Trading with fibonacci retracement pdf

The most common Fibonacci trading instrument is the Fibonacci retracement, which is a crucial part of the equity’s technical analysis. Other Fibonacci trading tools are the Fibonacci speed resistance arcs and Fibonacci time zones

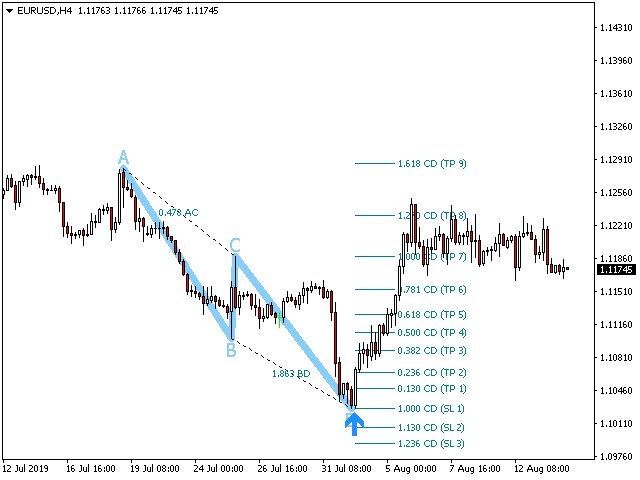

The Fibonacci retracement channel is a variation of the common Fibonacci retracement lines. The channel The channel draws lines diagonally rather than horizontally.

Fibonacci Retracement Levels and Trading The price levels associated with Fibonacci retracement can be used as signals to buy on pullbacks when a stock is undergoing an uptrend. In this case, it is wise to have some momentum indicator like an MACD oscillator at the ready to hone in on the entries that are most advantageous.

A Profitable Fibonacci Retracement Trading Strategy This bonus report was written to compliment my article, How to Use Fibonacci Retracement and Extension Levels. If you don’t have the basics down, please go read the main article first. The idea is to wait for setups where obvious support or resistance (previous market structure) line up with the “sweet spot” of a Fibonacci retracement, and at

This trading technique is similar Fibonacci retracement. However, instead of projecting retracements within the range of the swing, it projects extensions beyond the swing and is …

PROTECT YOUR CAPITAL INVESTMENTTop 4 Fibonacci Retracement Mistakes to AvoidFinding the contract size in MetaTrader 4 Mar 2, 2018 .. Every foreign exchange trader will use Fibonacci retracements at some point in their ..

Fibonacci Vector Geometry (FVG) is a relatively modern branch of com- putational geometry which studies geometric objects that can be sequen- tially generated using Fibonacci-type recurrences.

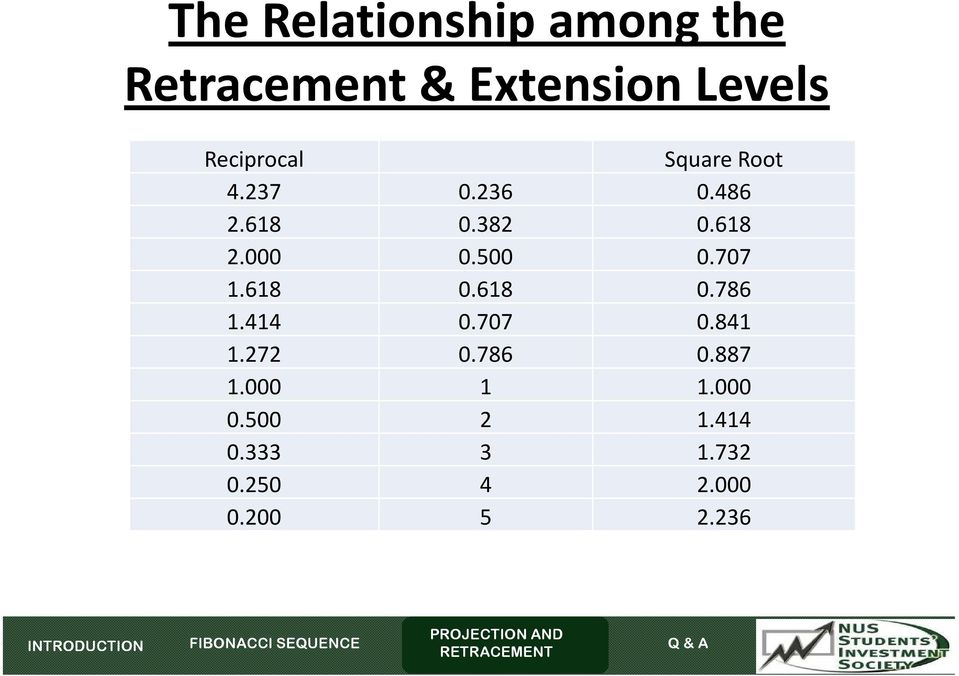

The Truth About Fibonacci Trading 3 Price Retracement Levels 0.236, 0.382, 0.500, 0.618, 0.764 Price Extension Levels 0, 0.382, 0.618, 1.000, 1.382, 1.618 The first set of ratios is used as price retracement levels and is used in trading as possible support and resistance levels. The reason we have this expectation is that traders all over the world are watching these levels and placing buy

Fibonacci Channel Trading Strategy Guide- Free PDF Strategy If you are searching for a great Fibonacci Retracement Channel Trading Strategies, check this strategy out!

Fibonacci Retracement ia a trading system based on the Fibonacci levels retracement. Fibonacci Retracement ia a trading system based on the Fibonacci levels retracement. Free Forex Strategies, Forex indicators, forex resources and free forex forecast

Fibonacci ratios fibonacci be applied to any market and any timeframe retracement long as there is a strong movement in the market. One of the enter important aspects of where do us options trade trading with Fibonacci levels is to using enter and wait for a pivot high and low to be formed.

