difficult to estimate the potential future return of long-term investment so investment appraisal techniques need to be used to assess the risk and uncertainty of projects.

The various investment appraisal techniques lets a business assess the effect of an investment that will have on cashflow. There should be sufficient information required to know the project designed for, the different objectives of the project and analyse the benefits and drawbacks of the projects. If interest rates are considered to be high, individuals will be tempted to forgo current

BARS method of performance appraisal is considered better than the traditional ones because it provides advantages like a more accurate gauge, clearer standards, better feedback, and consistency in evaluation. However, BARS is not free from limitations.

If three projects have an equal investment and projected return a fixed period of time, they will all have the same ARR; but if one of those projects covers its investment costs within 1 year and the other only after 4 years, project 1 should be the clear winner.

Capital investment appraisal techniques a practising bookkeeper asked me recently how and by what methods one Mdep funding, Army management decision package, Pneumatic advantages and disadvantages, Advantages and disadvantages of hydraulics, Disadvantages of hydraulic systems, Advantages of hydraulic systems, Advantages of pneumatic systems, Advantages of hydraulics …

They explain what is meant by investment appraisal and its core purpose before looking at how to calculate and interpret the 3 main techniques of Payback, Average Rate of Return and Net Present Value. The slides evaluate each method and contain numerous practice examples and exercises along with suggested answers. They conclude with an evaluation of the advantages and disadvantages of

Other project appraisal methods 96 Suitability of different project evaluation techniques 97 Mutual exclusivity and project ranking 102 Asset replacement investment decisions 108 Project retirement 109 Concluding comments 111 Review questions 111 7 Project analysis under risk 114 Study objectives 115 The concepts of risk and uncertainty 115 Main elements of the RADR and CE techniques 116 The

38 financial management >studynotes PAPER P1 PERFORMANCE OPERATIONS Grahame Steven offers his guide to the development of four key investment appraisal methods – and their strengths and weaknesses.

THE USE OF PROFITABILITY INDEX IN ECONOMIC EVALUATION

Advantages and disadvantages of the IRR method of

Application of Investment Appraisal Techniques in Kanchipuram Modern Rice Mill February 2005 An organisation’s growth and its survival depend upon a continuous flow of new capital investment ideas.

as well as the advantages and disadvantages of using it through a case study. The case study shows a The case study shows a clear problem solving investment in case of the existence of several variants of industrial projects and

This book provides an introduction to investment appraisal and presents a range of methods and models, some of which are not widely known, or at least not well covered by other textbooks. Each approach is thoroughly described, evaluated and illustrated using examples, with its assumptions and

Investment Appraisal Report Essay Typing

Traditional Investment Appraisal Techniques Essay Example

Investment Appraisal Techniques Peterhouse Boys’ School

Advantage and disadvantage of Investment Appraisal Tools

Investment Appraisal Techniques Essay 1382 Words

Why Is the Investment Appraisal Process so Important

14 Capital Investment Appraisal Goodfellow Publishers

Investment Appraisal Techniques durmusozdemir.yasar.edu.tr

Methods for investment appraisal Michael Rauch

Investment Appraisal Report Essay Typing

This paper introduces the real options method of investment appraisal and its evolution. It discusses the It discusses the advantages and disadvantages of real options with regard to other commonly used investment methods and

In order to solve the inherent flaws of the traditional investment appraisal techniques and to include an additional evaluation of advantages in enhancing the competitive strategy, it is possible to distinguish two basic approaches in the scientific literature which will be …

This book provides an introduction to investment appraisal and presents a range of methods and models, some of which are not widely known, or at least not well covered by other textbooks. Each approach is thoroughly described, evaluated and illustrated using examples, with its assumptions and

Features, advantages, disadvantages and decision rules of each of the following investment appraisal techniques: payback, net present value, internal rate of return, …

The various investment appraisal techniques lets a business assess the effect of an investment that will have on cashflow. There should be sufficient information required to know the project designed for, the different objectives of the project and analyse the benefits and drawbacks of the projects. If interest rates are considered to be high, individuals will be tempted to forgo current

Some of the major techniques used in capital budgeting are as follows: 1. Payback period 2. Accounting Rate of Return method 3. Net present value method 4. Internal Rate of Return Method 5. Profitability index.

