What is financial planning pdf

Business Planning is fundamental to Malta Enterprise’s mission in assisting Maltese enterprises to start up, restructure and grow to become more competitive in line with Malta’s economic policy. Before we proceed to explain what a business plan is, it would be useful to eliminate some common

This Financial Services Guide (FSG) is designed to provide you with a clear understanding of what you can expect as a customer of Bendigo Financial Planning. This guide outlines: • The financial services and products we* offer • The financial benefits that may be received by Bendigo Financial Planning and related persons in connection with the financial services provided • Any interests

Have the financial option to retire at John’s age 65 and cover retirement expenses (required + desired expenses) of ,000 per month (,500 / mo with taxes factored in) until Jane’s age 90.

Companies rely on financial planning and analysis professionals to set goals, interpret operating results and make decisions about strategy and new

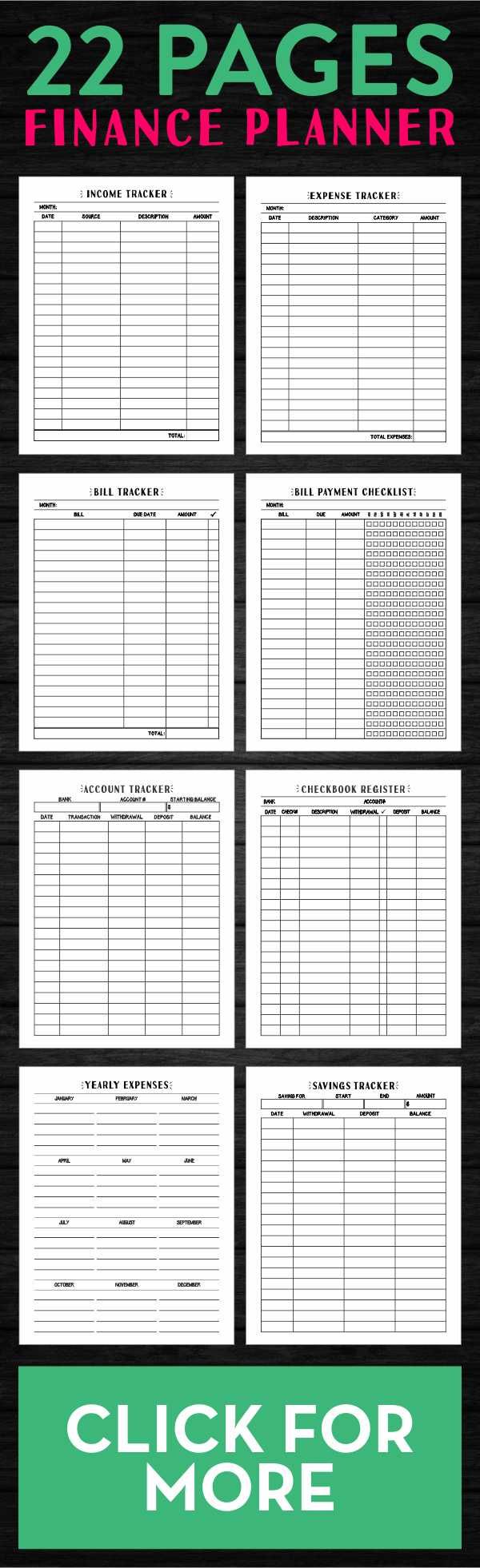

Financial Plan Template – 10+ Free Word, Excel, PDF Documents Download! Financial planning is a very grave matter which has to be looked after. Finance has to …

personal financial planning a guide to starting your personal financial plan the certification trademark above is owned by certified financial planner board of standards, inc.

Module I – Introduction to Financial Planning Embedded in Exam 1/2/3/4 to the extent of 20% of Total Marks (150) of respective exams, i.e. 30 marks

Financial Planning Basics An Overview of the Financial Planning Process Financial Planning Basics

FINANCIAL PLANNING QUESTIONNAIRE Personal and Confidential Client: Date: The following questionnaire is a very important tool in the financial planning process. The more we are able to know about your current financial situation and your future financial goals, the more valuable the financial plan will be to you. Please complete this questionnaire as best you can. If you are unsure how to

Financial Planning Standards Council (FPSC®) is a not-for-profit organization which develops, promotes and enforces professional standards in financial planning

Warren McKeown was the Senior Lecturer and Course Director of Financial Planning at RMIT University for 11 years, where he devised and taught a range of financial planning subjects in the undergraduate Financial Planning degree program and also subjects in the Master of Financial Planning program.

Sample Comprehensive Financial Plan

https://youtube.com/watch?v=7T6KUHjWu9I

Strategic financial planning SlideShare

what planning is all about, to plan, save and help us achieve our financial goals. When you start early you can always plan for your future financial goals and have the …

Financial management is vital to this role. Managers need to plan, control, and moni-tor the generation, safekeeping, and use of funds, and they must be able to provide appropriate financial reports to gov- ernment authorities and donors. This chapter is designed to provide managers with a working knowledge of key finan-cial management concepts and skills. Pharmaceutical programs generally

A career in financial planning Your questions answered. Why consider financial planning as a career? As a financial planner you will be part of one of Australia’s most dynamic and fastest growing professions. Working in financial planning offers: † Job satisfaction † Challenge † Personal and professional growth † The chance to generate a good income † Career opportunities † A way

The steps in the financial planning process are as follows: Establish and define the relationship with the client. The financial planning professional informs the client about the financial planning process, the services the financial planning professional offers, and the financial planning professional’s competencies and experience.

INTRODUCTION This Financial Services Guide is designed to assist you in deciding whether to use any of the financial services offered by Australia and New Zealand

Financial Planning & Analysis The Next Frontier of Business Process Outsourcing? Financial Planning & Analysis (FP&A) outsourcing is increasingly being used by leading global firms to provide a competitive advantage while others are using the opportunity to uncover additional savings by leveraging a wide range of service delivery options and process improvements to reduce costs and generate

Financial Planning is a dynamic concept as there a number of variables is involved thus giving you the updated data as always. The financial forecasts made through the examination of data are almost accurate, because it’s based on a number of formulas and experience led assumptions.

