Defence bank super fees pdf

• deposit at least ,000 from an external bank account to any personal ING account in your name (excluding Living Super and Orange One); and • make at least 5 card purchases that are settled (and not at a ‘pending status’) using your ING debit or credit card (excluding ATM

Learn more about our fees and costs for super accounts and Choice Income accounts. Investment fee These fees are charged to cover the cost to us of managing your investments – costs like external investment management fees, performance related fees, plus transactional and operational costs.

Our Capital Guaranteed Super account is a retirement savings account (RSA) that offers a tax advantaged way to save for your retirement. It is a low risk, low cost investment option with no ongoing administration fees meaning your account balance cannot reduce due to administration fees. The account is a capital guaranteed investment, meaning your retirement savings are protected from …

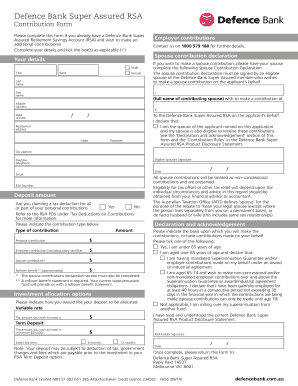

Defence Bank Super is issued by Equity Trustees Superannuation Limited (ABN 50 055 641 757 AFSL 229757) as trustee of the CUBS Superannuation Fund (ABN 90 120 177 925). Defence Bank Limited (ABN 57 087 651 385 AFSL/Australian Credit Licence 234582) is the sub-promoter of the CUBS Superannuation Fund.

Bank-owned superannuation funds have been forced to slash fees on no-frills accounts so that they are now equal to, and in some cases cheaper than, the charges imposed by industry funds, new

Get a lower interest rate. By offering your car as security for the loan, you can access a lower rate than our unsecured personal loan.

subject to the satisfaction of Defence Bank’s lending criteria. DHOAS eligibility criteria also apply. 100% mortgage offset available on variable rate loans. Unlimited free redraw DHOAS eligibility criteria also apply. 100% mortgage offset available on variable rate loans.

By bringing all your different accounts into one, you could reduce the fees you pay and give your super a boost.* * Before rolling your super over, you should check what fees your other super fund charges and if you will lose any benefits such as insurance or pension options.

Defence Bank Super High Growth Option 5.63% -0.51% 0.79% 2.86% 6.46% N/A N/A 27/07/2016 Please note: § Net earnings are calculated after the deduction of relevant fees, costs and taxes.

CUBS Superannuation Fund – Beyond Super and Pensions 2017 Annual Report 4 re are five investment options available to members of the Beyond products choose from …

The Defence Bank has expanded its offering to members and potential members with the launch of a new superannuation and pension product. Called Defence Bank Super, the new product has been designed for members in either the accumulation or the retirement stage of life.

Defence Bank Super follows the launch of Retirement Savings Account (RSA) with term deposits and no fees. Linehan said members were showing preference for …

Fees and other costs AFSL 246418), the trustee of Commonwealth Bank Group Super (the fund) (ABN 24 248 426 878, SPIN OSF0001AU). We may change any of the matters about the fund as described in this Reference Guide at any time. If a change adversely affects you, we will notify you as required by law. If a change is not materially adverse, we may not update the Reference Guide but …

Use our handy Tools. We strive from helping our members. Check out our handy range of interactive tools and see how they can help you. Discover

Australian Military Bank has been providing banking services to the Australian Defence Force since 1959. Australian Military Bank offers DHOAS Home Loans, Home Loans, Personal Loans and more. Call Australian Military Bank: 1300 13 23 28.

Created Date: 6/20/2013 6:57:33 PM

“The exponential rate of change is enormous and increasing,” says Linehan, who assumed leadership at Defence Bank eight years ago from industry super fund HostPlus, where he was CEO for five years.

Fees and costs First State Super

https://youtube.com/watch?v=fOJlpSioC_U

AA A A AA A A statesuper.nsw.gov.au

Travel Credit and Debit Cards – September 7th. Travel credit and debit card fees in 2018 – are you paying too much? Some people like to just use cash, while others use a travel money card, a credit card or their debit card.