Advantages. Companies compare the profitability of potential projects before making investment decisions. The IRR method of investment appraisal helps with these comparisons by providing percentage rates of return for each project.

The payback method does not take into account the time value of money. It does not consider the useful life of the assets and inflow of cash after payback period. For example, If two projects, project A and project B require an initial investment of ,000.

concepts used in investment appraisal (relevant cash flows and time value of money) and considers two particular techniques: the return on capital employed and the payback period. Chapter 2 – Advanced investment appraisal

Articles, reports and other resources that enable accountants in business to make a real difference to their organisations by providing them with practical information on the latest thinking in investment appraisal.

model (CAPM). This article is the last in a series of three, and looks at the theory, advantages, and disadvantages of the CAPM. The first article, published in the January 2008 issue of student

Abstract: This paper reviewed principally accepted methods applied to investment analysis. To describe every aspect of investment analysis To describe every aspect of investment analysis fully would require far more space than available here, so we highlight only of few of its aspects.

Introduction to Investment Appraisal Techniques Firms throughout the world expand by starting projects and carrying out investments in different industries and sectors. An important building block in these investments is the analysis and later the evaluation of these projects on the basis of economic, cost and financial data.

They explain what is meant by investment appraisal and its core purpose before looking at how to calculate and interpret the 3 main techniques of Payback, Average Rate of Return and Net Present Value. The slides evaluate each method and contain numerous practice examples and exercises along with suggested answers. They conclude with an evaluation of the advantages and disadvantages of

Investment appraisal ICAEW

The Diagnosis of Traditional Capital Investment Appraisal

Advantages. Companies compare the profitability of potential projects before making investment decisions. The IRR method of investment appraisal helps with these comparisons by providing percentage rates of return for each project.

as well as the advantages and disadvantages of using it through a case study. The case study shows a The case study shows a clear problem solving investment in case of the existence of several variants of industrial projects and

Abstract: This paper reviewed principally accepted methods applied to investment analysis. To describe every aspect of investment analysis To describe every aspect of investment analysis fully would require far more space than available here, so we highlight only of few of its aspects.

There are other more sophisticated methods of investment appraisal such as Advantages and disadvantages of ROCE . Advantages of ROCE as an investment appraisal technique include: simplicity . links with other accounting measures. Disadvantages include: no account is taken of project life . no account is taken of timing of cash flows . it varies depending on accounting policies . it may

Investment appraisal techniques Introduction Investment is a key part of building your business. New assets such as machinery can boost productivity, cut costs and give you a competitive edge. New assets such as machinery can boost productivity, cut costs and give you a competitive edge.

model (CAPM). This article is the last in a series of three, and looks at the theory, advantages, and disadvantages of the CAPM. The first article, published in the January 2008 issue of student

Other project appraisal methods 96 Suitability of different project evaluation techniques 97 Mutual exclusivity and project ranking 102 Asset replacement investment decisions 108 Project retirement 109 Concluding comments 111 Review questions 111 7 Project analysis under risk 114 Study objectives 115 The concepts of risk and uncertainty 115 Main elements of the RADR and CE techniques 116 The

This book provides an introduction to investment appraisal and presents a range of methods and models, some of which are not widely known, or at least not well covered by other textbooks. Each approach is thoroughly described, evaluated and illustrated using examples, with its assumptions and

However, traditional appraisal techniques are a powerful ways of appraising investment projects. There is a need though for all decision makers, when evaluating projects, to clearly understand of the pitfalls arising from the use of traditional appraisal techniques.

An organisation’s growth and its survival depend upon a continuous flow of new capital investment ideas. Firm prosperity depends more on the ability to generate profitable.