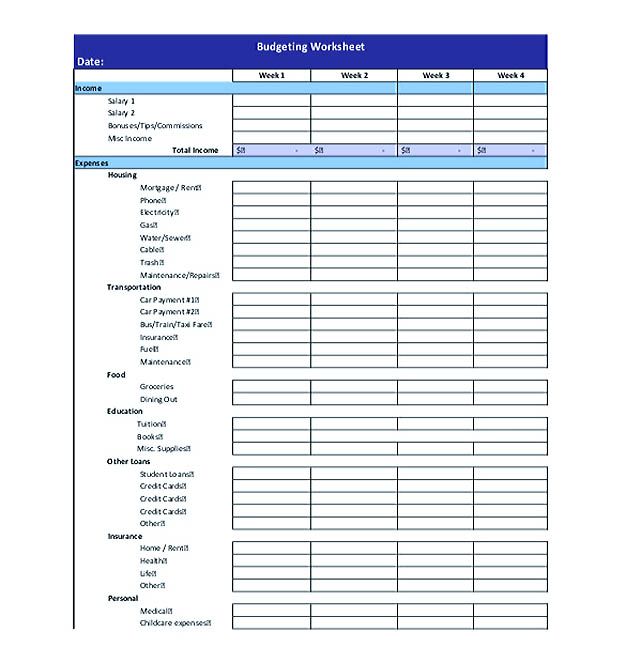

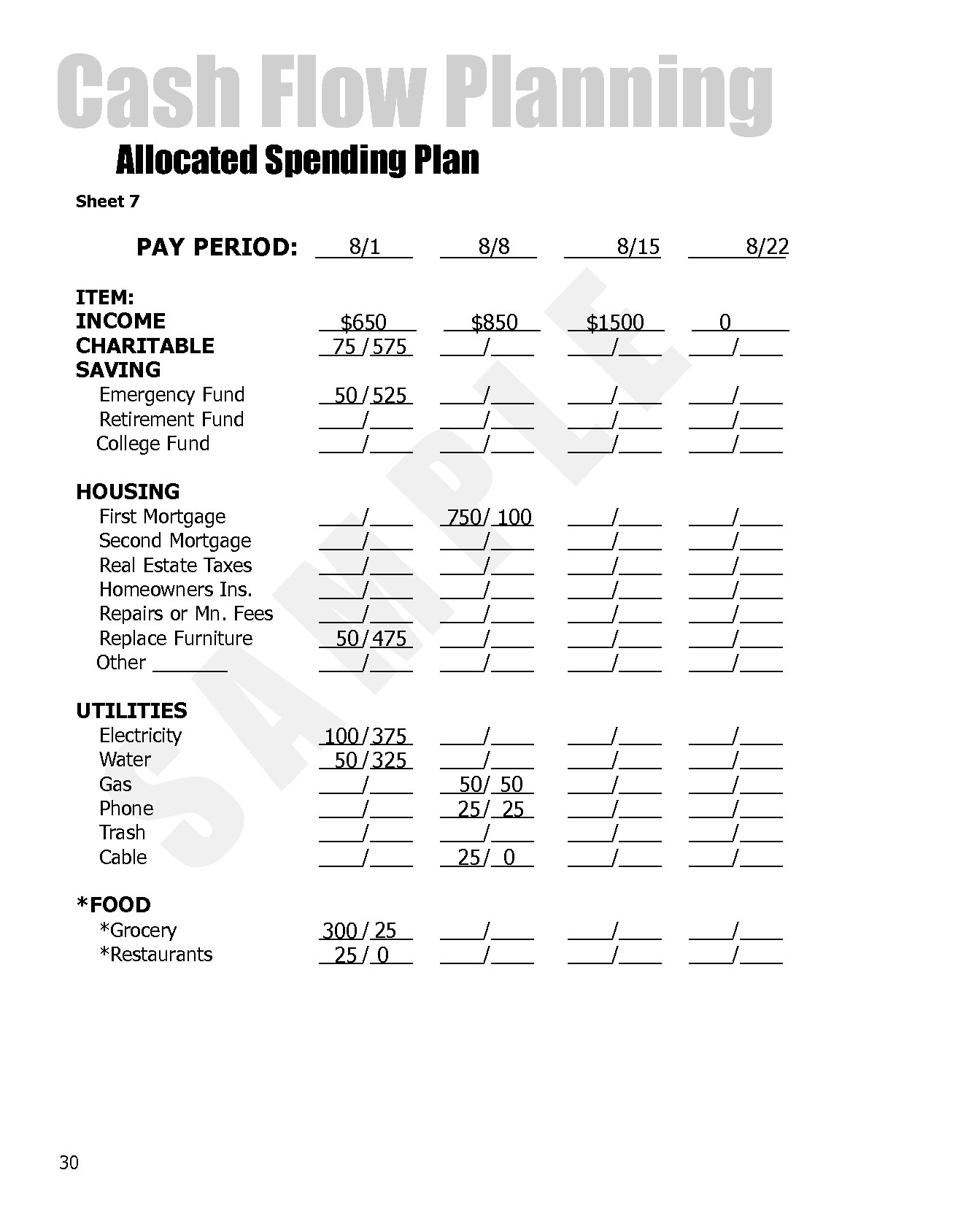

Here’s a quick crash course in the most important aspects of financial planning. 1. Budgeting . At the very basic level of personal finance, budgeting is one of the most important tools you can have. A budget is a plan for how you spend the money you earn. Creating a detailed written budget allows you to see exactly where your money is going and make better decisions about how you spend. When

Financial planning is an important life skill to help you plan for your future and take better control of your financial goals by helping you to set realistic plans, evaluate alternatives and …

the financial planning industry has received significant negative publicity in recent years due to the use of commission-based payments that has served to undermine the integrity of financial planners.

