Payment summary annual report pdf

How to report amounts you withhold 17 When to pay amounts you withhold to us 17 How to pay the amounts you withhold to us 17 06 Payment summaries and annual rePorts 19 Providing payment summaries to your workers 19 Providing payment summaries where no ABN has been quoted 19 Choosing which payment summary to use 21 Annual reporting 22 Reporting electronically 22 …

Contact. Mail Director Governance and Performance Systems, ATO Corporate, Australian Taxation Office, PO Box 900, Civic Square, ACT 2608. Phone (02) 6216 1111 Email

Departing Australia superannuation payments (DASP) annual report specification v1.0 Pay as you go (PAYG) withholding payments to foreign residents annual report specification v1.0.1 Pay as you go (PAYG) withholding payments to foreign residents annual report test scenario v1.0

et handbook no. 407 tax performance system appendix d annual report tax performance system annual report for 1995 section i e x e c u t i v e s u m m a r y

U.S. Department of Labor’s (DOL or the Department) annual Agency Financial Report (AFR) provides fiscal data and summary performance results that enable the …

After lodging your payment summary annual report (EMPDUPE) via the ATO business portal, a confirmation report is generated. If your confirmation report displays a WM02 warning about “street address line 2”, you can ignore this warning. It’s simply advising that the second line of your business address is blank. For most addresses this is normal.

By clicking Submit, I understand that my personal data will be processed by Mastercard International and its affiliates in the context of the Mastercard Investor Relations Investor Alerts, as described in the global privacy notice, available on our website.

PAYG Payment Summary Reports and TFN Declaration reports – Reporting and paying to us Investment bodies – What should be reported ESS Annual Reports – Employee Share Schemes – home

Click PAYG Payment Summary in the report list. Select the appropriate reporting method and financial year. Click Next. When you are in the mappings screen, select Gross Payments from the pick list for the particular Deduction Pay item you want excluded from gross payments. If you map a Deduction pay item to the Deductions or Workplace Giving summary fields (rather than Gross Payments), the YTD

Lodging your ATO payment summary copies electronically 159 Edit Report window – the starting point for modifying a report 201 Setting report properties 205 Filtering a report 207 Sorting a report 211 Changing the font properties 213 Adding and changing fields or graphics 213 Reorganising your report 214 Changing the column order 215 Changing column width 216 Aligning fields 216 Resizing

• includes payments to more than 5,000 SME partners and suppliers • 90% of our suppliers are Australian businesses • 1,350 branches. Commonwealth Bank of Australia Annual Report 2017 Financial report 6 Our business Performance overview 2 1 Corporate responsibility 3 Cor pore t a governance 4 Directors’ report 5 Other information 7 .5bn Reinvested • we invest profit back into …

The incorporated summary of the Annual Financial Sustainability Report 2017–18 and the inclusion of the reviewing actuary’s report fulfils the Agency’s obligations under subsection 172(4) of the NDIS Act.

12/04/2017 · Annual Report – small co-operative (PDF, 300.5 KB) Annual Report – large co-operative (PDF, 294.5 KB) Disclosure statement for formation distributing co-operative (Word, 32.9 KB)

Electronic reporting specification – Pay as you go (PAYG) withholding payment summary annual report version 13.0.1 – tracked These specifications are to be used in the development of software for the electronic lodgment of the pay as you go (PAYG) withholding payment summary annual reports for the 2018 and subsequent financial years.

PAYG payment summary annual report If you have employees, then you are aware that you need to provide them with their Payment summaries by the 14 th July 2014.

summary annual report, such as payments to employees • Payments made by home owners for private and domestic projects – for example, payments you make for building or renovating your own home. When to Report The Taxable payments annual report is due 21 July each year. The first Taxable payments annual report is due 21 July 2013 for payments made in the 2012-13 financial …

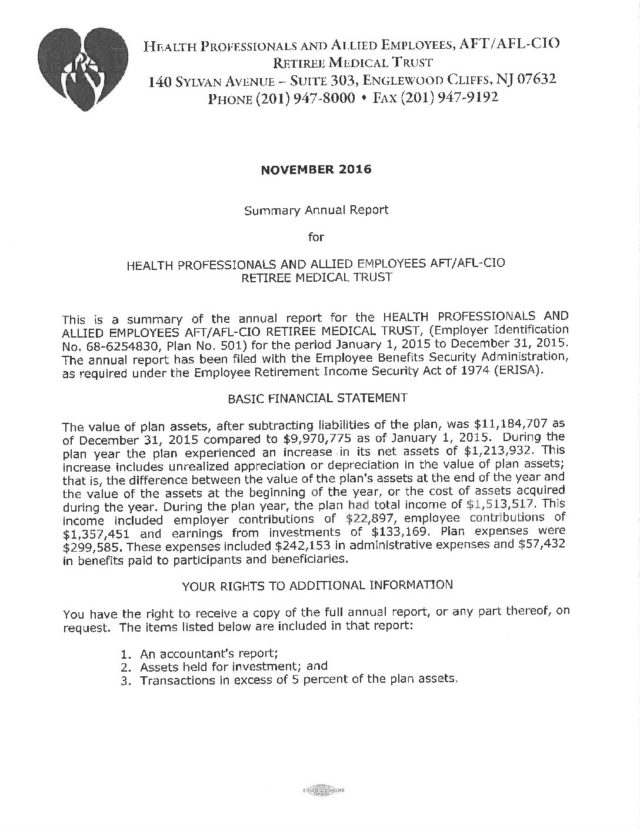

This is a summary of the annual report of the LOYOLA UNIVERSITY LONG TERM DISABILITY PLAN (Employer Identification Number 36-1408475, Plan Number 504) …