Fees and Costs Defence Bank Super This fact sheet details all the fees and costs that may apply to your Defence Bank Super account. It’s designed to be read in conjunction with the Defence Bank Super Product Disclosure Statement and is subject to review from time to time. This document shows fees and other costs that you may be charged. These fees and other costs may be deducted from …

Low fees: easy-to-use and low cost super solution to help you or your employees save for retirement. There are no fees on opening an account, contributions, withdrawals or investment switching. Our administration fee of only per annum leaves more money to grow a retirement nest egg (please refer to the ‘Fees and costs’ section for further information on the fees and costs applicable to

Defence Bank is a member-owned bank based in Melbourne. As a member-owned institution, Defence Bank does not have external shareholders. Instead, profits are reinvested back into the business in order to lower rates and fees.

Important: Before consolidating, you need to consider how your existing super accounts compare to AMP Flexible Super, whether any exit fees apply and what effect consolidating will …

Types of super funds. Are you my type? There are many super funds to choose from, so you don’t have to pick the first one you see. There’s a fund out there that’s just right for you.

How we invest your super 6 6. Fees and costs 8 7. How your super is taxed 11 8. Insurance in your super 13 9. How to open an account 15 10. How to contact us 15. PAGE 3 OF 16 SUNCORP EVERYDAY SUPER® PRODUCT DISCLOSURE STATEMENT 1. About Suncorp Everyday Super Suncorp Everyday Super (Everyday Super) is a way of saving for your future without having to think …

1 This figure comprises of the investment fee and indirect cost ratio which are based on the fees and costs for the financial year ended 30 June 2018 and the administration fee which reduced from 0.18% to 0.16% from 1 July 2018.

(within the meaning of the Consular Fees Act 1955) • Bailiff • Bank officer with 5 or more continuous years of service • Building society officer with 5 or more years of continuous service • Chief executive officer of a Commonwealth court • Clerk of a court • Commissioner for Affidavits • Commissioner for Declarations • Credit union officer with 5 or more years of

4 things to consider with fees and costs. Look at the total cost. Super funds can report their fees in different ways, so make sure that you’re comparing apples with apples, and look at the total cost.

This week it engulfed NAB, but the Melbourne-based bank is not alone — AMP has already paid compensation in this area along with a range of less prominent institutions such as Yellow Brick Road.

the Consular Fees Act 1955) Bailiff Bank Officer, Building Society Officer or Credit Union Officer (with 2 or more years of continuous service) Chiropractor Commissioner for Affidavits or Declarations Court Officer: Registrar or Deputy Registrar of a Court, Judge, Clerk, Magistrate, Master of a Court, Chief Executive Officer of a Commonwealth Court Dentist Fellow of the National Tax

57087651385 Defence Bank Limited 57087651385001 Defence Bank Super Assured RSA 40725722496 DPM Retirement Service 40725722496002 DPM Retirement Service – Account-based Pension 40725722496 DPM Retirement Service 40725722496001 DPM Retirement Service – Superannuation Service 45960194277 e-Clipse Super 45960194277001 e-Clipse Super 68486630403 Encircle …

These limits include combined transaction fees from your Cbus Super and/or Super Income Stream account/s. If you want to deduct a Financial Planner Payment from your Cbus account, your Certified Financial Planner can discuss your eligibility with you and arrange the required forms.

Bank Ltd. Defence Bank Ltd is an authorised deposit-taking institution (ADI). The assets for the CUBS Superannuation Fund as a whole (incorporating all products and segments of the Fund including the Greater Rollover and Pension Fund) as at 30 June 2015 and 30 June 2014

A great bank for Defence members providing fast and easy banking. It is awesome to have a bank tailored to Defence members and it has easily accessible money overseas.

Netwealth Super Accelerator, Netwealth Super Wrap and Russell Investments Super Series are products available in the Netwealth Superannuation Master Fund. S Netwealth Investments Limited ABN 85 090 569 109 AFSL 230975, trustee of the Netwealth …

Defence Bank Super is a product offered from the CUBS Superannuation Fund (‘Fund’), which is a public offer superannuation fund. Defence Bank Super provides access to five pooled investment options and term deposits. The Fund’s superannuation products include accumulation accounts, transition to retirement accounts and pension accounts. Defence Bank Super is an accumulation …

https://youtube.com/watch?v=qYoZTGVDRSQ

Reference Guide Fees and other costs oursuperfund.com.au

2013-11defencebank_supertdpdsv3.pdf 2015annualfinancialreport_lr.pdf 2015annualreport-defencebanksuper.pdf 2016-04db_employerscontsviadirectdebitgeneric_v2.pdf

Member uper acts did you know? Information helpline For more information on CareSuper or any other super-related topics, call the CareSuperLine on 1300 360 149 ,

Latest News. New online banking login. Defence Bank has removed its floating keyboard from the Online Banking login page and members can now access internet banking by simply typing in their Member number and password.