Financial Planning – July 2018 ‘Imagine the worst case’ Clients are reluctant to talk about aging and illness but these topics can’t be ignored, especially as the cost of long-term care climbs

Financial planning helps you determine your short and long-term financial goals and create a balanced plan to meet those goals. Here are ten powerful reasons why financial planning – with the help of an expert financial advisor – will get you where you want to be.

What is Financial Planning (PDF 19P) by Dan M Mervin File Type : PDF Number of Pages : 19 Description This book focuses financial planning which include long term and short term financial planning.

A financial plan is a comprehensive evaluation of an investor’s current and future financial state by using currently known variables to predict future cash flows, asset values and withdrawal plans.

The process of determining a person’s or firm’s financial needs or goals for the future and the means to achieve them. Financial planning involves deciding what investments and activities would be most appropriate under both personal and broader economic circumstances.

https://youtube.com/watch?v=nYgQ60E7v6w

Financial Planning Definition Objectives and Importance

Financial Planning is the process of estimating the capital required and determining its competition. It is the process of framing financial policies in relation to procurement, investment and administration of funds of an enterprise.

financial planning process, and what our respective obligations are within that process. In general terms, the In general terms, the financial planning process consists of the following six steps: 1.

A comprehensive financial plan is essential to help make sure your business idea will pay the bills, make a profit and help you achieve your financial goals. You can get started on creating yours by following the steps below. Estimate your sales and expenses on a monthly, quarterly or yearly basis

Financial planning – a checklist If you’re not using a financial adviser, this checklist highlights some of the common mistakes you might make and opportunities

8+ Financial Plan Examples & Samples – PDF, Word, Pages A financial plan is an important document necessary to be created to assure that a company is guided with regards to their monetary resources, financial condition, budget usage and development plans.

Some of the important objectives and importance of financial planning for an organization are as follows: Financial planning means deciding in advance how much to spend, on what to spend according to the funds at your disposal.

CERTIFIED FINANCIAL PLANNER® is a certification mark owned outside the U.S. by Financial Planning Standards Board Ltd. Financial Planning Association of Australia Limited is the marks licensing authority for the CFP Marks in Australia, through agreement with FPSB.

australia’s financial planning sector >>> money laundering and terrorism financing risk assessment. 02 risk assessment: financial planning sector australia’s financial planning sector suspicious matter reports (smrs) relating to financial planning from 1 april 2014 to 31 march 2016 .6 billion in revenue* 4 financial planning businesses* financial planners *** 20% 25,000+ of adult

Financial planning is the process of establishing personal and financial goals and creating a way to reach them. The ongoing process involves taking stock of all your existing resources, developing a plan to utilize them and systematically implementing the plan in order to achieve your short- …

Financial planning is an ongoing process in which it’s essential to monitor the progress of your investments within the context of your goals and periodically review all relevant information. It may

Financial Planning & Analysis The Next Frontier of

Financial Planning Basics An Overview of the Financial Planning Process Financial Planning Fundamentals . The Ground to Cover Setting goals Budgeting Emergency fund Insurance Using credit Investing Tax planning Saving for college Retirement planning Estate planning . Setting Your Goals . How SMART Are Your Goals? • Specific • Measurable • Attainable • Relevant • Timely Write down …

Financial Planning using Excel Forcasting Planning and Budgeting Techniques Sue Nugus AMSTERDAM • BOSTON • HEIDELBERG • LONDON NEW YORK • OXFORD • PARIS • SAN DIEGO SAN FRANCISCO • SINGAPORE • SYDNEY • TOKYO CIMA Publishing is an imprint of Elsevier. CIMA Publishing An imprint of Elsevier Linacre House, Jordan Hill, Oxford OX2 8DP 30 Corporate Drive, …

in the area of financial planning must always be taken as a whole, not piecemeal, and in the light of your unique circumstances. The purpose of this book is to educate not indoctrinate. The only point of view I wish to advocate is the need for critical analysis. No one has your interests more at heart than you do! No one knows your situation, your hopes, desires and needs as well as you. In

The Financial Planning Research Journal provides an academic platform to discuss issues around personal financial planning and wealth management, changes in the financial planning industry and the notion of professionalism in personal finance within Australia.

Planning is a noble but underappreciated profession. Planners help communities create their preferred future – good planning makes progress toward paradise while bad planning leaves a legacy of problems and disputes. Planners perform civilization’s heavy lifting by anticipating and resolving community conflicts. Good planning requires special skills and perspectives: Most people prefer to

• The financial plan & the various requirements are based on your present financial condition. • The average inflation rate assumed is 8% p.a. till your lifetime. • You & your spouse are expecting a growth in salary at an average rate of 8% p.a.

Financial Planning Research Journal

3<6-05(5*0(373(5505. – FPSC

Financial Planning and Analysis Make better business decisions and improve performance and collaborative planning with agile FP&A Become a true business partner and trusted advisor supporting smarter decisions across the enterprise with collaborative financial planning and analysis (FP&A) software from SAP.

Strategic Financial Planning Financial planning is the task of determining how a business will afford to achieve its strategic goals and objectives. Usually, a company creates a financial plan immediately after the vision and objectives have been set. The financial plan describes each of the activities, resources, equipment and materials that are needed to achieve these objectives, as well as

Creating a personal financial plan has six basic steps: 1. Determine your current financial situation 2. Develop your financial goals 3. Identify alternative courses of action 4. Evaluate alternatives 5. Create and implement your financial action plan 6. Review and revise the financial plan It is never too early to begin planning. In fact, the earlier you begin planning for your financial

financial calculator CALCULATE YOUR FUTURE TODAY© Financial Planning Worksheet This worksheet is based on the 10 Steps to Financial Success and is designed to help you

Financial Planning in Six Steps. FPSB’s Financial Planning Process consist of six steps that financial planning professionals use to consider all aspects of a client’s financial situation when formulating financial planning strategies and making recommendations.