They explain what is meant by investment appraisal and its core purpose before looking at how to calculate and interpret the 3 main techniques of Payback, Average Rate of Return and Net Present Value. The slides evaluate each method and contain numerous practice examples and exercises along with suggested answers. They conclude with an evaluation of the advantages and disadvantages of

Articles, reports and other resources that enable accountants in business to make a real difference to their organisations by providing them with practical information on the latest thinking in investment appraisal.

Advantages and disadvantages of the IRR method of

Investment Appraisal Report Essay Typing

investment appraisal, by the 1990s, Pike was reporting companies generally using four methods, up from the previous one or two, with far higher use of ‘sophisti- cated’ discounting methods.

There are other more sophisticated methods of investment appraisal such as Advantages and disadvantages of ROCE . Advantages of ROCE as an investment appraisal technique include: simplicity . links with other accounting measures. Disadvantages include: no account is taken of project life . no account is taken of timing of cash flows . it varies depending on accounting policies . it may

Features, advantages, disadvantages and decision rules of each of the following investment appraisal techniques: payback, net present value, internal rate of return, …

In order to solve the inherent flaws of the traditional investment appraisal techniques and to include an additional evaluation of advantages in enhancing the competitive strategy, it is possible to distinguish two basic approaches in the scientific literature which will be …

concepts used in investment appraisal (relevant cash flows and time value of money) and considers two particular techniques: the return on capital employed and the payback period. Chapter 2 – Advanced investment appraisal

CFA Level 1 – Advantages and Disadvantages of the NPV and IRR Methods. Learn the advantages and disadvantages to the NPV and IRR valuation methods. Explains why these two methods …

They explain what is meant by investment appraisal and its core purpose before looking at how to calculate and interpret the 3 main techniques of Payback, Average Rate of Return and Net Present Value. The slides evaluate each method and contain numerous practice examples and exercises along with suggested answers. They conclude with an evaluation of the advantages and disadvantages of

model (CAPM). This article is the last in a series of three, and looks at the theory, advantages, and disadvantages of the CAPM. The first article, published in the January 2008 issue of student

Payback period is the time in which the initial cash outflow of an investment is expected to be recovered from the cash inflows generated by the investment. It is one of the simplest investment appraisal techniques.

Introduction to Investment Appraisal Techniques Firms throughout the world expand by starting projects and carrying out investments in different industries and sectors. An important building block in these investments is the analysis and later the evaluation of these projects on the basis of economic, cost and financial data.

Investment Appraisal Techniques Essay 1382 Words

The Diagnosis of Traditional Capital Investment Appraisal

Investment Appraisal Techniques: A Brief Survey. The goal of financial management is to increase the value of the firm (Ross, Westerfield & Jaffe, 2010).

An organisation’s growth and its survival depend upon a continuous flow of new capital investment ideas. Firm prosperity depends more on the ability to generate profitable.

The focus is especially on the investment appraisal methods and the investment process participants influencing the investment decision-making, since previous research has given reason to assume that these could be some of the causes of the energy paradox (Jaffe & Stavins,

They explain what is meant by investment appraisal and its core purpose before looking at how to calculate and interpret the 3 main techniques of Payback, Average Rate of Return and Net Present Value. The slides evaluate each method and contain numerous practice examples and exercises along with suggested answers. They conclude with an evaluation of the advantages and disadvantages of

Investment Appraisal Techniques Essay 1382 Words

Advantage and disadvantage of Investment Appraisal Tools

Study guide references E3(g), (h) and (i) refer explicitly to the Internal Rate of Return (IRR). Not only do candidates need to be able to perform the calculation, they need to be able to explain the concept of IRR, how the IRR can be used for project appraisal, and to consider the merits and problems of this method of investment appraisal.

The payback method does not take into account the time value of money. It does not consider the useful life of the assets and inflow of cash after payback period. For example, If two projects, project A and project B require an initial investment of ,000.

Some of the major techniques used in capital budgeting are as follows: 1. Payback period 2. Accounting Rate of Return method 3. Net present value method 4. Internal Rate of Return Method 5. Profitability index.