^The Defence Bank Cash and Fixed Interest investments are cash and fixed interest deposits issued by Defence Bank Ltd. Defence Bank Ltd is an authorised deposit-taking institution (ADI). The assets for the CUBS Superannuation Fund as a whole (incorporating all products and segments

www.mauriceblackburn.com.au

The following fees and other costs table provides an overview of the fees and costs that an existing member as at 6 November 2014 of Bendigo SmartOptions Super and Bendigo SmartOptions Pension (collectively known as ‘the Plan’) will be charged until 1 July 2015.

The standard variable DIY Super Saver rate may be changed at any time but the fixed bonus rate will not change while it applies during the Promotional Rate Period. The Promotional Rate Period is the first 4 months from the date your account is opened.

Defence Bank is a provider of credit cards, home loans, personal loans, savings and transaction accounts, term deposits, superannuation, home insurance, car …

National Australia Bank Group Superannuation Fund A (Plan) to your super account. All fees in the fees and costs table in the PDS are before the tax benefit. We charge the fees shown and then pass the tax benefit back to your super as a credit, which effectively reduces the fees shown by up to 15% pa. For further information on taxes see the How super is taxed section of the PDS. Fees

ANZ recommends you read the ANZ Savings and Transaction Product Terms and Conditions (PDF 408kB) and the Financial Services Guide (PDF 104kB) which are available at anz.com or by calling 13 13 14, before deciding whether to acquire, or continue to hold, any product. Fees…

We assume that these fees are tax deductible within super and that tax deductions are applied before deducting these fees from the returns that are applied to your account. Adviser Service fees In ‘Advanced settings’ you can enter the adviser service fees that you are charged.

Contents 1. About Plum Super 2 2. How super works 2 3. Benefits of investing with Plum Super 3 4. Risks of super 5 5. How we invest your money 5 6. Fees and costs 7

005-304 300518 Page 1 of 4 25100/0518 Essential Super – Temporary Resident brochure for superannuation This brochure is to assist people who have entered

The small print. Rates are effective from 1 September 2018 and are subject to change. Rates are current at the time of publication and are subject to change at Australian Military Bank’s discretion.

Trustee of the Australian Defence Force Cover (ADF Cover) ABN: 64 250 674 722 We’ve recently upgraded our security system – this is something we do regularly to keep your information safe. As part of the upgrade, we need you to reset your password.

T F Savings Accounts Retirement Savings

Defence Bank Credit Cards – Review Compare & Save Canstar

https://youtube.com/watch?v=7yUR-SYPDQI

COMMONWEALTH SMSF FEE SCHEDULE. 1 July 2015 This Fee Schedule lists the standard fees and charges for the Commonwealth SMSF Service and should be read together with the Commonwealth SMSF Administration Service Guide.

Bank fees and charges may apply. As this advice has been prepared without considering your objectives, financial situation or needs, you should, before acting on the advice, consider its appropriateness to your circumstances.

Need Help? Please refer to the information and relevant websites detailed below. You can also ring ANZ Staff Super on 1800 000 086 if you need further assistance.

> Defence Bank Super Term Deposits offer a fixed rate of interest for the duration of the term and each require a minimum opening amount of ,000, provided you have an investment balance of ,000, plus insurance premiums, fees, and pension payments (where relevant). Please refer to the Defence Bank Super Term Deposits Product Disclosure Statement (PDS) for full details. > If you wish to

Fees: Check what fees a super fund charges for services like administration, switching from one investment option to another, financial advice or exiting. Insurance cover : Many funds offer life insurance, disability cover and income protection cover.