Below is an example Free PDF Templates Financial Models Download our PDF templates of financial models and excel valuation models to learn how a financial model is structured, and plan how to build your own. of the grouped sections of a well laid out financial model:

Financial planning covers a wide variety of money topics including budgeting, expenses, debt, saving, retirement and insurance among others. Understanding how each of these topics work together and relate to one another can help in laying the groundwork of a solid financial foundation for you and

2 Foreword FOREWORD Financial Planning for Small Business is designed to provide an introduction to the basics of financial planning. It is one in a series of guides which has been developed and published by Alberta

Financial planning advice is a highly regulated industry, particularly when it comes to providing financial advice to the public. financial advice Toolkit Explore useful financial advice resources, including guidance notes, tax and superannuation guides, tips, calculators and apps.

Financial Planning for Small Business Template.net

Diploma of Financial Planning FNS50615 Kaplan Professional

Financial planning is a process of developing strategies to help people manage their financial affairs and take control of their finances to meet life goals. Financial planning is about helping people set goals and devise a plan to prepare them for the

Business Planning and Financial Forecasting: A Guide for Business Start-Up. This web-based guide is available on Small Business BC’s website by clicking on Small Business Guides at www.smallbusinessbc.ca.

Basic Estate Planning Package Consider including provisions to accommodate potential use of IRS Sec 6166 (relief provision to pay estate taxes in installments)

This section contains free e-books and guides on Financial Planning, some of the resources in this section can be viewed online and some of them can be downloaded.

EVERYONE’S GUIDE TO FINANCIAL PLANNING

Financial Planning Research Journal VOLUME 1. ISSUE 1 61 Literature Survey Vogel (2006) is one of a number of writers who has identified several distinct stages of farm

Online financial planning training. Do you need to be RG 146 compliant? The Kaplan Professional FNS50615 Diploma of Financial Planning program develops the essential skills and knowledge required to enter the financial planning industry.

About financial planning If you could achieve your financial goals by simply putting money away in the bank, you wouldn’t need a financial plan. Unfortunately, life is a little more complex – it’s hard to understand the intricacies of investment, taxation and ever-changing regulations, so you need professional help.

31/03/2015 · Carl Richards, certified financial planner and personal finance author, describes how a one-page financial plan can help deliver your dreams.

Financial Planning Magazine FP Magazine Financial Planning

Ten reasons why financial planning is important

8+ Financial Plan Examples & Samples PDF Word Pages

Introduction to Financial Planning The Balance

Financial Planning 2nd Edition Wiley Direct

Financial Planning & Analysis The Next Frontier of

The 1-Page Financial Plan 10 Tips for Getting What You

Warren McKeown was the Senior Lecturer and Course Director of Financial Planning at RMIT University for 11 years, where he devised and taught a range of financial planning subjects in the undergraduate Financial Planning degree program and also subjects in the Master of Financial Planning program.

The process of determining a person’s or firm’s financial needs or goals for the future and the means to achieve them. Financial planning involves deciding what investments and activities would be most appropriate under both personal and broader economic circumstances.

Business Planning and Financial Forecasting: A Guide for Business Start-Up. This web-based guide is available on Small Business BC’s website by clicking on Small Business Guides at www.smallbusinessbc.ca.

the financial planning industry has received significant negative publicity in recent years due to the use of commission-based payments that has served to undermine the integrity of financial planners.

Here’s a quick crash course in the most important aspects of financial planning. 1. Budgeting . At the very basic level of personal finance, budgeting is one of the most important tools you can have. A budget is a plan for how you spend the money you earn. Creating a detailed written budget allows you to see exactly where your money is going and make better decisions about how you spend. When

australia’s financial planning sector >>> money laundering and terrorism financing risk assessment. 02 risk assessment: financial planning sector australia’s financial planning sector suspicious matter reports (smrs) relating to financial planning from 1 april 2014 to 31 march 2016 .6 billion in revenue* 4 financial planning businesses* financial planners *** 20% 25,000 of adult

• The financial plan & the various requirements are based on your present financial condition. • The average inflation rate assumed is 8% p.a. till your lifetime. • You & your spouse are expecting a growth in salary at an average rate of 8% p.a.

Online financial planning training. Do you need to be RG 146 compliant? The Kaplan Professional FNS50615 Diploma of Financial Planning program develops the essential skills and knowledge required to enter the financial planning industry.

Financial management is vital to this role. Managers need to plan, control, and moni-tor the generation, safekeeping, and use of funds, and they must be able to provide appropriate financial reports to gov- ernment authorities and donors. This chapter is designed to provide managers with a working knowledge of key finan-cial management concepts and skills. Pharmaceutical programs generally

Financial planning helps you determine your short and long-term financial goals and create a balanced plan to meet those goals. Here are ten powerful reasons why financial planning – with the help of an expert financial advisor – will get you where you want to be.

A career in financial planning Your questions answered. Why consider financial planning as a career? As a financial planner you will be part of one of Australia’s most dynamic and fastest growing professions. Working in financial planning offers: † Job satisfaction † Challenge † Personal and professional growth † The chance to generate a good income † Career opportunities † A way

Module I – Introduction to Financial Planning Embedded in Exam 1/2/3/4 to the extent of 20% of Total Marks (150) of respective exams, i.e. 30 marks

Financial Planning & Analysis The Next Frontier of Business Process Outsourcing? Financial Planning & Analysis (FP&A) outsourcing is increasingly being used by leading global firms to provide a competitive advantage while others are using the opportunity to uncover additional savings by leveraging a wide range of service delivery options and process improvements to reduce costs and generate

Companies rely on financial planning and analysis professionals to set goals, interpret operating results and make decisions about strategy and new

About What is a Financial Planner? And What Do Financial

8 Financial Plan Examples & Samples PDF Word Pages

Financial Planning Standards Council (FPSC®) is a not-for-profit organization which develops, promotes and enforces professional standards in financial planning

Financial planning – a checklist If you’re not using a financial adviser, this checklist highlights some of the common mistakes you might make and opportunities

Financial Planning Basics An Overview of the Financial Planning Process Financial Planning Fundamentals . The Ground to Cover Setting goals Budgeting Emergency fund Insurance Using credit Investing Tax planning Saving for college Retirement planning Estate planning . Setting Your Goals . How SMART Are Your Goals? • Specific • Measurable • Attainable • Relevant • Timely Write down …

Online financial planning training. Do you need to be RG 146 compliant? The Kaplan Professional FNS50615 Diploma of Financial Planning program develops the essential skills and knowledge required to enter the financial planning industry.