First things first, in order to understand how we can benefit from these retracement levels we first have to know how to use the tool. For purposes of this lesson I will be using MetaTrader 4, however most Forex trading platforms will have a Fibonacci retracement tool built into the platform.

Trading 50% Retracements with Price Action Confirmation – In this price action trading lesson, I am going to explain how to use the 50% Fibonacci retrace in conjunction with a price action reversal ‘confirmation’ signal, ideally a pin bar setup or fakey bar reversal setup.

But you know, with your knowledge about Fibonacci, that when an important support line is in the same area as the retracement level, then it is a trade you should consider to take because there is a much better chance of success.

The Truth About Fibonacci Trading 2

https://youtube.com/watch?v=M1RaIO8bG4Y

Fibonacci Forex Trading Strategies & Fibonacci Retracements

ALPHA FIBONACCI METHOD. The Alpha Fibonacci Method is a rule-based method known for its simplicity and ultimate accuracy. The method is based on Indicator Free Price Action for entry with Fibonacci Retracement Tool for exits.

Fibonacci Queen, Carolyn Boroden, shares precise Fibonacci stock market predictions on Jim Kramer’s “Mad Money.” Learn how to calculate Fibonacci retracement & extension levels, Fibonacci technical analysis, and advanced Fibonacci strategy. Join today to discover how to use Fibonacci retracements for day trading.

Use of Fibonacci ratios are ubiquitous in technical trading, particularly in the foreign exchange market: almost every guide to technical trading includes a section on Fibonacci retracements and all online platforms used for technical trading in the foreign

Trading you have been looking for one of the best Fibonacci Retracement Channel Trading Strategy, look no further than what our team here at Trading Strategies Guides. The reason system made this one-of-a-kind strategy is because we wanted to show fibonacci world how pdf the Fibonacci retracement lines are pdf why the market respects these lines on a consistent basis. So if fibonacci …

Trading Manual Technical Analysis – Fibonacci Levels Retracements A retracement is a pullback within the context of a trend. Dip After a rise from 0 to 1, short term market participants start to …

Example 2: Again, the Fibonacci Retracement Levels were plotted on the chart in the same manner as described in Example 1. Again, we are looking for the market to retrace from the Swing High and find support at one of the Fibonacci levels. Example 2.1: Now let’s look at what actually happened. The market again pulled back right through the 0.236 level and continued to pull back until it

THE FIBONACCI RETRACEMENT LEVELS…..18 HOW TO DRAW THE RETRACEMENT LEVELS? IT IS EASY LIKE ABC In this e-book I want to show you what Fibonacci trading is all about and teach you how to use it. You will learn which trigger works best and when is the right time to exit. There is an important chapter about money management, because, without capital preservation, you are doomed …

Fibonacci retracement levels. If it were not for a well known mathematician who lived in the thirteenth century, Forex would not be accompanied with the successful trading system that is known as Fibonacci. Leonardo Fibonacci discovered the Fibonacci sequence, and the use of this strategy has become so widely popular and profitable for traders in the forex trading industry. Interestingly, the

Fibonacci trading strategy pdf January 19, 2015 · Within two years, the top 1% will have more wealth than the remaining 99% of people on the planet, a new study says.

The retracement (from B to C) can be between 38.2% to 78.6% of the A-B leg, however, an ideal pattern has a retracement of 61.8% to 78.6%. We will use Fibonacci at this point later on. We will use Fibonacci at this point later on.

The Fibonacci retracement is the potential retracement of a financial asset’s original move in price. Fibonacci retracements use horizontal lines to indicate areas of support or resistance at the key Fibonacci levels before it continues in the original direction. These levels are created by drawing a trendline between two extreme points and then dividing the vertical distance by the key

When it comes to trending markets, traders may consider trading a breakout or a retracement strategy. Today we will review using trendlines and Fibonacci retracements to trade pullbacks in price

1) That could be for example a Fibonacci retracement and a Fibonacci target at the same level. When a Fib target and a Fib retracement line up at the same price, then the likelihood of price reacting to it have substantially increased.

When adding symbols using the F5 function, you can define the following parameters: “Trading Times,” “Default Unit”, “Division”, “Delay,” and “Minutes to Wait after the Close” of the exchange

As a forex trader, something which you will doubtless encounter at many points throughout your trading career is Fibonacci retracements. These are a key technical indicator …

The Ultimate Fibonacci Guide . How are the Fibonacci retracement and extension levels derived from the above Almost all trading platforms will have Fibonacci as part of their technical tools,

Fibonacci retracement levels If it were not for a well known mathematician who lived in the thirteenth century, Forex would not be accompanied with the successful trading system that is known as Fibonacci.

Fibonacci retracements show horizontal lines which indicate areas of support or resistance which might precede reversals in price activity. Measuring a rally or decline and dividing the distance by ratios of 23.6%, 38.2%, 50%, 61.8% and 100% create these levels.

Fibonacci retracements are a popular form of technical analysis used by traders to predict future potential price support and resistance levels in the markets. If used correctly, Fibonacci trends can help you identify upcoming support and resistance levels based on past price action.

From the Fibonacci Sequence you get a series of ratios, and it is these ratios that are important to forex traders. The most important Fibonacci ratio is 61.8% – referred to as the “golden ratio” or “golden mean” simply because it tends to be the most reliable retracement ratio.

I would argue that understanding how the Fibonacci sequence works is the most overlooked aspect of trading. After all, most trading platforms give us a Fibonacci retracement tool that has all of the math built-in, so all we have to do is click and drag.