INVESTMENT APPRAISAL TECHNIQUES – PAYBACK PERIOD, NPV, IRR, ARR. 1. Payback period The payback period is the time taken to recoup the initial investment (in cash terms) out of its earnings.

This book provides an introduction to investment appraisal and presents a range of methods and models, some of which are not widely known, or at least not well covered by other textbooks. Each approach is thoroughly described, evaluated and illustrated using examples, with its assumptions and

variety of investment appraisals. A distinction can be made between static and dynamic investment appraisals. Examples of static investment appraisals are the comparative cost method, the average return method and the payback rule. The method of accumulation of an annuity, the net present value method and the internal rate of return method are representative of the dynamic investment appraisal

The focus is especially on the investment appraisal methods and the investment process participants influencing the investment decision-making, since previous research has given reason to assume that these could be some of the causes of the energy paradox (Jaffe & Stavins,

Methods of Investment Appraisal – Download as Word Doc (.doc), PDF File (.pdf), Text File (.txt) or read online. Scribd is the world’s largest social reading and publishing site. Search Search

26/06/2018 · Internal Rate of Return, or IRR, is an easy way to estimate the value of different projects, but it doesn’t account for other factors, like project size, that might be important.

CFA Level 1 – Advantages and Disadvantages of the NPV and IRR Methods. Learn the advantages and disadvantages to the NPV and IRR valuation methods. Explains why these two methods …

“Advantages and Disadvantages of Capital Budgeting Techniques”

Advantages and disadvantages of the IRR method of

Investment appraisal should not be confined to financial appraisal and must take place within the overall strategy of the business. Managers should equip themselves to participate and contribute to all stages of the process. The investment appraisal process includes the generation of ideas, assessment and authorisation, implementation and control of the project. No appraisal technique can

Abstract: This paper reviewed principally accepted methods applied to investment analysis. To describe every aspect of investment analysis To describe every aspect of investment analysis fully would require far more space than available here, so we highlight only of few of its aspects.

5-2 Project Evaluation Methods Used by the Entities Surveyed (a) The aggregate percentage exceeds 100% because most respondents used more than one method of project evaluation.

There are different techniques you can use which help you to assess the effects that spending money will have on your business. This is sometimes called ‘capital budgeting’ or ‘investment appraisal’. This is sometimes called ‘capital budgeting’ or ‘investment appraisal’.

Advantage and disadvantage of Investment Appraisal Tools Problems make investment decisions for a business or company need to be evaluated and scrutinized by investors when investors always want to earn profits for themselves, but there are also risks losing.

investment appraisal techniques (9 items), and major constraints on capital investment (3 items). Five point Likert scale was used to collect the dataere 1 was the highest level of agreement , wh and 5 was the least level of agreement and the scale was adapted from the research paper

Methods of Investment Appraisal – Download as Word Doc (.doc), PDF File (.pdf), Text File (.txt) or read online. Scribd is the world’s largest social reading and publishing site. Search Search

38 financial management >studynotes PAPER P1 PERFORMANCE OPERATIONS Grahame Steven offers his guide to the development of four key investment appraisal methods – and their strengths and weaknesses.

concepts used in investment appraisal (relevant cash flows and time value of money) and considers two particular techniques: the return on capital employed and the payback period. Chapter 2 – Advanced investment appraisal

They explain what is meant by investment appraisal and its core purpose before looking at how to calculate and interpret the 3 main techniques of Payback, Average Rate of Return and Net Present Value. The slides evaluate each method and contain numerous practice examples and exercises along with suggested answers. They conclude with an evaluation of the advantages and disadvantages of

Advantages. Companies compare the profitability of potential projects before making investment decisions. The IRR method of investment appraisal helps with these comparisons by providing percentage rates of return for each project.