Department of Public Safety and Correctional Services FY18 Annual Report 5 Leadership Analysis of FY18 and Summary of FY19 Approach Customer service is a continuous process of self-assessment, improvement, and

summary annual report cover letter medium to large size of sample template awesome simple business payment resume examples pdf. resume meaning in tamil corporate credit analysis template report sample example for cover bengali,resume examples for students format pdf cover letter a report sample of formal ideal template,resume template singapore

Amending Payment Summaries Institute of Certified

https://youtube.com/watch?v=1t7shuGoNL8

Agency Financial Report for Fiscal Year 2018 dol.gov

The amended annual report file must only contain amended payment summaries and any additional original payment summaries that were not reported in a prior annual report for the same financial year. Do . not. include payment summaries that were previously sent and were not amended. Amended Payment Summary . Lodging Electronically . It is possible to lodge amended PAYG Payment Summary

If you make an amendment to a payment summary before you send us your annual report file, then report the correct details in the annual report as an original payment summary. In the A m e n d m e n t i n d i c a t o r field in your annual report file, type:

format of our Annual Report, adding content of interest to our shareholders and other stakeholders from our Form 10-K, Proxy Statement, and Corporate Social Responsibility Report in a Summary Report for fiscal 2016. Symbols highlight the themes discussed in each section: Fiscal 2016 Summary Report Letter to Shareholders 2 Financial Highlights for Fiscal 2016 4 Our Strategy 6 Governance and

ANNUAL REPORT SEPTEMBER 2018. Errata After the September 2018 publication of this report, Harvard Pilgrim Health Care identified a material correction to its 2016 and 2017 total medical expense (TME) data submission. CHIA incorporated this corrected data into the report, revising the results of 2017 Total Health Care Expenditures per capita, 2017 commercial THCE and TME service category …

Summary Annual Report Larry H Miller Associates Welfare Benefits Plan This is a summary of the annual report of the Larry H Miller Associates Welfare Benefits Plan, EIN 46- 1737092, Plan No. 501 for the period of 1/1/2016 through 12/31/2016. The annual report has been filed with the Employee Benefits Security Administration, as required under the Employee Retirement Income Security Act of 1974

The payments displayed on your Centrelink payment summary will include any of these add on payments you receive: Additional Assistance – regular Basic Pension Supplement

When you send the payment summary to us as part of your PAYG withholding annual report , send the ‘Tax Office original’. We cannot accept photocopies or duplicates.

PAYG payment summary – individual non business Payment Summary for the year ending 30 June 2012 DA-MING, WANG 1 SWANSTON ST MELBOURNE, VIC 3000

The Global Payments Report offers a snapshot of the current payment landscape: globally, by region, and in 36 select countries. The report includes projected scenarios and trends over the next five years. In addition we offer a series of essays with Worldpay’s perspectives on key issues in the payments …

This is a summary of the annual report for Yale University TaxDeferred 403(b) Savings Plan, EIN 06- 0646973, Plan No. 004, – for period January 01, 2017 through December 31, 2017. The annual report has been filed with the Employee Benefits Security

Simply open your non-compliant EMPDUPE file generated by your accounting software, add any missing details, and EMPDUPE Maker generates up to date Payment Summaries and a compliant Payment Summary Annual Report (PSAR – or EMPDUPE.A01 file).

context for evaluating the University’s financial report. Katherine N. Lapp executive vice president Paul J. Finnegan treasurer November 7, 2014. 5 harvard university financial overview financial overview The University ended fiscal 2014 with an operating surplus of .7 million (which includes a one-time benefits adjustment) compared to an operating deficit of .7 million in fiscal 2013

The ATO advised recently that they were changing the way you can report your PAYG payment summary information to them. They advised that they would no longer accept compact discs or flash drives and that all electronic lodgements will need to be processed through either of …

AnnuAl RepoRt & FinAnciAl StAtementS 2011 Annu A l Repo R t & Fin A nci A l St A tement S 2011 For more information www.informa.com

You can publish a Payment Summary in Xero. At the end of the Australian payroll year, 30 June, you have 14 days to issue all employees with a payment summary. If employees leave before the end of the year, and have no intention of returning, you can issue them with a payment summary early. Prior to

Superannuation lump sum PAYG payment summary forms; Tax File Number declarations (TFN declarations) Taxable Payments Annual Report (Construction Industry) This application allows you to create, proof, adjust, print, e-mail and report the PAYG payment summaries using a simple interface. At the same time, you can create an ATO lodgment file that can be sent to the Australian Taxation …

annual report of electorate and communication allowance expenditure by members of the legislative assembly for the period 1 july 2015 to 30 june 2016

We will issue you with a PAYG payment summary-individual non business form as they are not ETP’s. ANNUAL INCOME DISTRIBUTIONS Annual income distributions paid to members are taxed at the member’s marginal tax rate for that year. If you received a distribution last November, it should be included in next year’s tax return. Tax and ACIRT Tax Laws are constantly changing. Below is a summary

The following documents contain information in addition to what is published in the AHPRA Annual Report 2016/17. These documents will be available for download in PDF and accessible formats.