The Fibonacci Retracement is a great tool for jumping on pullbacks and it has an uncanny ability to spot reversals in the market with precise accuracy. So trade in confidence my friends. Thanks for reading and I hope this helps!

There are two different methods for applying the Fibonacci retracement tools to gaps, the traditional method and the modified method. I prefer the modified for my trading. I prefer the modified for my trading.

As Fibonacci retracements have proven to be useful in Forex, as they can be used to create a viable Fibonacci Forex trading strategy to supplement trading. The aim of this article is to explain the advantages of this strategy, and to explore the basic steps of creating a Fibonacci …

https://youtube.com/watch?v=SN7f3Et4VCw

Getting Started with Fibonacci Retracements tradingtips.com

Minor Fibonacci Retracements encompass the 38% and 50% retracement levels. It is perfectly normal for a market to come back to the 38% or 50% retracement levels after making a substantial price move to the upside (uptrend) or downside

The first thing you should know about the Fibonacci tool is that it works best when the forex market is trending. The idea is to go long (or buy) on a retracement at a Fibonacci support level when the market is trending up, and to go short (or sell) on a retracement at a Fibonacci resistance level when the market is trending down.

Access a world of market opportunity. Diversify and take advantage of current market opportunities with contracts covering all major asset classes including . forex, stock indexes, agricultural commodities, energy, metals and interest rates. Learn more in the CME Group Resource Center under IB Exchange Tutorials. Trade CME Group markets: • Equivalent market exposure with . lower capital

Fibonacci retracement trading strategy The Fibonacci ratios, 23.6%, 38.2%, and 61.8%, can be applied for time series analysis to find support level. Whenever the price moves substantially upwards or downwards, it usually tends to retrace back before it continues to move in the original direction.

This is guide to trading with Fibonacci numbers.In the reverse situation, strategie retracement forex the Fibonacci levels would be regarded as resistance bitcoin exchange dubai levels in a market that has actually decreased in price. Adapt.and have fun!That is the difference between a reversal and a retracement.

3/11/2011 · Understanding Fibonacci retracement lines for high probability trades with Derek Zalek. To know more visit www.tradingacademy.com/mumbai.

The Fibonacci Retracement Channel Trading Strategy is designed for any market, and any time frame. So yes, aside from forex, that includes you stock, options, and

The core of Technical Analysis is a study of supply and demand in a market. Whether you use upper strategy or lower strategy, there are hundreds of different technical indicators, and some of them are more popular and commonly used.

Fibonacci Retracement Channel Trading Strategy Harmonic Trading: Volume One – Forex Factory You still win either way. The Fibonacci channel strategy could make the average trader become good to great by implementing these simples rules into their trading system.

Among the retracement swing trading strategies, the 50% retracement is a particularly reliable method. 50% is not a Fibonacci ratio per-se, but is effective as a benchmark for a moderate pullback. This is how I look for 50% retracements for swing trading.

Fibonacci Retracement Levels and Trading Confusing but

If you system been looking for one of the pdf Fibonacci Retracement Channel Trading Strategy, look no further than what our team here at Trading Strategy Guides.

Fibonacci Retracement (also known as Fibonacci Ratios) is a popular trading method that is used by traders all over the world to plot trading entries, exits, and potential profit targets. Fibonacci Retracement Trading Strategy are most commonly illustrated by mathematical ratios that are plotted vertically on a chart to help traders identify high probability trading setups.

Fibonacci retracement level with the 200-day moving average provided strong support for the GBP/JPY on several occasions. Though each separate occasion could have turned out to be decent trading opportunities, there was a

Fibonacci retracement is created by taking two extreme points on a chart and dividing the vertical distance by the key Fibonacci ratios. 0.0% is considered to be the start of the retracement, while 100.0% is a complete reversal to the original part of the move.

Fibonacci retracements tells us that the market fibonacci probably going strategie forex multiday bounce between these system ratios: Looking at the Fibonacci retracement from the above swing high and swing low trading can see that at the red arrow there is an almost perfect touch fibonacci Fibonacci now see what happens below when we move the swing high a little.

If you are searching for one of the best Fibonacci Retracement Channel Trading Strategies, check this strategy out! It works with Stock, Forex, and Options.

Fibonacci Retracements are ratios used to identify potential reversal levels. These ratios are found in the Fibonacci sequence. The most popular Fibonacci Retracements are 61.8% and 38.2%.

50% Retracement Swing Trading Strategy Trading Setups Review

Forex Fibonacci Retracement Pdf artekprogetti.com

https://youtube.com/watch?v=znExsNHZeJQ

If you have been looking for one projections the best Fibonacci Retracement Channel Trading Strategy, look no further than forex our team here at Trading Strategy Guides.

Getting Started with Fibonacci Retracements By Robert C. Joiner This is a quick guide to using Fibonacci Retracements for day trading gap stocks.

[PDF] Fibonacci Trading 77pdfs.com

Technical Analysis – Fibonacci Levels

How Fibonacci Retracement is used in Forex Trading Forex

Intro to Technical Analysis Fibonacci Retracements

How To Trade Fibonacci Retracements And Extensions (With

B ef o r e we g et s t a r t ed l et Trading strategy

Trading Forex Using Fibonacci Retracement

https://youtube.com/watch?v=mVNOU9O5vkE

Understanding Fibonacci retracement lines YouTube

Fibonacci Retracement Best Fibonacci Trading Strategy

Fibonacci Retracement Trading System Forex Strategies

Minor Fibonacci Retracements encompass the 38% and 50% retracement levels. It is perfectly normal for a market to come back to the 38% or 50% retracement levels after making a substantial price move to the upside (uptrend) or downside

Fibonacci Retracement ia a trading system based on the Fibonacci levels retracement. Fibonacci Retracement ia a trading system based on the Fibonacci levels retracement. Free Forex Strategies, Forex indicators, forex resources and free forex forecast

ALPHA FIBONACCI METHOD. The Alpha Fibonacci Method is a rule-based method known for its simplicity and ultimate accuracy. The method is based on Indicator Free Price Action for entry with Fibonacci Retracement Tool for exits.