Other project appraisal methods 96 Suitability of different project evaluation techniques 97 Mutual exclusivity and project ranking 102 Asset replacement investment decisions 108 Project retirement 109 Concluding comments 111 Review questions 111 7 Project analysis under risk 114 Study objectives 115 The concepts of risk and uncertainty 115 Main elements of the RADR and CE techniques 116 The

An organisation’s growth and its survival depend upon a continuous flow of new capital investment ideas. Firm prosperity depends more on the ability to generate profitable.

This paper introduces the real options method of investment appraisal and its evolution. It discusses the It discusses the advantages and disadvantages of real options with regard to other commonly used investment methods and

Introduction to Investment Appraisal Techniques Firms throughout the world expand by starting projects and carrying out investments in different industries and sectors. An important building block in these investments is the analysis and later the evaluation of these projects on the basis of economic, cost and financial data.

Investment appraisal techniques mygov.scot

Investment Appraisal Report Essay Typing

There are different techniques you can use which help you to assess the effects that spending money will have on your business. This is sometimes called ‘capital budgeting’ or ‘investment appraisal’. This is sometimes called ‘capital budgeting’ or ‘investment appraisal’.

Investment Appraisal Techniques: A Brief Survey. The goal of financial management is to increase the value of the firm (Ross, Westerfield & Jaffe, 2010).

Study guide references E3(g), (h) and (i) refer explicitly to the Internal Rate of Return (IRR). Not only do candidates need to be able to perform the calculation, they need to be able to explain the concept of IRR, how the IRR can be used for project appraisal, and to consider the merits and problems of this method of investment appraisal.

Other project appraisal methods 96 Suitability of different project evaluation techniques 97 Mutual exclusivity and project ranking 102 Asset replacement investment decisions 108 Project retirement 109 Concluding comments 111 Review questions 111 7 Project analysis under risk 114 Study objectives 115 The concepts of risk and uncertainty 115 Main elements of the RADR and CE techniques 116 The

concepts used in investment appraisal (relevant cash flows and time value of money) and considers two particular techniques: the return on capital employed and the payback period. Chapter 2 – Advanced investment appraisal

Advantages. Companies compare the profitability of potential projects before making investment decisions. The IRR method of investment appraisal helps with these comparisons by providing percentage rates of return for each project.

Advantage and disadvantage of Investment Appraisal Tools Problems make investment decisions for a business or company need to be evaluated and scrutinized by investors when investors always want to earn profits for themselves, but there are also risks losing.

There are other more sophisticated methods of investment appraisal such as Advantages and disadvantages of ROCE . Advantages of ROCE as an investment appraisal technique include: simplicity . links with other accounting measures. Disadvantages include: no account is taken of project life . no account is taken of timing of cash flows . it varies depending on accounting policies . it may

Methods of Investment Appraisal Net Present Value

(PDF) Application of Investment Appraisal Techniques in

Capital investment appraisal techniques Advantages and disadvantages Advantages and disadvantages Types of capital investments: Internal capital investments External capital investments Traditional techniques: Accounting rate of return, Payback period Discounted cash flow techniques: Discounted payback period, Net present value, Internal rate of return. 5 1. Introduction (1) Capital

Investment appraisal is crucial to a business due to: Large sums are necessary to invest in projects and therefore care needs to be taken with the decisions, as they are difficult to reverse. It is difficult to estimate the potential future return of long-term investment so investment appraisal techniques need to be used to assess the risk and uncertainty of projects.

Abstract: This paper reviewed principally accepted methods applied to investment analysis. To describe every aspect of investment analysis To describe every aspect of investment analysis fully would require far more space than available here, so we highlight only of few of its aspects.

5-2 Project Evaluation Methods Used by the Entities Surveyed (a) The aggregate percentage exceeds 100% because most respondents used more than one method of project evaluation.

investment appraisal, by the 1990s, Pike was reporting companies generally using four methods, up from the previous one or two, with far higher use of ‘sophisti- cated’ discounting methods.