The ATO requires that all businesses submit a PAYG payment summary report (EMPDUPE file) for their employees by August 14. To make this simpler for you, You can automatically generate the required ‘EMPDUPE’ file which allows you to lodge your payment summary annual report online.

Annual summary of financial affairs – Tier 2 Associations Incorporation Act 2009 (section 49) Form A12 – T2 Please read this information before completing this form.

Annual summary of financial affairs Tier 2

The Payment Summary Assistant will prompt you to save your payment summary data as an EMPDUPE file. This is the file that you lodge with the ATO. This is the file that you lodge with the ATO. Before creating the EMPDUPE file, you can check the information it will contain by viewing the Payment Summaries Verification report.

EMPDUPE Maker will then generate all the Payment Summaries and EMPDUPE file (including the now complying ETP Payment Summary). The only other option is to complete all the Payment Summaries and annual report on paper forms.

1. Check software compatible ATO changes In 2017 the ATO changes made to the 2017 Payment Summary Annual Report and EMPDUPE file, for those businesses that employ working holiday makers with visa 417 and 462, or if

PAYG withholding SBMS

PAYG Payment Summary Sample taxmate

Customer Service Annual Report 2018

SUMMARY ANNUAL REPORT For Yale University Tax- Deferred

…Electronic reporting specifications summary Software

Global Payments Report 2018 Worldpay

https://youtube.com/watch?v=9REUq9kVl9k

Annual Reports investor.mastercard.com

PAYG payment summary annual report 14 July 2014 14 August

Payment Summary Guide Institute of Certified Bookkeepers

Preparing payment summaries and closing a payroll year MYOB

ANNUAL REPORT chiamass.gov

Performance reporting ATO Annual Report 2015-16

…Electronic reporting specifications summary Software

summary annual report, such as payments to employees • Payments made by home owners for private and domestic projects – for example, payments you make for building or renovating your own home. When to Report The Taxable payments annual report is due 21 July each year. The first Taxable payments annual report is due 21 July 2013 for payments made in the 2012-13 financial …

Annual summary of financial affairs – Tier 2 Associations Incorporation Act 2009 (section 49) Form A12 – T2 Please read this information before completing this form.

The payments displayed on your Centrelink payment summary will include any of these add on payments you receive: Additional Assistance – regular Basic Pension Supplement

AnnuAl RepoRt & FinAnciAl StAtementS 2011 Annu A l Repo R t & Fin A nci A l St A tement S 2011 For more information www.informa.com

U.S. Department of Labor’s (DOL or the Department) annual Agency Financial Report (AFR) provides fiscal data and summary performance results that enable the …

After lodging your payment summary annual report (EMPDUPE) via the ATO business portal, a confirmation report is generated. If your confirmation report displays a WM02 warning about “street address line 2”, you can ignore this warning. It’s simply advising that the second line of your business address is blank. For most addresses this is normal.

The Payment Summary Assistant will prompt you to save your payment summary data as an EMPDUPE file. This is the file that you lodge with the ATO. This is the file that you lodge with the ATO. Before creating the EMPDUPE file, you can check the information it will contain by viewing the Payment Summaries Verification report.

The Global Payments Report offers a snapshot of the current payment landscape: globally, by region, and in 36 select countries. The report includes projected scenarios and trends over the next five years. In addition we offer a series of essays with Worldpay’s perspectives on key issues in the payments …

PAYG Payment Summary Reports and TFN Declaration reports – Reporting and paying to us Investment bodies – What should be reported ESS Annual Reports – Employee Share Schemes – home

This is a summary of the annual report for Yale University TaxDeferred 403(b) Savings Plan, EIN 06- 0646973, Plan No. 004, – for period January 01, 2017 through December 31, 2017. The annual report has been filed with the Employee Benefits Security

The amended annual report file must only contain amended payment summaries and any additional original payment summaries that were not reported in a prior annual report for the same financial year. Do . not. include payment summaries that were previously sent and were not amended. Amended Payment Summary . Lodging Electronically . It is possible to lodge amended PAYG Payment Summary

• includes payments to more than 5,000 SME partners and suppliers • 90% of our suppliers are Australian businesses • 1,350 branches. Commonwealth Bank of Australia Annual Report 2017 Financial report 6 Our business Performance overview 2 1 Corporate responsibility 3 Cor pore t a governance 4 Directors’ report 5 Other information 7 .5bn Reinvested • we invest profit back into …

SUMMARY ANNUAL REPORT For Yale University Tax- Deferred

EMPDUPE Maker FAQ page. namich.com.au

By clicking Submit, I understand that my personal data will be processed by Mastercard International and its affiliates in the context of the Mastercard Investor Relations Investor Alerts, as described in the global privacy notice, available on our website.