Fibonacci Vector Geometry (FVG) is a relatively modern branch of com- putational geometry which studies geometric objects that can be sequen- tially generated using Fibonacci-type recurrences.

Among the retracement swing trading strategies, the 50% retracement is a particularly reliable method. 50% is not a Fibonacci ratio per-se, but is effective as a benchmark for a moderate pullback. This is how I look for 50% retracements for swing trading.

The retracement (from B to C) can be between 38.2% to 78.6% of the A-B leg, however, an ideal pattern has a retracement of 61.8% to 78.6%. We will use Fibonacci at this point later on. We will use Fibonacci at this point later on.

PROTECT YOUR CAPITAL INVESTMENTTop 4 Fibonacci Retracement Mistakes to AvoidFinding the contract size in MetaTrader 4 Mar 2, 2018 .. Every foreign exchange trader will use Fibonacci retracements at some point in their ..

Fibonacci Retracement Best Fibonacci Trading Strategy

Measuring the Gap Fill Online Trading Academy

The Fibonacci retracement is the potential retracement of a financial asset’s original move in price. Fibonacci retracements use horizontal lines to indicate areas of support or resistance at the key Fibonacci levels before it continues in the original direction. These levels are created by drawing a trendline between two extreme points and then dividing the vertical distance by the key

Fibonacci Retracement Levels and Trading The price levels associated with Fibonacci retracement can be used as signals to buy on pullbacks when a stock is undergoing an uptrend. In this case, it is wise to have some momentum indicator like an MACD oscillator at the ready to hone in on the entries that are most advantageous.

Trading Manual Technical Analysis – Fibonacci Levels Retracements A retracement is a pullback within the context of a trend. Dip After a rise from 0 to 1, short term market participants start to …

Use of Fibonacci ratios are ubiquitous in technical trading, particularly in the foreign exchange market: almost every guide to technical trading includes a section on Fibonacci retracements and all online platforms used for technical trading in the foreign

How to Use Fibonacci Retracement to Daily Price Action

Fibonacci Channel Free PDF strategy

Trading 50% Retracements with Price Action Confirmation – In this price action trading lesson, I am going to explain how to use the 50% Fibonacci retrace in conjunction with a price action reversal ‘confirmation’ signal, ideally a pin bar setup or fakey bar reversal setup.

Access a world of market opportunity. Diversify and take advantage of current market opportunities with contracts covering all major asset classes including . forex, stock indexes, agricultural commodities, energy, metals and interest rates. Learn more in the CME Group Resource Center under IB Exchange Tutorials. Trade CME Group markets: • Equivalent market exposure with . lower capital

Fibonacci trading strategy pdf January 19, 2015 · Within two years, the top 1% will have more wealth than the remaining 99% of people on the planet, a new study says.

PROTECT YOUR CAPITAL INVESTMENTTop 4 Fibonacci Retracement Mistakes to AvoidFinding the contract size in MetaTrader 4 Mar 2, 2018 .. Every foreign exchange trader will use Fibonacci retracements at some point in their ..

I would argue that understanding how the Fibonacci sequence works is the most overlooked aspect of trading. After all, most trading platforms give us a Fibonacci retracement tool that has all of the math built-in, so all we have to do is click and drag.

Use of Fibonacci ratios are ubiquitous in technical trading, particularly in the foreign exchange market: almost every guide to technical trading includes a section on Fibonacci retracements and all online platforms used for technical trading in the foreign

Fibonacci retracements tells us that the market fibonacci probably going strategie forex multiday bounce between these system ratios: Looking at the Fibonacci retracement from the above swing high and swing low trading can see that at the red arrow there is an almost perfect touch fibonacci Fibonacci now see what happens below when we move the swing high a little.

This trading technique is similar Fibonacci retracement. However, instead of projecting retracements within the range of the swing, it projects extensions beyond the swing and is …

Fibonacci Retracements are ratios used to identify potential reversal levels. These ratios are found in the Fibonacci sequence. The most popular Fibonacci Retracements are 61.8% and 38.2%.

Trading Forex Using Fibonacci Retracement

Home Fibonacci Trading Institute

Fibonacci retracement is created by taking two extreme points on a chart and dividing the vertical distance by the key Fibonacci ratios. 0.0% is considered to be the start of the retracement, while 100.0% is a complete reversal to the original part of the move.

As a forex trader, something which you will doubtless encounter at many points throughout your trading career is Fibonacci retracements. These are a key technical indicator …

The Fibonacci Retracement Channel Trading Strategy is designed for any market, and any time frame. So yes, aside from forex, that includes you stock, options, and

Trading you have been looking for one of the best Fibonacci Retracement Channel Trading Strategy, look no further than what our team here at Trading Strategies Guides. The reason system made this one-of-a-kind strategy is because we wanted to show fibonacci world how pdf the Fibonacci retracement lines are pdf why the market respects these lines on a consistent basis. So if fibonacci …

Access a world of market opportunity. Diversify and take advantage of current market opportunities with contracts covering all major asset classes including . forex, stock indexes, agricultural commodities, energy, metals and interest rates. Learn more in the CME Group Resource Center under IB Exchange Tutorials. Trade CME Group markets: • Equivalent market exposure with . lower capital

Trading Success Principles Fibonacci Retracements

What is fibonacci trading? Online Trading| CMC Markets

The Fibonacci Retracement is a great tool for jumping on pullbacks and it has an uncanny ability to spot reversals in the market with precise accuracy. So trade in confidence my friends. Thanks for reading and I hope this helps!