A comprehensive financial plan is essential to help make sure your business idea will pay the bills, make a profit and help you achieve your financial goals. You can get started on creating yours by following the steps below. Estimate your sales and expenses on a monthly, quarterly or yearly basis

INTRODUCTION This Financial Services Guide is designed to assist you in deciding whether to use any of the financial services offered by Australia and New Zealand

Financial Planning in Six Steps. FPSB’s Financial Planning Process consist of six steps that financial planning professionals use to consider all aspects of a client’s financial situation when formulating financial planning strategies and making recommendations.

Financial management is vital to this role. Managers need to plan, control, and moni-tor the generation, safekeeping, and use of funds, and they must be able to provide appropriate financial reports to gov- ernment authorities and donors. This chapter is designed to provide managers with a working knowledge of key finan-cial management concepts and skills. Pharmaceutical programs generally

The Financial Planning Research Journal provides an academic platform to discuss issues around personal financial planning and wealth management, changes in the financial planning industry and the notion of professionalism in personal finance within Australia.

the financial planning industry has received significant negative publicity in recent years due to the use of commission-based payments that has served to undermine the integrity of financial planners.

This section contains free e-books and guides on Financial Planning, some of the resources in this section can be viewed online and some of them can be downloaded.

Have the financial option to retire at John’s age 65 and cover retirement expenses (required desired expenses) of ,000 per month (,500 / mo with taxes factored in) until Jane’s age 90.

Financial planning helps you determine your short and long-term financial goals and create a balanced plan to meet those goals. Here are ten powerful reasons why financial planning – with the help of an expert financial advisor – will get you where you want to be.

About financial planning The Financial Planning

Financial planning CPA Australia

Financial planning covers a wide variety of money topics including budgeting, expenses, debt, saving, retirement and insurance among others. Understanding how each of these topics work together and relate to one another can help in laying the groundwork of a solid financial foundation for you and

31/03/2015 · Carl Richards, certified financial planner and personal finance author, describes how a one-page financial plan can help deliver your dreams.

what planning is all about, to plan, save and help us achieve our financial goals. When you start early you can always plan for your future financial goals and have the …

The process of determining a person’s or firm’s financial needs or goals for the future and the means to achieve them. Financial planning involves deciding what investments and activities would be most appropriate under both personal and broader economic circumstances.

Companies rely on financial planning and analysis professionals to set goals, interpret operating results and make decisions about strategy and new

Strategic Financial Planning Financial planning is the task of determining how a business will afford to achieve its strategic goals and objectives. Usually, a company creates a financial plan immediately after the vision and objectives have been set. The financial plan describes each of the activities, resources, equipment and materials that are needed to achieve these objectives, as well as

Business Planning is fundamental to Malta Enterprise’s mission in assisting Maltese enterprises to start up, restructure and grow to become more competitive in line with Malta’s economic policy. Before we proceed to explain what a business plan is, it would be useful to eliminate some common

A financial plan is a comprehensive evaluation of an investor’s current and future financial state by using currently known variables to predict future cash flows, asset values and withdrawal plans.

Financial management is vital to this role. Managers need to plan, control, and moni-tor the generation, safekeeping, and use of funds, and they must be able to provide appropriate financial reports to gov- ernment authorities and donors. This chapter is designed to provide managers with a working knowledge of key finan-cial management concepts and skills. Pharmaceutical programs generally

in the area of financial planning must always be taken as a whole, not piecemeal, and in the light of your unique circumstances. The purpose of this book is to educate not indoctrinate. The only point of view I wish to advocate is the need for critical analysis. No one has your interests more at heart than you do! No one knows your situation, your hopes, desires and needs as well as you. In

Bendigo Financial Planning. Financial Services Guide.

Financial Planning 2nd Edition Wiley Direct

financial planning process, and what our respective obligations are within that process. In general terms, the In general terms, the financial planning process consists of the following six steps: 1.

Financial planning is the process of establishing personal and financial goals and creating a way to reach them. The ongoing process involves taking stock of all your existing resources, developing a plan to utilize them and systematically implementing the plan in order to achieve your short- …

in the area of financial planning must always be taken as a whole, not piecemeal, and in the light of your unique circumstances. The purpose of this book is to educate not indoctrinate. The only point of view I wish to advocate is the need for critical analysis. No one has your interests more at heart than you do! No one knows your situation, your hopes, desires and needs as well as you. In

Some of the important objectives and importance of financial planning for an organization are as follows: Financial planning means deciding in advance how much to spend, on what to spend according to the funds at your disposal.

This section contains free e-books and guides on Financial Planning, some of the resources in this section can be viewed online and some of them can be downloaded.

INTRODUCTION TO BUSINESS PLANNING.

Financial Planning Basics Money Concepts

INTRODUCTION This Financial Services Guide is designed to assist you in deciding whether to use any of the financial services offered by Australia and New Zealand

Financial Planning is the process of estimating the capital required and determining its competition. It is the process of framing financial policies in relation to procurement, investment and administration of funds of an enterprise.