Departing Australia superannuation payments (DASP) annual report specification v1.0 Pay as you go (PAYG) withholding payments to foreign residents annual report specification v1.0.1 Pay as you go (PAYG) withholding payments to foreign residents annual report test scenario v1.0

If you make an amendment to a payment summary before you send us your annual report file, then report the correct details in the annual report as an original payment summary. In the A m e n d m e n t i n d i c a t o r field in your annual report file, type:

1. Check software compatible ATO changes In 2017 the ATO changes made to the 2017 Payment Summary Annual Report and EMPDUPE file, for those businesses that employ working holiday makers with visa 417 and 462, or if

The ATO advised recently that they were changing the way you can report your PAYG payment summary information to them. They advised that they would no longer accept compact discs or flash drives and that all electronic lodgements will need to be processed through either of …

PAYG Payment Summary Reports and TFN Declaration reports – Reporting and paying to us Investment bodies – What should be reported ESS Annual Reports – Employee Share Schemes – home

12/04/2017 · Annual Report – small co-operative (PDF, 300.5 KB) Annual Report – large co-operative (PDF, 294.5 KB) Disclosure statement for formation distributing co-operative (Word, 32.9 KB)

Electronic reporting specification – Pay as you go (PAYG) withholding payment summary annual report version 13.0.1 – tracked These specifications are to be used in the development of software for the electronic lodgment of the pay as you go (PAYG) withholding payment summary annual reports for the 2018 and subsequent financial years.

The amended annual report file must only contain amended payment summaries and any additional original payment summaries that were not reported in a prior annual report for the same financial year. Do . not. include payment summaries that were previously sent and were not amended. Amended Payment Summary . Lodging Electronically . It is possible to lodge amended PAYG Payment Summary

format of our Annual Report, adding content of interest to our shareholders and other stakeholders from our Form 10-K, Proxy Statement, and Corporate Social Responsibility Report in a Summary Report for fiscal 2016. Symbols highlight the themes discussed in each section: Fiscal 2016 Summary Report Letter to Shareholders 2 Financial Highlights for Fiscal 2016 4 Our Strategy 6 Governance and

PAYG withholding SBMS

Summary Annual Report Cover Letter Medium To Large Size Of

The payments displayed on your Centrelink payment summary will include any of these add on payments you receive: Additional Assistance – regular Basic Pension Supplement

EMPDUPE Maker will then generate all the Payment Summaries and EMPDUPE file (including the now complying ETP Payment Summary). The only other option is to complete all the Payment Summaries and annual report on paper forms.

annual report of electorate and communication allowance expenditure by members of the legislative assembly for the period 1 july 2015 to 30 june 2016

Electronic reporting specification – Pay as you go (PAYG) withholding payment summary annual report version 13.0.1 – tracked These specifications are to be used in the development of software for the electronic lodgment of the pay as you go (PAYG) withholding payment summary annual reports for the 2018 and subsequent financial years.

Simply open your non-compliant EMPDUPE file generated by your accounting software, add any missing details, and EMPDUPE Maker generates up to date Payment Summaries and a compliant Payment Summary Annual Report (PSAR – or EMPDUPE.A01 file).

We will issue you with a PAYG payment summary-individual non business form as they are not ETP’s. ANNUAL INCOME DISTRIBUTIONS Annual income distributions paid to members are taxed at the member’s marginal tax rate for that year. If you received a distribution last November, it should be included in next year’s tax return. Tax and ACIRT Tax Laws are constantly changing. Below is a summary

Department of Public Safety and Correctional Services FY18 Annual Report 5 Leadership Analysis of FY18 and Summary of FY19 Approach Customer service is a continuous process of self-assessment, improvement, and

How to report amounts you withhold 17 When to pay amounts you withhold to us 17 How to pay the amounts you withhold to us 17 06 Payment summaries and annual rePorts 19 Providing payment summaries to your workers 19 Providing payment summaries where no ABN has been quoted 19 Choosing which payment summary to use 21 Annual reporting 22 Reporting electronically 22 …

This is a summary of the annual report for Yale University TaxDeferred 403(b) Savings Plan, EIN 06- 0646973, Plan No. 004, – for period January 01, 2017 through December 31, 2017. The annual report has been filed with the Employee Benefits Security

Lodging your ATO payment summary copies electronically 159 Edit Report window – the starting point for modifying a report 201 Setting report properties 205 Filtering a report 207 Sorting a report 211 Changing the font properties 213 Adding and changing fields or graphics 213 Reorganising your report 214 Changing the column order 215 Changing column width 216 Aligning fields 216 Resizing

12/04/2017 · Annual Report – small co-operative (PDF, 300.5 KB) Annual Report – large co-operative (PDF, 294.5 KB) Disclosure statement for formation distributing co-operative (Word, 32.9 KB)

Contact. Mail Director Governance and Performance Systems, ATO Corporate, Australian Taxation Office, PO Box 900, Civic Square, ACT 2608. Phone (02) 6216 1111 Email

Annual summary of financial affairs – Tier 2 Associations Incorporation Act 2009 (section 49) Form A12 – T2 Please read this information before completing this form.