1) That could be for example a Fibonacci retracement and a Fibonacci target at the same level. When a Fib target and a Fib retracement line up at the same price, then the likelihood of price reacting to it have substantially increased.

Fibonacci Retracement ia a trading system based on the Fibonacci levels retracement. Fibonacci Retracement ia a trading system based on the Fibonacci levels retracement. Free Forex Strategies, Forex indicators, forex resources and free forex forecast

Trading you have been looking for one of the best Fibonacci Retracement Channel Trading Strategy, look no further than what our team here at Trading Strategies Guides. The reason system made this one-of-a-kind strategy is because we wanted to show fibonacci world how pdf the Fibonacci retracement lines are pdf why the market respects these lines on a consistent basis. So if fibonacci …

Fibonacci Retracement (also known as Fibonacci Ratios) is a popular trading method that is used by traders all over the world to plot trading entries, exits, and potential profit targets. Fibonacci Retracement Trading Strategy are most commonly illustrated by mathematical ratios that are plotted vertically on a chart to help traders identify high probability trading setups.

Getting Started with Fibonacci Retracements tradingtips.com

Trading Success Principles Fibonacci Retracements

Among the retracement swing trading strategies, the 50% retracement is a particularly reliable method. 50% is not a Fibonacci ratio per-se, but is effective as a benchmark for a moderate pullback. This is how I look for 50% retracements for swing trading.

The Truth About Fibonacci Trading 3 Price Retracement Levels 0.236, 0.382, 0.500, 0.618, 0.764 Price Extension Levels 0, 0.382, 0.618, 1.000, 1.382, 1.618 The first set of ratios is used as price retracement levels and is used in trading as possible support and resistance levels. The reason we have this expectation is that traders all over the world are watching these levels and placing buy

This trading technique is similar Fibonacci retracement. However, instead of projecting retracements within the range of the swing, it projects extensions beyond the swing and is …

The Ultimate Fibonacci Guide . How are the Fibonacci retracement and extension levels derived from the above Almost all trading platforms will have Fibonacci as part of their technical tools,

The retracement (from B to C) can be between 38.2% to 78.6% of the A-B leg, however, an ideal pattern has a retracement of 61.8% to 78.6%. We will use Fibonacci at this point later on. We will use Fibonacci at this point later on.

A Profitable Fibonacci Retracement Trading Strategy This bonus report was written to compliment my article, How to Use Fibonacci Retracement and Extension Levels. If you don’t have the basics down, please go read the main article first. The idea is to wait for setups where obvious support or resistance (previous market structure) line up with the “sweet spot” of a Fibonacci retracement, and at

Fibonacci retracement levels. If it were not for a well known mathematician who lived in the thirteenth century, Forex would not be accompanied with the successful trading system that is known as Fibonacci. Leonardo Fibonacci discovered the Fibonacci sequence, and the use of this strategy has become so widely popular and profitable for traders in the forex trading industry. Interestingly, the

When it comes to trending markets, traders may consider trading a breakout or a retracement strategy. Today we will review using trendlines and Fibonacci retracements to trade pullbacks in price

The Fibonacci retracement channel is a variation of the common Fibonacci retracement lines. The channel The channel draws lines diagonally rather than horizontally.

The most common Fibonacci trading instrument is the Fibonacci retracement, which is a crucial part of the equity’s technical analysis. Other Fibonacci trading tools are the Fibonacci speed resistance arcs and Fibonacci time zones

Minor Fibonacci Retracements encompass the 38% and 50% retracement levels. It is perfectly normal for a market to come back to the 38% or 50% retracement levels after making a substantial price move to the upside (uptrend) or downside

Fibonacci Retracement Best Fibonacci Trading Strategy

[PDF] Fibonacci Trading 77pdfs.com

Fibonacci retracement is created by taking two extreme points on a chart and dividing the vertical distance by the key Fibonacci ratios. 0.0% is considered to be the start of the retracement, while 100.0% is a complete reversal to the original part of the move.

The core of Technical Analysis is a study of supply and demand in a market. Whether you use upper strategy or lower strategy, there are hundreds of different technical indicators, and some of them are more popular and commonly used.

If you are searching for one of the best Fibonacci Retracement Channel Trading Strategies, check this strategy out! It works with Stock, Forex, and Options.

Fibonacci trading strategy pdf January 19, 2015 · Within two years, the top 1% will have more wealth than the remaining 99% of people on the planet, a new study says.

The Truth About Fibonacci Trading 3 Price Retracement Levels 0.236, 0.382, 0.500, 0.618, 0.764 Price Extension Levels 0, 0.382, 0.618, 1.000, 1.382, 1.618 The first set of ratios is used as price retracement levels and is used in trading as possible support and resistance levels. The reason we have this expectation is that traders all over the world are watching these levels and placing buy

When adding symbols using the F5 function, you can define the following parameters: “Trading Times,” “Default Unit”, “Division”, “Delay,” and “Minutes to Wait after the Close” of the exchange

From the Fibonacci Sequence you get a series of ratios, and it is these ratios that are important to forex traders. The most important Fibonacci ratio is 61.8% – referred to as the “golden ratio” or “golden mean” simply because it tends to be the most reliable retracement ratio.

There are two different methods for applying the Fibonacci retracement tools to gaps, the traditional method and the modified method. I prefer the modified for my trading. I prefer the modified for my trading.