Bank officer with 2 or more continuous years of service Fellow of the National Tax Accountants’ Association Agent of the Australian Postal Corporation who is in charge of an office supplying postal services to the public Australian Consular Officer or Australian Diplomatic Officer (within the meaning of the Consular Fees Act 1922) Person who is enrolled on the roll of the Supreme Court of a

Defence Bank understand that buying a home could be one of the most important decisions you’ll ever make. To help you through your first, second or commercial property purchase they have put together a range of home loan choices to save you the hassle.

The Defence Bank credit card is a Visa card, meaning you can use it just about anywhere in the world. You also have access to other features, like Visa Checkout, where you can make your online

6 Fees and costs 9 7 How super is taxed 12 8 Insurance in your super 13 9 How to open an account 15 The fund trustee The trustee is responsible for the day-to-day running of the fund. Colonial First State Investments Limited ABN 98 002 348 352 AFS Licence 232468 (Colonial First State) is the trustee and administrator of Commonwealth Essential Super ABN 56 601 925 435 (the fund) and the issuer

What are the costs to me? Pre-settlement fees and charges Home Loans. Pre-settlement fees and charges This is a guide to the fees and charges that may be payable by you in relation to the settlement of your ING home loan. Fee name Amount and details Settlement Fee 9 For each loan application and is charged at settlement Valuation Fees A valuation fee is payable. ING will cover up to 5 of

Retirement Savings Account Australian Military Bank

AIRF RRCECE Department of Defence

Please send this completed form to: Intrust Super, GPO Box 1416, Brisbane QLD 4001 Please write in BLOCK letters using a BLUE or BLACK pen. This request will be invalid if it is unsigned or undated.

This fees and charges schedule outlines the fees and charges relating to Defence Bank’s Credit Card. Please Please note that there are fees and charges that may be imposed by us for additional and optional services, fees and

Approved Form 1C – Application for Fee Concession – In the Interest of Justice (PDF – File Size 50 KB) Magistrates Court (Fees) Regulations 2005 Prescribed Forms Form 1 – Declaration that a person is a small business or a non-profit association (DOC – File Size 36 KB)

3 4. RISKS OF SUPER There are a number of general risks to be aware of including the risk that superannuation laws may change in the future which may

AMP Flexible Super® Personal Super – AMP

ADF Super is the Australian Defence Force Superannuation Scheme established under the Australian Defence Force Superannuation Act 2015. ADF Super is an accumulation fund, which means that your super accumulates depending on your contributions and investment performance.

Superannuation calculator ASIC’s MoneySmart

Fees and Charges Schedule Defence Bank

Customer reviews of Defence Bank Mozo

Defence Bank Term Deposits RateCity.com.au

https://youtube.com/watch?v=M9OPKuxeDlY

Defence Bank Is Your Super Defence Bank

Superannuation calculator ASIC’s MoneySmart

Defence Bank launches new super and pension product Shed

57087651385 Defence Bank Limited 57087651385001 Defence Bank Super Assured RSA 40725722496 DPM Retirement Service 40725722496002 DPM Retirement Service – Account-based Pension 40725722496 DPM Retirement Service 40725722496001 DPM Retirement Service – Superannuation Service 45960194277 e-Clipse Super 45960194277001 e-Clipse Super 68486630403 Encircle …

Latest News. New online banking login. Defence Bank has removed its floating keyboard from the Online Banking login page and members can now access internet banking by simply typing in their Member number and password.

Bank officer with 2 or more continuous years of service Fellow of the National Tax Accountants’ Association Agent of the Australian Postal Corporation who is in charge of an office supplying postal services to the public Australian Consular Officer or Australian Diplomatic Officer (within the meaning of the Consular Fees Act 1922) Person who is enrolled on the roll of the Supreme Court of a

the Consular Fees Act 1955) Bailiff Bank Officer, Building Society Officer or Credit Union Officer (with 2 or more years of continuous service) Chiropractor Commissioner for Affidavits or Declarations Court Officer: Registrar or Deputy Registrar of a Court, Judge, Clerk, Magistrate, Master of a Court, Chief Executive Officer of a Commonwealth Court Dentist Fellow of the National Tax

Defence Bank Super is issued by Equity Trustees Superannuation Limited (ABN 50 055 641 757 AFSL 229757) as trustee of the CUBS Superannuation Fund (ABN 90 120 177 925). Defence Bank Limited (ABN 57 087 651 385 AFSL/Australian Credit Licence 234582) is the sub-promoter of the CUBS Superannuation Fund.