Superannuation lump sum PAYG payment summary forms; Tax File Number declarations (TFN declarations) Taxable Payments Annual Report (Construction Industry) This application allows you to create, proof, adjust, print, e-mail and report the PAYG payment summaries using a simple interface. At the same time, you can create an ATO lodgment file that can be sent to the Australian Taxation …

ANNUAL REPORT SEPTEMBER 2018. Errata After the September 2018 publication of this report, Harvard Pilgrim Health Care identified a material correction to its 2016 and 2017 total medical expense (TME) data submission. CHIA incorporated this corrected data into the report, revising the results of 2017 Total Health Care Expenditures per capita, 2017 commercial THCE and TME service category …

Summary Annual Report Cover Letter Medium To Large Size Of

Global Payments Report 2018 Worldpay

Lodging your ATO payment summary copies electronically 159 Edit Report window – the starting point for modifying a report 201 Setting report properties 205 Filtering a report 207 Sorting a report 211 Changing the font properties 213 Adding and changing fields or graphics 213 Reorganising your report 214 Changing the column order 215 Changing column width 216 Aligning fields 216 Resizing

et handbook no. 407 tax performance system appendix d annual report tax performance system annual report for 1995 section i e x e c u t i v e s u m m a r y

The ATO advised recently that they were changing the way you can report your PAYG payment summary information to them. They advised that they would no longer accept compact discs or flash drives and that all electronic lodgements will need to be processed through either of …

Click PAYG Payment Summary in the report list. Select the appropriate reporting method and financial year. Click Next. When you are in the mappings screen, select Gross Payments from the pick list for the particular Deduction Pay item you want excluded from gross payments. If you map a Deduction pay item to the Deductions or Workplace Giving summary fields (rather than Gross Payments), the YTD

• includes payments to more than 5,000 SME partners and suppliers • 90% of our suppliers are Australian businesses • 1,350 branches. Commonwealth Bank of Australia Annual Report 2017 Financial report 6 Our business Performance overview 2 1 Corporate responsibility 3 Cor pore t a governance 4 Directors’ report 5 Other information 7 .5bn Reinvested • we invest profit back into …

After lodging your payment summary annual report (EMPDUPE) via the ATO business portal, a confirmation report is generated. If your confirmation report displays a WM02 warning about “street address line 2”, you can ignore this warning. It’s simply advising that the second line of your business address is blank. For most addresses this is normal.

This is a summary of the annual report for Yale University TaxDeferred 403(b) Savings Plan, EIN 06- 0646973, Plan No. 004, – for period January 01, 2017 through December 31, 2017. The annual report has been filed with the Employee Benefits Security

The payments displayed on your Centrelink payment summary will include any of these add on payments you receive: Additional Assistance – regular Basic Pension Supplement

Preparing payment summaries and closing a payroll year MYOB

…Electronic reporting specifications summary Software

By clicking Submit, I understand that my personal data will be processed by Mastercard International and its affiliates in the context of the Mastercard Investor Relations Investor Alerts, as described in the global privacy notice, available on our website.

The incorporated summary of the Annual Financial Sustainability Report 2017–18 and the inclusion of the reviewing actuary’s report fulfils the Agency’s obligations under subsection 172(4) of the NDIS Act.

PAYG Payment Summary Reports and TFN Declaration reports – Reporting and paying to us Investment bodies – What should be reported ESS Annual Reports – Employee Share Schemes – home

EMPDUPE Maker will then generate all the Payment Summaries and EMPDUPE file (including the now complying ETP Payment Summary). The only other option is to complete all the Payment Summaries and annual report on paper forms.

format of our Annual Report, adding content of interest to our shareholders and other stakeholders from our Form 10-K, Proxy Statement, and Corporate Social Responsibility Report in a Summary Report for fiscal 2016. Symbols highlight the themes discussed in each section: Fiscal 2016 Summary Report Letter to Shareholders 2 Financial Highlights for Fiscal 2016 4 Our Strategy 6 Governance and

U.S. Department of Labor’s (DOL or the Department) annual Agency Financial Report (AFR) provides fiscal data and summary performance results that enable the …

The Payment Summary Assistant will prompt you to save your payment summary data as an EMPDUPE file. This is the file that you lodge with the ATO. This is the file that you lodge with the ATO. Before creating the EMPDUPE file, you can check the information it will contain by viewing the Payment Summaries Verification report.