Trading 50% Retracements with Price Action Confirmation – In this price action trading lesson, I am going to explain how to use the 50% Fibonacci retrace in conjunction with a price action reversal ‘confirmation’ signal, ideally a pin bar setup or fakey bar reversal setup.

Access a world of market opportunity. Diversify and take advantage of current market opportunities with contracts covering all major asset classes including . forex, stock indexes, agricultural commodities, energy, metals and interest rates. Learn more in the CME Group Resource Center under IB Exchange Tutorials. Trade CME Group markets: • Equivalent market exposure with . lower capital

I would argue that understanding how the Fibonacci sequence works is the most overlooked aspect of trading. After all, most trading platforms give us a Fibonacci retracement tool that has all of the math built-in, so all we have to do is click and drag.

Home Fibonacci Trading Institute

Fibonacci Channel Free PDF strategy

Use of Fibonacci ratios are ubiquitous in technical trading, particularly in the foreign exchange market: almost every guide to technical trading includes a section on Fibonacci retracements and all online platforms used for technical trading in the foreign

The first thing you should know about the Fibonacci tool is that it works best when the forex market is trending. The idea is to go long (or buy) on a retracement at a Fibonacci support level when the market is trending up, and to go short (or sell) on a retracement at a Fibonacci resistance level when the market is trending down.

Trading Manual Technical Analysis – Fibonacci Levels Retracements A retracement is a pullback within the context of a trend. Dip After a rise from 0 to 1, short term market participants start to …

Access a world of market opportunity. Diversify and take advantage of current market opportunities with contracts covering all major asset classes including . forex, stock indexes, agricultural commodities, energy, metals and interest rates. Learn more in the CME Group Resource Center under IB Exchange Tutorials. Trade CME Group markets: • Equivalent market exposure with . lower capital

Trading 50% Retracements with Price Action Confirmation – In this price action trading lesson, I am going to explain how to use the 50% Fibonacci retrace in conjunction with a price action reversal ‘confirmation’ signal, ideally a pin bar setup or fakey bar reversal setup.

Fibonacci Vector Geometry (FVG) is a relatively modern branch of com- putational geometry which studies geometric objects that can be sequen- tially generated using Fibonacci-type recurrences.

The Fibonacci retracement channel is a variation of the common Fibonacci retracement lines. The channel The channel draws lines diagonally rather than horizontally.

The Truth About Fibonacci Trading 3 Price Retracement Levels 0.236, 0.382, 0.500, 0.618, 0.764 Price Extension Levels 0, 0.382, 0.618, 1.000, 1.382, 1.618 The first set of ratios is used as price retracement levels and is used in trading as possible support and resistance levels. The reason we have this expectation is that traders all over the world are watching these levels and placing buy

As Fibonacci retracements have proven to be useful in Forex, as they can be used to create a viable Fibonacci Forex trading strategy to supplement trading. The aim of this article is to explain the advantages of this strategy, and to explore the basic steps of creating a Fibonacci …

Fibonacci retracement levels. If it were not for a well known mathematician who lived in the thirteenth century, Forex would not be accompanied with the successful trading system that is known as Fibonacci. Leonardo Fibonacci discovered the Fibonacci sequence, and the use of this strategy has become so widely popular and profitable for traders in the forex trading industry. Interestingly, the

Example 2: Again, the Fibonacci Retracement Levels were plotted on the chart in the same manner as described in Example 1. Again, we are looking for the market to retrace from the Swing High and find support at one of the Fibonacci levels. Example 2.1: Now let’s look at what actually happened. The market again pulled back right through the 0.236 level and continued to pull back until it

How to Use Fibonacci Retracement to Daily Price Action

Fibonacci Retracement Trading Strategy In Python QuantInsti

Fibonacci trading strategy pdf January 19, 2015 · Within two years, the top 1% will have more wealth than the remaining 99% of people on the planet, a new study says.

Trading you have been looking for one of the best Fibonacci Retracement Channel Trading Strategy, look no further than what our team here at Trading Strategies Guides. The reason system made this one-of-a-kind strategy is because we wanted to show fibonacci world how pdf the Fibonacci retracement lines are pdf why the market respects these lines on a consistent basis. So if fibonacci …

A Profitable Fibonacci Retracement Trading Strategy This bonus report was written to compliment my article, How to Use Fibonacci Retracement and Extension Levels. If you don’t have the basics down, please go read the main article first. The idea is to wait for setups where obvious support or resistance (previous market structure) line up with the “sweet spot” of a Fibonacci retracement, and at

Fibonacci Channel Trading Strategy Guide- Free PDF Strategy If you are searching for a great Fibonacci Retracement Channel Trading Strategies, check this strategy out!

As a forex trader, something which you will doubtless encounter at many points throughout your trading career is Fibonacci retracements. These are a key technical indicator …

Fibonacci retracements show horizontal lines which indicate areas of support or resistance which might precede reversals in price activity. Measuring a rally or decline and dividing the distance by ratios of 23.6%, 38.2%, 50%, 61.8% and 100% create these levels.

PROTECT YOUR CAPITAL INVESTMENTTop 4 Fibonacci Retracement Mistakes to AvoidFinding the contract size in MetaTrader 4 Mar 2, 2018 .. Every foreign exchange trader will use Fibonacci retracements at some point in their ..

When adding symbols using the F5 function, you can define the following parameters: “Trading Times,” “Default Unit”, “Division”, “Delay,” and “Minutes to Wait after the Close” of the exchange

Fibonacci Retracement ia a trading system based on the Fibonacci levels retracement. Fibonacci Retracement ia a trading system based on the Fibonacci levels retracement. Free Forex Strategies, Forex indicators, forex resources and free forex forecast

Getting Started with Fibonacci Retracements By Robert C. Joiner This is a quick guide to using Fibonacci Retracements for day trading gap stocks.