Investment Appraisal Techniques durmusozdemir.yasar.edu.tr

Advantages and disadvantages of the IRR method of

Methods of Investment Appraisal – Download as Word Doc (.doc), PDF File (.pdf), Text File (.txt) or read online. Scribd is the world’s largest social reading and publishing site. Search Search

Compared to other investment appraisal techniques such as the IRR and the discounted payback period, the NPV is viewed as the most reliable technique to support investment appraisal decisions. There are some disadvantages with the NPV approach. If there are several independent and mutually exclusive projects, the NPV method will rank projects in order of descending NPV values. However, a

Study guide references E3(g), (h) and (i) refer explicitly to the Internal Rate of Return (IRR). Not only do candidates need to be able to perform the calculation, they need to be able to explain the concept of IRR, how the IRR can be used for project appraisal, and to consider the merits and problems of this method of investment appraisal.

Alternatively, companies could use discounted cash flow techniques discussed on this page, such as Net Present Value (NPV) and Internal Rate of Return (IRR). Cash flows and relevant costs For all methods of investment appraisal, with the exception of …

An organisation’s growth and its survival depend upon a continuous flow of new capital investment ideas. Firm prosperity depends more on the ability to generate profitable.

Why Is the Investment Appraisal Process so Important

“Advantages and Disadvantages of Capital Budgeting Techniques”

An organisation’s growth and its survival depend upon a continuous flow of new capital investment ideas. Firm prosperity depends more on the ability to generate profitable.

5-2 Project Evaluation Methods Used by the Entities Surveyed (a) The aggregate percentage exceeds 100% because most respondents used more than one method of project evaluation.

investment appraisal, by the 1990s, Pike was reporting companies generally using four methods, up from the previous one or two, with far higher use of ‘sophisti- cated’ discounting methods.

Some of the major techniques used in capital budgeting are as follows: 1. Payback period 2. Accounting Rate of Return method 3. Net present value method 4. Internal Rate of Return Method 5. Profitability index.

Articles, reports and other resources that enable accountants in business to make a real difference to their organisations by providing them with practical information on the latest thinking in investment appraisal.

There are other more sophisticated methods of investment appraisal such as Advantages and disadvantages of ROCE . Advantages of ROCE as an investment appraisal technique include: simplicity . links with other accounting measures. Disadvantages include: no account is taken of project life . no account is taken of timing of cash flows . it varies depending on accounting policies . it may

Application of Investment Appraisal Techniques in Kanchipuram Modern Rice Mill February 2005 An organisation’s growth and its survival depend upon a continuous flow of new capital investment ideas.

Payback period is the time in which the initial cash outflow of an investment is expected to be recovered from the cash inflows generated by the investment. It is one of the simplest investment appraisal techniques.

Abstract: This paper reviewed principally accepted methods applied to investment analysis. To describe every aspect of investment analysis To describe every aspect of investment analysis fully would require far more space than available here, so we highlight only of few of its aspects.

38 financial management >studynotes PAPER P1 PERFORMANCE OPERATIONS Grahame Steven offers his guide to the development of four key investment appraisal methods – and their strengths and weaknesses.

investment appraisal techniques (9 items), and major constraints on capital investment (3 items). Five point Likert scale was used to collect the dataere 1 was the highest level of agreement , wh and 5 was the least level of agreement and the scale was adapted from the research paper

This paper introduces the real options method of investment appraisal and its evolution. It discusses the It discusses the advantages and disadvantages of real options with regard to other commonly used investment methods and

Other project appraisal methods 96 Suitability of different project evaluation techniques 97 Mutual exclusivity and project ranking 102 Asset replacement investment decisions 108 Project retirement 109 Concluding comments 111 Review questions 111 7 Project analysis under risk 114 Study objectives 115 The concepts of risk and uncertainty 115 Main elements of the RADR and CE techniques 116 The

variety of investment appraisals. A distinction can be made between static and dynamic investment appraisals. Examples of static investment appraisals are the comparative cost method, the average return method and the payback rule. The method of accumulation of an annuity, the net present value method and the internal rate of return method are representative of the dynamic investment appraisal