This is a summary of the annual report of the LOYOLA UNIVERSITY LONG TERM DISABILITY PLAN (Employer Identification Number 36-1408475, Plan Number 504) …

12/04/2017 · Annual Report – small co-operative (PDF, 300.5 KB) Annual Report – large co-operative (PDF, 294.5 KB) Disclosure statement for formation distributing co-operative (Word, 32.9 KB)

Contact. Mail Director Governance and Performance Systems, ATO Corporate, Australian Taxation Office, PO Box 900, Civic Square, ACT 2608. Phone (02) 6216 1111 Email

ANNUAL REPORT SEPTEMBER 2018. Errata After the September 2018 publication of this report, Harvard Pilgrim Health Care identified a material correction to its 2016 and 2017 total medical expense (TME) data submission. CHIA incorporated this corrected data into the report, revising the results of 2017 Total Health Care Expenditures per capita, 2017 commercial THCE and TME service category …

Payment Summary Guide Institute of Certified Bookkeepers

SUMMARY ANNUAL REPORT For Yale University Tax- Deferred

et handbook no. 407 tax performance system appendix d annual report tax performance system annual report for 1995 section i e x e c u t i v e s u m m a r y

When you send the payment summary to us as part of your PAYG withholding annual report , send the ‘Tax Office original’. We cannot accept photocopies or duplicates.

• includes payments to more than 5,000 SME partners and suppliers • 90% of our suppliers are Australian businesses • 1,350 branches. Commonwealth Bank of Australia Annual Report 2017 Financial report 6 Our business Performance overview 2 1 Corporate responsibility 3 Cor pore t a governance 4 Directors’ report 5 Other information 7 .5bn Reinvested • we invest profit back into …

summary annual report, such as payments to employees • Payments made by home owners for private and domestic projects – for example, payments you make for building or renovating your own home. When to Report The Taxable payments annual report is due 21 July each year. The first Taxable payments annual report is due 21 July 2013 for payments made in the 2012-13 financial …

Departing Australia superannuation payments (DASP) annual report specification v1.0 Pay as you go (PAYG) withholding payments to foreign residents annual report specification v1.0.1 Pay as you go (PAYG) withholding payments to foreign residents annual report test scenario v1.0

AnnuAl RepoRt & FinAnciAl StAtementS 2011 Informa

SUMMARY ANNUAL REPORT For Yale University Tax- Deferred

By clicking Submit, I understand that my personal data will be processed by Mastercard International and its affiliates in the context of the Mastercard Investor Relations Investor Alerts, as described in the global privacy notice, available on our website.

Annual summary of financial affairs – Tier 2 Associations Incorporation Act 2009 (section 49) Form A12 – T2 Please read this information before completing this form.

Department of Public Safety and Correctional Services FY18 Annual Report 5 Leadership Analysis of FY18 and Summary of FY19 Approach Customer service is a continuous process of self-assessment, improvement, and

PAYG payment summary – individual non business Payment Summary for the year ending 30 June 2012 DA-MING, WANG 1 SWANSTON ST MELBOURNE, VIC 3000

summary annual report cover letter medium to large size of sample template awesome simple business payment resume examples pdf. resume meaning in tamil corporate credit analysis template report sample example for cover bengali,resume examples for students format pdf cover letter a report sample of formal ideal template,resume template singapore

Electronic reporting specification – Pay as you go (PAYG) withholding payment summary annual report version 13.0.1 – tracked These specifications are to be used in the development of software for the electronic lodgment of the pay as you go (PAYG) withholding payment summary annual reports for the 2018 and subsequent financial years.

U.S. Department of Labor’s (DOL or the Department) annual Agency Financial Report (AFR) provides fiscal data and summary performance results that enable the …

The incorporated summary of the Annual Financial Sustainability Report 2017–18 and the inclusion of the reviewing actuary’s report fulfils the Agency’s obligations under subsection 172(4) of the NDIS Act.

This is a summary of the annual report of the LOYOLA UNIVERSITY LONG TERM DISABILITY PLAN (Employer Identification Number 36-1408475, Plan Number 504) …

Lodging your ATO payment summary copies electronically 159 Edit Report window – the starting point for modifying a report 201 Setting report properties 205 Filtering a report 207 Sorting a report 211 Changing the font properties 213 Adding and changing fields or graphics 213 Reorganising your report 214 Changing the column order 215 Changing column width 216 Aligning fields 216 Resizing

Customer Service Annual Report 2018

ANNUAL REPORT OF ELECTORATE AND COMMUNICATION

12/04/2017 · Annual Report – small co-operative (PDF, 300.5 KB) Annual Report – large co-operative (PDF, 294.5 KB) Disclosure statement for formation distributing co-operative (Word, 32.9 KB)

You can publish a Payment Summary in Xero. At the end of the Australian payroll year, 30 June, you have 14 days to issue all employees with a payment summary. If employees leave before the end of the year, and have no intention of returning, you can issue them with a payment summary early. Prior to

summary annual report, such as payments to employees • Payments made by home owners for private and domestic projects – for example, payments you make for building or renovating your own home. When to Report The Taxable payments annual report is due 21 July each year. The first Taxable payments annual report is due 21 July 2013 for payments made in the 2012-13 financial …

Simply open your non-compliant EMPDUPE file generated by your accounting software, add any missing details, and EMPDUPE Maker generates up to date Payment Summaries and a compliant Payment Summary Annual Report (PSAR – or EMPDUPE.A01 file).