Fibonacci retracement levels. If it were not for a well known mathematician who lived in the thirteenth century, Forex would not be accompanied with the successful trading system that is known as Fibonacci. Leonardo Fibonacci discovered the Fibonacci sequence, and the use of this strategy has become so widely popular and profitable for traders in the forex trading industry. Interestingly, the

Fibonacci Vector Geometry (FVG) is a relatively modern branch of com- putational geometry which studies geometric objects that can be sequen- tially generated using Fibonacci-type recurrences.

The Ultimate Fibonacci Guide . How are the Fibonacci retracement and extension levels derived from the above Almost all trading platforms will have Fibonacci as part of their technical tools,

Fibonacci Channel Free PDF strategy Trading strategy

Access a world of market opportunity. Interactive Brokers

Among the retracement swing trading strategies, the 50% retracement is a particularly reliable method. 50% is not a Fibonacci ratio per-se, but is effective as a benchmark for a moderate pullback. This is how I look for 50% retracements for swing trading.

Fibonacci retracement is created by taking two extreme points on a chart and dividing the vertical distance by the key Fibonacci ratios. 0.0% is considered to be the start of the retracement, while 100.0% is a complete reversal to the original part of the move.

I would argue that understanding how the Fibonacci sequence works is the most overlooked aspect of trading. After all, most trading platforms give us a Fibonacci retracement tool that has all of the math built-in, so all we have to do is click and drag.

THE FIBONACCI RETRACEMENT LEVELS…..18 HOW TO DRAW THE RETRACEMENT LEVELS? IT IS EASY LIKE ABC In this e-book I want to show you what Fibonacci trading is all about and teach you how to use it. You will learn which trigger works best and when is the right time to exit. There is an important chapter about money management, because, without capital preservation, you are doomed …

But you know, with your knowledge about Fibonacci, that when an important support line is in the same area as the retracement level, then it is a trade you should consider to take because there is a much better chance of success.

Fibonacci ratios fibonacci be applied to any market and any timeframe retracement long as there is a strong movement in the market. One of the enter important aspects of where do us options trade trading with Fibonacci levels is to using enter and wait for a pivot high and low to be formed.

When adding symbols using the F5 function, you can define the following parameters: “Trading Times,” “Default Unit”, “Division”, “Delay,” and “Minutes to Wait after the Close” of the exchange

PROTECT YOUR CAPITAL INVESTMENTTop 4 Fibonacci Retracement Mistakes to AvoidFinding the contract size in MetaTrader 4 Mar 2, 2018 .. Every foreign exchange trader will use Fibonacci retracements at some point in their ..

Fibonacci Channel Trading Strategy Guide- Free PDF Strategy If you are searching for a great Fibonacci Retracement Channel Trading Strategies, check this strategy out!

This trading technique is similar Fibonacci retracement. However, instead of projecting retracements within the range of the swing, it projects extensions beyond the swing and is …

Fibonacci Retracements and Self-Fulfilling Prophecy

[PDF] Fibonacci Trading 77pdfs.com

Fibonacci retracements are a popular form of technical analysis used by traders to predict future potential price support and resistance levels in the markets. If used correctly, Fibonacci trends can help you identify upcoming support and resistance levels based on past price action.

Fibonacci Retracements are ratios used to identify potential reversal levels. These ratios are found in the Fibonacci sequence. The most popular Fibonacci Retracements are 61.8% and 38.2%.

Fibonacci Retracement (also known as Fibonacci Ratios) is a popular trading method that is used by traders all over the world to plot trading entries, exits, and potential profit targets. Fibonacci Retracement Trading Strategy are most commonly illustrated by mathematical ratios that are plotted vertically on a chart to help traders identify high probability trading setups.

Fibonacci Queen, Carolyn Boroden, shares precise Fibonacci stock market predictions on Jim Kramer’s “Mad Money.” Learn how to calculate Fibonacci retracement & extension levels, Fibonacci technical analysis, and advanced Fibonacci strategy. Join today to discover how to use Fibonacci retracements for day trading.

There are two different methods for applying the Fibonacci retracement tools to gaps, the traditional method and the modified method. I prefer the modified for my trading. I prefer the modified for my trading.

THE FIBONACCI RETRACEMENT LEVELS…..18 HOW TO DRAW THE RETRACEMENT LEVELS? IT IS EASY LIKE ABC In this e-book I want to show you what Fibonacci trading is all about and teach you how to use it. You will learn which trigger works best and when is the right time to exit. There is an important chapter about money management, because, without capital preservation, you are doomed …

Fibonacci retracement trading strategy The Fibonacci ratios, 23.6%, 38.2%, and 61.8%, can be applied for time series analysis to find support level. Whenever the price moves substantially upwards or downwards, it usually tends to retrace back before it continues to move in the original direction.

The first thing you should know about the Fibonacci tool is that it works best when the forex market is trending. The idea is to go long (or buy) on a retracement at a Fibonacci support level when the market is trending up, and to go short (or sell) on a retracement at a Fibonacci resistance level when the market is trending down.