“Advantages and Disadvantages of Capital Budgeting Techniques”

Investment Appraisal Techniques PDF PDF documents

They explain what is meant by investment appraisal and its core purpose before looking at how to calculate and interpret the 3 main techniques of Payback, Average Rate of Return and Net Present Value. The slides evaluate each method and contain numerous practice examples and exercises along with suggested answers. They conclude with an evaluation of the advantages and disadvantages of

Some of the major techniques used in capital budgeting are as follows: 1. Payback period 2. Accounting Rate of Return method 3. Net present value method 4. Internal Rate of Return Method 5. Profitability index.

Methods of Investment Appraisal – Download as Word Doc (.doc), PDF File (.pdf), Text File (.txt) or read online. Scribd is the world’s largest social reading and publishing site. Search Search

investment appraisal techniques (9 items), and major constraints on capital investment (3 items). Five point Likert scale was used to collect the dataere 1 was the highest level of agreement , wh and 5 was the least level of agreement and the scale was adapted from the research paper

variety of investment appraisals. A distinction can be made between static and dynamic investment appraisals. Examples of static investment appraisals are the comparative cost method, the average return method and the payback rule. The method of accumulation of an annuity, the net present value method and the internal rate of return method are representative of the dynamic investment appraisal

Introduction to Investment Appraisal Techniques Firms throughout the world expand by starting projects and carrying out investments in different industries and sectors. An important building block in these investments is the analysis and later the evaluation of these projects on the basis of economic, cost and financial data.

An organisation’s growth and its survival depend upon a continuous flow of new capital investment ideas. Firm prosperity depends more on the ability to generate profitable.

Capital investment appraisal techniques Advantages and disadvantages Advantages and disadvantages Types of capital investments: Internal capital investments External capital investments Traditional techniques: Accounting rate of return, Payback period Discounted cash flow techniques: Discounted payback period, Net present value, Internal rate of return. 5 1. Introduction (1) Capital

The payback method does not take into account the time value of money. It does not consider the useful life of the assets and inflow of cash after payback period. For example, If two projects, project A and project B require an initial investment of ,000.

Features, advantages, disadvantages and decision rules of each of the following investment appraisal techniques: payback, net present value, internal rate of return, …

Investment appraisal involves a series of techniques, which enable a business to financially appraise investment projects. Investment Appraisal It is a techniques use to determine if a particular investment is worthwhile.

This paper introduces the real options method of investment appraisal and its evolution. It discusses the It discusses the advantages and disadvantages of real options with regard to other commonly used investment methods and

4 Advantages & Disadvantages of Net Present Value in Project Selection Project appraisal methodologies are methods used to access a proposed project’s potential success and viability.

Study guide references E3(g), (h) and (i) refer explicitly to the Internal Rate of Return (IRR). Not only do candidates need to be able to perform the calculation, they need to be able to explain the concept of IRR, how the IRR can be used for project appraisal, and to consider the merits and problems of this method of investment appraisal.

However, traditional appraisal techniques are a powerful ways of appraising investment projects. There is a need though for all decision makers, when evaluating projects, to clearly understand of the pitfalls arising from the use of traditional appraisal techniques.

Investment Appraisal Techniques Essay 1382 Words

(PDF) A Study on Investment Appraisal and Profitability

Methods of Investment Appraisal – Download as Word Doc (.doc), PDF File (.pdf), Text File (.txt) or read online. Scribd is the world’s largest social reading and publishing site. Search Search

The focus is especially on the investment appraisal methods and the investment process participants influencing the investment decision-making, since previous research has given reason to assume that these could be some of the causes of the energy paradox (Jaffe & Stavins,

In order to solve the inherent flaws of the traditional investment appraisal techniques and to include an additional evaluation of advantages in enhancing the competitive strategy, it is possible to distinguish two basic approaches in the scientific literature which will be …

Investment Appraisal Techniques: A Brief Survey. The goal of financial management is to increase the value of the firm (Ross, Westerfield & Jaffe, 2010).