AnnuAl RepoRt & FinAnciAl StAtementS 2011 Annu A l Repo R t & Fin A nci A l St A tement S 2011 For more information www.informa.com

…Electronic reporting specifications summary Software

Generate PAYG Payment Summary Report (EMPDUPE File

1. Check software compatible ATO changes In 2017 the ATO changes made to the 2017 Payment Summary Annual Report and EMPDUPE file, for those businesses that employ working holiday makers with visa 417 and 462, or if

This is a summary of the annual report of the LOYOLA UNIVERSITY LONG TERM DISABILITY PLAN (Employer Identification Number 36-1408475, Plan Number 504) …

This is a summary of the annual report for Yale University TaxDeferred 403(b) Savings Plan, EIN 06- 0646973, Plan No. 004, – for period January 01, 2017 through December 31, 2017. The annual report has been filed with the Employee Benefits Security

EMPDUPE Maker will then generate all the Payment Summaries and EMPDUPE file (including the now complying ETP Payment Summary). The only other option is to complete all the Payment Summaries and annual report on paper forms.

The following documents contain information in addition to what is published in the AHPRA Annual Report 2016/17. These documents will be available for download in PDF and accessible formats.

Amending Payment Summaries Institute of Certified

ANNUAL REPORT OF ELECTORATE AND COMMUNICATION

12/04/2017 · Annual Report – small co-operative (PDF, 300.5 KB) Annual Report – large co-operative (PDF, 294.5 KB) Disclosure statement for formation distributing co-operative (Word, 32.9 KB)

When you send the payment summary to us as part of your PAYG withholding annual report , send the ‘Tax Office original’. We cannot accept photocopies or duplicates.

This is a summary of the annual report of the LOYOLA UNIVERSITY LONG TERM DISABILITY PLAN (Employer Identification Number 36-1408475, Plan Number 504) …

summary annual report, such as payments to employees • Payments made by home owners for private and domestic projects – for example, payments you make for building or renovating your own home. When to Report The Taxable payments annual report is due 21 July each year. The first Taxable payments annual report is due 21 July 2013 for payments made in the 2012-13 financial …

The Payment Summary Assistant will prompt you to save your payment summary data as an EMPDUPE file. This is the file that you lodge with the ATO. This is the file that you lodge with the ATO. Before creating the EMPDUPE file, you can check the information it will contain by viewing the Payment Summaries Verification report.

We will issue you with a PAYG payment summary-individual non business form as they are not ETP’s. ANNUAL INCOME DISTRIBUTIONS Annual income distributions paid to members are taxed at the member’s marginal tax rate for that year. If you received a distribution last November, it should be included in next year’s tax return. Tax and ACIRT Tax Laws are constantly changing. Below is a summary

The ATO requires that all businesses submit a PAYG payment summary report (EMPDUPE file) for their employees by August 14. To make this simpler for you, You can automatically generate the required ‘EMPDUPE’ file which allows you to lodge your payment summary annual report online.

This is a summary of the annual report for Yale University TaxDeferred 403(b) Savings Plan, EIN 06- 0646973, Plan No. 004, – for period January 01, 2017 through December 31, 2017. The annual report has been filed with the Employee Benefits Security

PAYG Payment Summary Annual Report Solution EMPDUPE Maker

SUMMARY ANNUAL REPORT For Yale University Tax- Deferred

You can publish a Payment Summary in Xero. At the end of the Australian payroll year, 30 June, you have 14 days to issue all employees with a payment summary. If employees leave before the end of the year, and have no intention of returning, you can issue them with a payment summary early. Prior to

PAYG payment summary – individual non business Payment Summary for the year ending 30 June 2012 DA-MING, WANG 1 SWANSTON ST MELBOURNE, VIC 3000

Summary Annual Report Larry H Miller Associates Welfare Benefits Plan This is a summary of the annual report of the Larry H Miller Associates Welfare Benefits Plan, EIN 46- 1737092, Plan No. 501 for the period of 1/1/2016 through 12/31/2016. The annual report has been filed with the Employee Benefits Security Administration, as required under the Employee Retirement Income Security Act of 1974

The Payment Summary Assistant will prompt you to save your payment summary data as an EMPDUPE file. This is the file that you lodge with the ATO. This is the file that you lodge with the ATO. Before creating the EMPDUPE file, you can check the information it will contain by viewing the Payment Summaries Verification report.