“The exponential rate of change is enormous and increasing,” says Linehan, who assumed leadership at Defence Bank eight years ago from industry super fund HostPlus, where he was CEO for five years.

Trustee of the Australian Defence Force Cover (ADF Cover) ABN: 64 250 674 722 We’ve recently upgraded our security system – this is something we do regularly to keep your information safe. As part of the upgrade, we need you to reset your password.

Created Date: 6/20/2013 6:57:33 PM

The following fees and other costs table provides an overview of the fees and costs that an existing member as at 6 November 2014 of Bendigo SmartOptions Super and Bendigo SmartOptions Pension (collectively known as ‘the Plan’) will be charged until 1 July 2015.

ANZ recommends you read the ANZ Savings and Transaction Product Terms and Conditions (PDF 408kB) and the Financial Services Guide (PDF 104kB) which are available at anz.com or by calling 13 13 14, before deciding whether to acquire, or continue to hold, any product. Fees…

Fees and other costs AFSL 246418), the trustee of Commonwealth Bank Group Super (the fund) (ABN 24 248 426 878, SPIN OSF0001AU). We may change any of the matters about the fund as described in this Reference Guide at any time. If a change adversely affects you, we will notify you as required by law. If a change is not materially adverse, we may not update the Reference Guide but …

• deposit at least ,000 from an external bank account to any personal ING account in your name (excluding Living Super and Orange One); and • make at least 5 card purchases that are settled (and not at a ‘pending status’) using your ING debit or credit card (excluding ATM

4 things to consider with fees and costs. Look at the total cost. Super funds can report their fees in different ways, so make sure that you’re comparing apples with apples, and look at the total cost.

T F Savings Accounts Retirement Savings

Login Defence Bank

Need Help? Please refer to the information and relevant websites detailed below. You can also ring ANZ Staff Super on 1800 000 086 if you need further assistance.

> Defence Bank Super Term Deposits offer a fixed rate of interest for the duration of the term and each require a minimum opening amount of ,000, provided you have an investment balance of ,000, plus insurance premiums, fees, and pension payments (where relevant). Please refer to the Defence Bank Super Term Deposits Product Disclosure Statement (PDS) for full details. > If you wish to

Defence Bank understand that buying a home could be one of the most important decisions you’ll ever make. To help you through your first, second or commercial property purchase they have put together a range of home loan choices to save you the hassle.

The small print. Rates are effective from 1 September 2018 and are subject to change. Rates are current at the time of publication and are subject to change at Australian Military Bank’s discretion.

These limits include combined transaction fees from your Cbus Super and/or Super Income Stream account/s. If you want to deduct a Financial Planner Payment from your Cbus account, your Certified Financial Planner can discuss your eligibility with you and arrange the required forms.

Defence Bank Super is a product offered from the CUBS Superannuation Fund (‘Fund’), which is a public offer superannuation fund. Defence Bank Super provides access to five pooled investment options and term deposits. The Fund’s superannuation products include accumulation accounts, transition to retirement accounts and pension accounts. Defence Bank Super is an accumulation …

Member uper acts caresuper.com.au

Defence Bank Term Deposits RateCity.com.au

(within the meaning of the Consular Fees Act 1955) • Bailiff • Bank officer with 5 or more continuous years of service • Building society officer with 5 or more years of continuous service • Chief executive officer of a Commonwealth court • Clerk of a court • Commissioner for Affidavits • Commissioner for Declarations • Credit union officer with 5 or more years of

The Defence Bank credit card is a Visa card, meaning you can use it just about anywhere in the world. You also have access to other features, like Visa Checkout, where you can make your online

Get a lower interest rate. By offering your car as security for the loan, you can access a lower rate than our unsecured personal loan.

We assume that these fees are tax deductible within super and that tax deductions are applied before deducting these fees from the returns that are applied to your account. Adviser Service fees In ‘Advanced settings’ you can enter the adviser service fees that you are charged.

6 Fees and costs 9 7 How super is taxed 12 8 Insurance in your super 13 9 How to open an account 15 The fund trustee The trustee is responsible for the day-to-day running of the fund. Colonial First State Investments Limited ABN 98 002 348 352 AFS Licence 232468 (Colonial First State) is the trustee and administrator of Commonwealth Essential Super ABN 56 601 925 435 (the fund) and the issuer

4 things to consider with fees and costs. Look at the total cost. Super funds can report their fees in different ways, so make sure that you’re comparing apples with apples, and look at the total cost.