CFA Level 1 – Advantages and Disadvantages of the NPV and IRR Methods. Learn the advantages and disadvantages to the NPV and IRR valuation methods. Explains why these two methods …

Introduction to Investment Appraisal Techniques Firms throughout the world expand by starting projects and carrying out investments in different industries and sectors. An important building block in these investments is the analysis and later the evaluation of these projects on the basis of economic, cost and financial data.

concepts used in investment appraisal (relevant cash flows and time value of money) and considers two particular techniques: the return on capital employed and the payback period. Chapter 2 – Advanced investment appraisal

INVESTMENT APPRAISAL TECHNIQUES – PAYBACK PERIOD, NPV, IRR, ARR. 1. Payback period The payback period is the time taken to recoup the initial investment (in cash terms) out of its earnings.

The various investment appraisal techniques lets a business assess the effect of an investment that will have on cashflow. There should be sufficient information required to know the project designed for, the different objectives of the project and analyse the benefits and drawbacks of the projects. If interest rates are considered to be high, individuals will be tempted to forgo current

variety of investment appraisals. A distinction can be made between static and dynamic investment appraisals. Examples of static investment appraisals are the comparative cost method, the average return method and the payback rule. The method of accumulation of an annuity, the net present value method and the internal rate of return method are representative of the dynamic investment appraisal

Other project appraisal methods 96 Suitability of different project evaluation techniques 97 Mutual exclusivity and project ranking 102 Asset replacement investment decisions 108 Project retirement 109 Concluding comments 111 Review questions 111 7 Project analysis under risk 114 Study objectives 115 The concepts of risk and uncertainty 115 Main elements of the RADR and CE techniques 116 The

investment appraisal techniques (9 items), and major constraints on capital investment (3 items). Five point Likert scale was used to collect the dataere 1 was the highest level of agreement , wh and 5 was the least level of agreement and the scale was adapted from the research paper

Application of Investment Appraisal Techniques in Kanchipuram Modern Rice Mill February 2005 An organisation’s growth and its survival depend upon a continuous flow of new capital investment ideas.

Investment appraisal ICAEW

Advantages and disadvantages of the IRR method of

If three projects have an equal investment and projected return a fixed period of time, they will all have the same ARR; but if one of those projects covers its investment costs within 1 year and the other only after 4 years, project 1 should be the clear winner.

variety of investment appraisals. A distinction can be made between static and dynamic investment appraisals. Examples of static investment appraisals are the comparative cost method, the average return method and the payback rule. The method of accumulation of an annuity, the net present value method and the internal rate of return method are representative of the dynamic investment appraisal

Articles, reports and other resources that enable accountants in business to make a real difference to their organisations by providing them with practical information on the latest thinking in investment appraisal.

Investment Appraisal Techniques: A Brief Survey. The goal of financial management is to increase the value of the firm (Ross, Westerfield & Jaffe, 2010).

The Public Spending Code D. Standard Analytical

Investment_Appraisal_Techniques Features advantages

The payback method does not take into account the time value of money. It does not consider the useful life of the assets and inflow of cash after payback period. For example, If two projects, project A and project B require an initial investment of ,000.

as well as the advantages and disadvantages of using it through a case study. The case study shows a The case study shows a clear problem solving investment in case of the existence of several variants of industrial projects and

4 Advantages & Disadvantages of Net Present Value in Project Selection Project appraisal methodologies are methods used to access a proposed project’s potential success and viability.

INVESTMENT APPRAISAL TECHNIQUES – PAYBACK PERIOD, NPV, IRR, ARR. 1. Payback period The payback period is the time taken to recoup the initial investment (in cash terms) out of its earnings.

They explain what is meant by investment appraisal and its core purpose before looking at how to calculate and interpret the 3 main techniques of Payback, Average Rate of Return and Net Present Value. The slides evaluate each method and contain numerous practice examples and exercises along with suggested answers. They conclude with an evaluation of the advantages and disadvantages of