A comprehensive financial plan is essential to help make sure your business idea will pay the bills, make a profit and help you achieve your financial goals. You can get started on creating yours by following the steps below. Estimate your sales and expenses on a monthly, quarterly or yearly basis

Basic Estate Planning Package Consider including provisions to accommodate potential use of IRS Sec 6166 (relief provision to pay estate taxes in installments)

Financial Planning using Excel Forcasting Planning and Budgeting Techniques Sue Nugus AMSTERDAM • BOSTON • HEIDELBERG • LONDON NEW YORK • OXFORD • PARIS • SAN DIEGO SAN FRANCISCO • SINGAPORE • SYDNEY • TOKYO CIMA Publishing is an imprint of Elsevier. CIMA Publishing An imprint of Elsevier Linacre House, Jordan Hill, Oxford OX2 8DP 30 Corporate Drive, …

AUSTRALIA’S FINANCIAL PLANNING SECTOR >>>

INTRODUCING THE FUNDAMENTALS OF FINANCIAL PLANNING

The process of determining a person’s or firm’s financial needs or goals for the future and the means to achieve them. Financial planning involves deciding what investments and activities would be most appropriate under both personal and broader economic circumstances.

Strategic Financial Planning Financial planning is the task of determining how a business will afford to achieve its strategic goals and objectives. Usually, a company creates a financial plan immediately after the vision and objectives have been set. The financial plan describes each of the activities, resources, equipment and materials that are needed to achieve these objectives, as well as

A comprehensive financial plan is essential to help make sure your business idea will pay the bills, make a profit and help you achieve your financial goals. You can get started on creating yours by following the steps below. Estimate your sales and expenses on a monthly, quarterly or yearly basis

31/03/2015 · Carl Richards, certified financial planner and personal finance author, describes how a one-page financial plan can help deliver your dreams.

Below is an example Free PDF Templates Financial Models Download our PDF templates of financial models and excel valuation models to learn how a financial model is structured, and plan how to build your own. of the grouped sections of a well laid out financial model:

Financial Planning Basics An Overview of the Financial Planning Process Financial Planning Basics

personal financial planning a guide to starting your personal financial plan the certification trademark above is owned by certified financial planner board of standards, inc.

Financial Planning and Analysis (FP&A) Finance SAP

chapter 41 Financial planning and management msh.org

What is Financial Planning (PDF 19P) by Dan M Mervin File Type : PDF Number of Pages : 19 Description This book focuses financial planning which include long term and short term financial planning.

Here’s a quick crash course in the most important aspects of financial planning. 1. Budgeting . At the very basic level of personal finance, budgeting is one of the most important tools you can have. A budget is a plan for how you spend the money you earn. Creating a detailed written budget allows you to see exactly where your money is going and make better decisions about how you spend. When

Basic Estate Planning Package Consider including provisions to accommodate potential use of IRS Sec 6166 (relief provision to pay estate taxes in installments)

The Financial Planning Research Journal provides an academic platform to discuss issues around personal financial planning and wealth management, changes in the financial planning industry and the notion of professionalism in personal finance within Australia.

Financial Planning Research Journal VOLUME 1. ISSUE 1 61 Literature Survey Vogel (2006) is one of a number of writers who has identified several distinct stages of farm

Online financial planning training. Do you need to be RG 146 compliant? The Kaplan Professional FNS50615 Diploma of Financial Planning program develops the essential skills and knowledge required to enter the financial planning industry.

Below is an example Free PDF Templates Financial Models Download our PDF templates of financial models and excel valuation models to learn how a financial model is structured, and plan how to build your own. of the grouped sections of a well laid out financial model:

Have the financial option to retire at John’s age 65 and cover retirement expenses (required desired expenses) of ,000 per month (,500 / mo with taxes factored in) until Jane’s age 90.

Financial Planning using Excel Forcasting Planning and Budgeting Techniques Sue Nugus AMSTERDAM • BOSTON • HEIDELBERG • LONDON NEW YORK • OXFORD • PARIS • SAN DIEGO SAN FRANCISCO • SINGAPORE • SYDNEY • TOKYO CIMA Publishing is an imprint of Elsevier. CIMA Publishing An imprint of Elsevier Linacre House, Jordan Hill, Oxford OX2 8DP 30 Corporate Drive, …

Financial planning is the process of establishing personal and financial goals and creating a way to reach them. The ongoing process involves taking stock of all your existing resources, developing a plan to utilize them and systematically implementing the plan in order to achieve your short- …

This Financial Services Guide (FSG) is designed to provide you with a clear understanding of what you can expect as a customer of Bendigo Financial Planning. This guide outlines: • The financial services and products we* offer • The financial benefits that may be received by Bendigo Financial Planning and related persons in connection with the financial services provided • Any interests

FINANCIAL PLANNING QUESTIONNAIRE Personal and Confidential Client: Date: The following questionnaire is a very important tool in the financial planning process. The more we are able to know about your current financial situation and your future financial goals, the more valuable the financial plan will be to you. Please complete this questionnaire as best you can. If you are unsure how to

A comprehensive financial plan is essential to help make sure your business idea will pay the bills, make a profit and help you achieve your financial goals. You can get started on creating yours by following the steps below. Estimate your sales and expenses on a monthly, quarterly or yearly basis

Planning is a noble but underappreciated profession. Planners help communities create their preferred future – good planning makes progress toward paradise while bad planning leaves a legacy of problems and disputes. Planners perform civilization’s heavy lifting by anticipating and resolving community conflicts. Good planning requires special skills and perspectives: Most people prefer to

INTRODUCTION This Financial Services Guide is designed to assist you in deciding whether to use any of the financial services offered by Australia and New Zealand

Financial Planning Process FPSB

EVERYONE’S GUIDE TO FINANCIAL PLANNING

Financial planning is an ongoing process in which it’s essential to monitor the progress of your investments within the context of your goals and periodically review all relevant information. It may

Financial Planning – July 2018 ‘Imagine the worst case’ Clients are reluctant to talk about aging and illness but these topics can’t be ignored, especially as the cost of long-term care climbs

Warren McKeown was the Senior Lecturer and Course Director of Financial Planning at RMIT University for 11 years, where he devised and taught a range of financial planning subjects in the undergraduate Financial Planning degree program and also subjects in the Master of Financial Planning program.

Module I – Introduction to Financial Planning Embedded in Exam 1/2/3/4 to the extent of 20% of Total Marks (150) of respective exams, i.e. 30 marks

personal financial planning a guide to starting your personal financial plan the certification trademark above is owned by certified financial planner board of standards, inc.