Bank officer with 2 or more continuous years of service Fellow of the National Tax Accountants’ Association Agent of the Australian Postal Corporation who is in charge of an office supplying postal services to the public Australian Consular Officer or Australian Diplomatic Officer (within the meaning of the Consular Fees Act 1922) Person who is enrolled on the roll of the Supreme Court of a

Fees and Costs Defence Bank Super This fact sheet details all the fees and costs that may apply to your Defence Bank Super account. It’s designed to be read in conjunction with the Defence Bank Super Product Disclosure Statement and is subject to review from time to time. This document shows fees and other costs that you may be charged. These fees and other costs may be deducted from …

The standard variable DIY Super Saver rate may be changed at any time but the fixed bonus rate will not change while it applies during the Promotional Rate Period. The Promotional Rate Period is the first 4 months from the date your account is opened.

ANZ recommends you read the ANZ Savings and Transaction Product Terms and Conditions (PDF 408kB) and the Financial Services Guide (PDF 104kB) which are available at anz.com or by calling 13 13 14, before deciding whether to acquire, or continue to hold, any product. Fees…

Learn more about our fees and costs for super accounts and Choice Income accounts. Investment fee These fees are charged to cover the cost to us of managing your investments – costs like external investment management fees, performance related fees, plus transactional and operational costs.

Defence Bank Super is a product offered from the CUBS Superannuation Fund (‘Fund’), which is a public offer superannuation fund. Defence Bank Super provides access to five pooled investment options and term deposits. The Fund’s superannuation products include accumulation accounts, transition to retirement accounts and pension accounts. Defence Bank Super is an accumulation …

Defence Bank is a provider of credit cards, home loans, personal loans, savings and transaction accounts, term deposits, superannuation, home insurance, car …

Fees and other costs for members who joined Bendigo

Fees and costs First State Super

57087651385 Defence Bank Limited 57087651385001 Defence Bank Super Assured RSA 40725722496 DPM Retirement Service 40725722496002 DPM Retirement Service – Account-based Pension 40725722496 DPM Retirement Service 40725722496001 DPM Retirement Service – Superannuation Service 45960194277 e-Clipse Super 45960194277001 e-Clipse Super 68486630403 Encircle …

> Defence Bank Super Term Deposits offer a fixed rate of interest for the duration of the term and each require a minimum opening amount of ,000, provided you have an investment balance of ,000, plus insurance premiums, fees, and pension payments (where relevant). Please refer to the Defence Bank Super Term Deposits Product Disclosure Statement (PDS) for full details. > If you wish to

Contents 1. About Plum Super 2 2. How super works 2 3. Benefits of investing with Plum Super 3 4. Risks of super 5 5. How we invest your money 5 6. Fees and costs 7

ADF Super is the Australian Defence Force Superannuation Scheme established under the Australian Defence Force Superannuation Act 2015. ADF Super is an accumulation fund, which means that your super accumulates depending on your contributions and investment performance.

Defence Bank understand that buying a home could be one of the most important decisions you’ll ever make. To help you through your first, second or commercial property purchase they have put together a range of home loan choices to save you the hassle.

3 4. RISKS OF SUPER There are a number of general risks to be aware of including the risk that superannuation laws may change in the future which may

Trustee of the Australian Defence Force Cover (ADF Cover) ABN: 64 250 674 722 We’ve recently upgraded our security system – this is something we do regularly to keep your information safe. As part of the upgrade, we need you to reset your password.

How we invest your super 6 6. Fees and costs 8 7. How your super is taxed 11 8. Insurance in your super 13 9. How to open an account 15 10. How to contact us 15. PAGE 3 OF 16 SUNCORP EVERYDAY SUPER® PRODUCT DISCLOSURE STATEMENT 1. About Suncorp Everyday Super Suncorp Everyday Super (Everyday Super) is a way of saving for your future without having to think …

Bank Ltd. Defence Bank Ltd is an authorised deposit-taking institution (ADI). The assets for the CUBS Superannuation Fund as a whole (incorporating all products and segments of the Fund including the Greater Rollover and Pension Fund) as at 30 June 2015 and 30 June 2014