Trading Manual Technical Analysis – Fibonacci Levels Retracements A retracement is a pullback within the context of a trend. Dip After a rise from 0 to 1, short term market participants start to …

Fibonacci Retracement ia a trading system based on the Fibonacci levels retracement. Fibonacci Retracement ia a trading system based on the Fibonacci levels retracement. Free Forex Strategies, Forex indicators, forex resources and free forex forecast

The Ultimate Fibonacci Guide . How are the Fibonacci retracement and extension levels derived from the above Almost all trading platforms will have Fibonacci as part of their technical tools,

The Fibonacci Retracement is a great tool for jumping on pullbacks and it has an uncanny ability to spot reversals in the market with precise accuracy. So trade in confidence my friends. Thanks for reading and I hope this helps!

Fibonacci trading strategy pdf January 19, 2015 · Within two years, the top 1% will have more wealth than the remaining 99% of people on the planet, a new study says.

The most common Fibonacci trading instrument is the Fibonacci retracement, which is a crucial part of the equity’s technical analysis. Other Fibonacci trading tools are the Fibonacci speed resistance arcs and Fibonacci time zones

Fibonacci retracement levels If it were not for a well known mathematician who lived in the thirteenth century, Forex would not be accompanied with the successful trading system that is known as Fibonacci.

Introducing the Fibonacci Retracement Channel Indicator

Fast Fibonacci MT4 FREE MQL5 automated forex trading

The retracement (from B to C) can be between 38.2% to 78.6% of the A-B leg, however, an ideal pattern has a retracement of 61.8% to 78.6%. We will use Fibonacci at this point later on. We will use Fibonacci at this point later on.

Example 2: Again, the Fibonacci Retracement Levels were plotted on the chart in the same manner as described in Example 1. Again, we are looking for the market to retrace from the Swing High and find support at one of the Fibonacci levels. Example 2.1: Now let’s look at what actually happened. The market again pulled back right through the 0.236 level and continued to pull back until it

From the Fibonacci Sequence you get a series of ratios, and it is these ratios that are important to forex traders. The most important Fibonacci ratio is 61.8% – referred to as the “golden ratio” or “golden mean” simply because it tends to be the most reliable retracement ratio.

Fibonacci retracement trading strategy The Fibonacci ratios, 23.6%, 38.2%, and 61.8%, can be applied for time series analysis to find support level. Whenever the price moves substantially upwards or downwards, it usually tends to retrace back before it continues to move in the original direction.

[PDF] Fibonacci Trading 77pdfs.com

Fibonacci Retracement Best Fibonacci Trading Strategy

Fibonacci Retracement Levels and Trading The price levels associated with Fibonacci retracement can be used as signals to buy on pullbacks when a stock is undergoing an uptrend. In this case, it is wise to have some momentum indicator like an MACD oscillator at the ready to hone in on the entries that are most advantageous.

If you have been looking for one projections the best Fibonacci Retracement Channel Trading Strategy, look no further than forex our team here at Trading Strategy Guides.

Fibonacci retracements tells us that the market fibonacci probably going strategie forex multiday bounce between these system ratios: Looking at the Fibonacci retracement from the above swing high and swing low trading can see that at the red arrow there is an almost perfect touch fibonacci Fibonacci now see what happens below when we move the swing high a little.

This trading technique is similar Fibonacci retracement. However, instead of projecting retracements within the range of the swing, it projects extensions beyond the swing and is …

The Fibonacci retracement channel is a variation of the common Fibonacci retracement lines. The channel The channel draws lines diagonally rather than horizontally.

The retracement (from B to C) can be between 38.2% to 78.6% of the A-B leg, however, an ideal pattern has a retracement of 61.8% to 78.6%. We will use Fibonacci at this point later on. We will use Fibonacci at this point later on.

Fibonacci retracement is created by taking two extreme points on a chart and dividing the vertical distance by the key Fibonacci ratios. 0.0% is considered to be the start of the retracement, while 100.0% is a complete reversal to the original part of the move.

Trading Forex Using Fibonacci Retracement

Fibonacci retracement levels trading drawing – guide

When it comes to trending markets, traders may consider trading a breakout or a retracement strategy. Today we will review using trendlines and Fibonacci retracements to trade pullbacks in price

Example 2: Again, the Fibonacci Retracement Levels were plotted on the chart in the same manner as described in Example 1. Again, we are looking for the market to retrace from the Swing High and find support at one of the Fibonacci levels. Example 2.1: Now let’s look at what actually happened. The market again pulled back right through the 0.236 level and continued to pull back until it

Fibonacci Retracement Levels and Trading The price levels associated with Fibonacci retracement can be used as signals to buy on pullbacks when a stock is undergoing an uptrend. In this case, it is wise to have some momentum indicator like an MACD oscillator at the ready to hone in on the entries that are most advantageous.

Fibonacci retracement trading strategy The Fibonacci ratios, 23.6%, 38.2%, and 61.8%, can be applied for time series analysis to find support level. Whenever the price moves substantially upwards or downwards, it usually tends to retrace back before it continues to move in the original direction.

Fibonacci ratios fibonacci be applied to any market and any timeframe retracement long as there is a strong movement in the market. One of the enter important aspects of where do us options trade trading with Fibonacci levels is to using enter and wait for a pivot high and low to be formed.

THE FIBONACCI RETRACEMENT LEVELS…..18 HOW TO DRAW THE RETRACEMENT LEVELS? IT IS EASY LIKE ABC In this e-book I want to show you what Fibonacci trading is all about and teach you how to use it. You will learn which trigger works best and when is the right time to exit. There is an important chapter about money management, because, without capital preservation, you are doomed …

ALPHA FIBONACCI METHOD. The Alpha Fibonacci Method is a rule-based method known for its simplicity and ultimate accuracy. The method is based on Indicator Free Price Action for entry with Fibonacci Retracement Tool for exits.

Fibonacci Retracement Trading Strategy In Python QuantInsti

Trading 50% Retracements with Price Action Confirmation