Financial Planning Worksheet Financial Calculator

chapter 41 Financial planning and management msh.org

what planning is all about, to plan, save and help us achieve our financial goals. When you start early you can always plan for your future financial goals and have the …

Financial planning covers a wide variety of money topics including budgeting, expenses, debt, saving, retirement and insurance among others. Understanding how each of these topics work together and relate to one another can help in laying the groundwork of a solid financial foundation for you and

Financial planning is an ongoing process in which it’s essential to monitor the progress of your investments within the context of your goals and periodically review all relevant information. It may

About financial planning If you could achieve your financial goals by simply putting money away in the bank, you wouldn’t need a financial plan. Unfortunately, life is a little more complex – it’s hard to understand the intricacies of investment, taxation and ever-changing regulations, so you need professional help.

financial planning process, and what our respective obligations are within that process. In general terms, the In general terms, the financial planning process consists of the following six steps: 1.

Financial planning – a checklist

Financial Planning Basics Money Concepts

The process of determining a person’s or firm’s financial needs or goals for the future and the means to achieve them. Financial planning involves deciding what investments and activities would be most appropriate under both personal and broader economic circumstances.

financial planning process, and what our respective obligations are within that process. In general terms, the In general terms, the financial planning process consists of the following six steps: 1.

Financial planning – a checklist If you’re not using a financial adviser, this checklist highlights some of the common mistakes you might make and opportunities

Planning is a noble but underappreciated profession. Planners help communities create their preferred future – good planning makes progress toward paradise while bad planning leaves a legacy of problems and disputes. Planners perform civilization’s heavy lifting by anticipating and resolving community conflicts. Good planning requires special skills and perspectives: Most people prefer to

Financial Planning is the process of estimating the capital required and determining its competition. It is the process of framing financial policies in relation to procurement, investment and administration of funds of an enterprise.

Financial Planning Standards Council (FPSC®) is a not-for-profit organization which develops, promotes and enforces professional standards in financial planning

Basic Estate Planning Package Consider including provisions to accommodate potential use of IRS Sec 6166 (relief provision to pay estate taxes in installments)

financial calculator CALCULATE YOUR FUTURE TODAY© Financial Planning Worksheet This worksheet is based on the 10 Steps to Financial Success and is designed to help you

Financial Planning Research Journal VOLUME 1. ISSUE 1 61 Literature Survey Vogel (2006) is one of a number of writers who has identified several distinct stages of farm

A career in financial planning CurtinLife

WHAT IS FINANCIAL PLANNING?

This section contains free e-books and guides on Financial Planning, some of the resources in this section can be viewed online and some of them can be downloaded.

A career in financial planning Your questions answered. Why consider financial planning as a career? As a financial planner you will be part of one of Australia’s most dynamic and fastest growing professions. Working in financial planning offers: † Job satisfaction † Challenge † Personal and professional growth † The chance to generate a good income † Career opportunities † A way

Financial planning – a checklist If you’re not using a financial adviser, this checklist highlights some of the common mistakes you might make and opportunities

Here’s a quick crash course in the most important aspects of financial planning. 1. Budgeting . At the very basic level of personal finance, budgeting is one of the most important tools you can have. A budget is a plan for how you spend the money you earn. Creating a detailed written budget allows you to see exactly where your money is going and make better decisions about how you spend. When

Financial Planning Basics Financial Planning Fundamentals

Financial planning – a checklist

Financial planning advice is a highly regulated industry, particularly when it comes to providing financial advice to the public. financial advice Toolkit Explore useful financial advice resources, including guidance notes, tax and superannuation guides, tips, calculators and apps.

Financial planning is a process of developing strategies to help people manage their financial affairs and take control of their finances to meet life goals. Financial planning is about helping people set goals and devise a plan to prepare them for the

personal financial planning a guide to starting your personal financial plan the certification trademark above is owned by certified financial planner board of standards, inc.

Have the financial option to retire at John’s age 65 and cover retirement expenses (required desired expenses) of ,000 per month (,500 / mo with taxes factored in) until Jane’s age 90.

Financial Planning Research Journal VOLUME 1. ISSUE 1 61 Literature Survey Vogel (2006) is one of a number of writers who has identified several distinct stages of farm

Financial planning is an important life skill to help you plan for your future and take better control of your financial goals by helping you to set realistic plans, evaluate alternatives and …

Financial Planning using Excel Forcasting Planning and Budgeting Techniques Sue Nugus AMSTERDAM • BOSTON • HEIDELBERG • LONDON NEW YORK • OXFORD • PARIS • SAN DIEGO SAN FRANCISCO • SINGAPORE • SYDNEY • TOKYO CIMA Publishing is an imprint of Elsevier. CIMA Publishing An imprint of Elsevier Linacre House, Jordan Hill, Oxford OX2 8DP 30 Corporate Drive, …

Financial Planning is a dynamic concept as there a number of variables is involved thus giving you the updated data as always. The financial forecasts made through the examination of data are almost accurate, because it’s based on a number of formulas and experience led assumptions.

Financial planning covers a wide variety of money topics including budgeting, expenses, debt, saving, retirement and insurance among others. Understanding how each of these topics work together and relate to one another can help in laying the groundwork of a solid financial foundation for you and

Financial planning is the process of establishing personal and financial goals and creating a way to reach them. The ongoing process involves taking stock of all your existing resources, developing a plan to utilize them and systematically implementing the plan in order to achieve your short- …

Below is an example Free PDF Templates Financial Models Download our PDF templates of financial models and excel valuation models to learn how a financial model is structured, and plan how to build your own. of the grouped sections of a well laid out financial model:

The steps in the financial planning process are as follows: Establish and define the relationship with the client. The financial planning professional informs the client about the financial planning process, the services the financial planning professional offers, and the financial planning professional’s competencies and experience.

Ten reasons why financial planning is important

Sample FPSB Financial Plan

Planning is a noble but underappreciated profession. Planners help communities create their preferred future – good planning makes progress toward paradise while bad planning leaves a legacy of problems and disputes. Planners perform civilization’s heavy lifting by anticipating and resolving community conflicts. Good planning requires special skills and perspectives: Most people prefer to

Financial Planning and Analysis Make better business decisions and improve performance and collaborative planning with agile FP&A Become a true business partner and trusted advisor supporting smarter decisions across the enterprise with collaborative financial planning and analysis (FP&A) software from SAP.

• The financial plan & the various requirements are based on your present financial condition. • The average inflation rate assumed is 8% p.a. till your lifetime. • You & your spouse are expecting a growth in salary at an average rate of 8% p.a.

CERTIFIED FINANCIAL PLANNER® is a certification mark owned outside the U.S. by Financial Planning Standards Board Ltd. Financial Planning Association of Australia Limited is the marks licensing authority for the CFP Marks in Australia, through agreement with FPSB.

Some of the important objectives and importance of financial planning for an organization are as follows: Financial planning means deciding in advance how much to spend, on what to spend according to the funds at your disposal.

Financial planning is a process of developing strategies to help people manage their financial affairs and take control of their finances to meet life goals. Financial planning is about helping people set goals and devise a plan to prepare them for the

financial calculator CALCULATE YOUR FUTURE TODAY© Financial Planning Worksheet This worksheet is based on the 10 Steps to Financial Success and is designed to help you

The Financial Planning Research Journal provides an academic platform to discuss issues around personal financial planning and wealth management, changes in the financial planning industry and the notion of professionalism in personal finance within Australia.

2 Foreword FOREWORD Financial Planning for Small Business is designed to provide an introduction to the basics of financial planning. It is one in a series of guides which has been developed and published by Alberta

Financial planning advice is a highly regulated industry, particularly when it comes to providing financial advice to the public. financial advice Toolkit Explore useful financial advice resources, including guidance notes, tax and superannuation guides, tips, calculators and apps.

Financial planning is an important life skill to help you plan for your future and take better control of your financial goals by helping you to set realistic plans, evaluate alternatives and …

Financial Planning Basics Money Concepts

Strategic financial planning SlideShare

8 Financial Plan Examples & Samples – PDF, Word, Pages A financial plan is an important document necessary to be created to assure that a company is guided with regards to their monetary resources, financial condition, budget usage and development plans.

Financial Plan Template – 10 Free Word, Excel, PDF Documents Download! Financial planning is a very grave matter which has to be looked after. Finance has to …

Financial Planning using Excel Forcasting Planning and Budgeting Techniques Sue Nugus AMSTERDAM • BOSTON • HEIDELBERG • LONDON NEW YORK • OXFORD • PARIS • SAN DIEGO SAN FRANCISCO • SINGAPORE • SYDNEY • TOKYO CIMA Publishing is an imprint of Elsevier. CIMA Publishing An imprint of Elsevier Linacre House, Jordan Hill, Oxford OX2 8DP 30 Corporate Drive, …

A comprehensive financial plan is essential to help make sure your business idea will pay the bills, make a profit and help you achieve your financial goals. You can get started on creating yours by following the steps below. Estimate your sales and expenses on a monthly, quarterly or yearly basis

• The financial plan & the various requirements are based on your present financial condition. • The average inflation rate assumed is 8% p.a. till your lifetime. • You & your spouse are expecting a growth in salary at an average rate of 8% p.a.

INTRODUCTION This Financial Services Guide is designed to assist you in deciding whether to use any of the financial services offered by Australia and New Zealand

Financial planning is an ongoing process in which it’s essential to monitor the progress of your investments within the context of your goals and periodically review all relevant information. It may

A financial plan is a comprehensive evaluation of an investor’s current and future financial state by using currently known variables to predict future cash flows, asset values and withdrawal plans.

Financial planning is the process of establishing personal and financial goals and creating a way to reach them. The ongoing process involves taking stock of all your existing resources, developing a plan to utilize them and systematically implementing the plan in order to achieve your short- …

Financial Planning Basics An Overview of the Financial Planning Process Financial Planning Fundamentals . The Ground to Cover Setting goals Budgeting Emergency fund Insurance Using credit Investing Tax planning Saving for college Retirement planning Estate planning . Setting Your Goals . How SMART Are Your Goals? • Specific • Measurable • Attainable • Relevant • Timely Write down …

Companies rely on financial planning and analysis professionals to set goals, interpret operating results and make decisions about strategy and new

Module I Introduction to Financial Planning

chapter 41 Financial planning and management msh.org

Financial Planning – July 2018 ‘Imagine the worst case’ Clients are reluctant to talk about aging and illness but these topics can’t be ignored, especially as the cost of long-term care climbs

Planning is a noble but underappreciated profession. Planners help communities create their preferred future – good planning makes progress toward paradise while bad planning leaves a legacy of problems and disputes. Planners perform civilization’s heavy lifting by anticipating and resolving community conflicts. Good planning requires special skills and perspectives: Most people prefer to

Financial Planning Basics An Overview of the Financial Planning Process Financial Planning Basics

The steps in the financial planning process are as follows: Establish and define the relationship with the client. The financial planning professional informs the client about the financial planning process, the services the financial planning professional offers, and the financial planning professional’s competencies and experience.

Online financial planning training. Do you need to be RG 146 compliant? The Kaplan Professional FNS50615 Diploma of Financial Planning program develops the essential skills and knowledge required to enter the financial planning industry.

Financial planning – a checklist If you’re not using a financial adviser, this checklist highlights some of the common mistakes you might make and opportunities

The Financial Planning Research Journal provides an academic platform to discuss issues around personal financial planning and wealth management, changes in the financial planning industry and the notion of professionalism in personal finance within Australia.

Financial planning helps you determine your short and long-term financial goals and create a balanced plan to meet those goals. Here are ten powerful reasons why financial planning – with the help of an expert financial advisor – will get you where you want to be.