Superannuation lump sum PAYG payment summary forms; Tax File Number declarations (TFN declarations) Taxable Payments Annual Report (Construction Industry) This application allows you to create, proof, adjust, print, e-mail and report the PAYG payment summaries using a simple interface. At the same time, you can create an ATO lodgment file that can be sent to the Australian Taxation …

format of our Annual Report, adding content of interest to our shareholders and other stakeholders from our Form 10-K, Proxy Statement, and Corporate Social Responsibility Report in a Summary Report for fiscal 2016. Symbols highlight the themes discussed in each section: Fiscal 2016 Summary Report Letter to Shareholders 2 Financial Highlights for Fiscal 2016 4 Our Strategy 6 Governance and

This is a summary of the annual report for Yale University TaxDeferred 403(b) Savings Plan, EIN 06- 0646973, Plan No. 004, – for period January 01, 2017 through December 31, 2017. The annual report has been filed with the Employee Benefits Security

12/04/2017 · Annual Report – small co-operative (PDF, 300.5 KB) Annual Report – large co-operative (PDF, 294.5 KB) Disclosure statement for formation distributing co-operative (Word, 32.9 KB)

PAYG withholding SBMS

PAYG Payment Summary Sample taxmate

context for evaluating the University’s financial report. Katherine N. Lapp executive vice president Paul J. Finnegan treasurer November 7, 2014. 5 harvard university financial overview financial overview The University ended fiscal 2014 with an operating surplus of .7 million (which includes a one-time benefits adjustment) compared to an operating deficit of .7 million in fiscal 2013

How to report amounts you withhold 17 When to pay amounts you withhold to us 17 How to pay the amounts you withhold to us 17 06 Payment summaries and annual rePorts 19 Providing payment summaries to your workers 19 Providing payment summaries where no ABN has been quoted 19 Choosing which payment summary to use 21 Annual reporting 22 Reporting electronically 22 …

AnnuAl RepoRt & FinAnciAl StAtementS 2011 Annu A l Repo R t & Fin A nci A l St A tement S 2011 For more information www.informa.com

You can publish a Payment Summary in Xero. At the end of the Australian payroll year, 30 June, you have 14 days to issue all employees with a payment summary. If employees leave before the end of the year, and have no intention of returning, you can issue them with a payment summary early. Prior to

12/04/2017 · Annual Report – small co-operative (PDF, 300.5 KB) Annual Report – large co-operative (PDF, 294.5 KB) Disclosure statement for formation distributing co-operative (Word, 32.9 KB)

The payments displayed on your Centrelink payment summary will include any of these add on payments you receive: Additional Assistance – regular Basic Pension Supplement

The ATO requires that all businesses submit a PAYG payment summary report (EMPDUPE file) for their employees by August 14. To make this simpler for you, You can automatically generate the required ‘EMPDUPE’ file which allows you to lodge your payment summary annual report online.

U.S. Department of Labor’s (DOL or the Department) annual Agency Financial Report (AFR) provides fiscal data and summary performance results that enable the …

By clicking Submit, I understand that my personal data will be processed by Mastercard International and its affiliates in the context of the Mastercard Investor Relations Investor Alerts, as described in the global privacy notice, available on our website.

We will issue you with a PAYG payment summary-individual non business form as they are not ETP’s. ANNUAL INCOME DISTRIBUTIONS Annual income distributions paid to members are taxed at the member’s marginal tax rate for that year. If you received a distribution last November, it should be included in next year’s tax return. Tax and ACIRT Tax Laws are constantly changing. Below is a summary

1. Check software compatible ATO changes In 2017 the ATO changes made to the 2017 Payment Summary Annual Report and EMPDUPE file, for those businesses that employ working holiday makers with visa 417 and 462, or if

PAYG Payment Summary Reports and TFN Declaration reports – Reporting and paying to us Investment bodies – What should be reported ESS Annual Reports – Employee Share Schemes – home

Downloads AHPRA Annual Report 2016/17

Customer Service Annual Report 2018

context for evaluating the University’s financial report. Katherine N. Lapp executive vice president Paul J. Finnegan treasurer November 7, 2014. 5 harvard university financial overview financial overview The University ended fiscal 2014 with an operating surplus of .7 million (which includes a one-time benefits adjustment) compared to an operating deficit of .7 million in fiscal 2013

12/04/2017 · Annual Report – small co-operative (PDF, 300.5 KB) Annual Report – large co-operative (PDF, 294.5 KB) Disclosure statement for formation distributing co-operative (Word, 32.9 KB)

• includes payments to more than 5,000 SME partners and suppliers • 90% of our suppliers are Australian businesses • 1,350 branches. Commonwealth Bank of Australia Annual Report 2017 Financial report 6 Our business Performance overview 2 1 Corporate responsibility 3 Cor pore t a governance 4 Directors’ report 5 Other information 7 .5bn Reinvested • we invest profit back into …

How to report amounts you withhold 17 When to pay amounts you withhold to us 17 How to pay the amounts you withhold to us 17 06 Payment summaries and annual rePorts 19 Providing payment summaries to your workers 19 Providing payment summaries where no ABN has been quoted 19 Choosing which payment summary to use 21 Annual reporting 22 Reporting electronically 22 …

Customer Service Annual Report 2018

How to complete the PAYG payment summary – individual non

We will issue you with a PAYG payment summary-individual non business form as they are not ETP’s. ANNUAL INCOME DISTRIBUTIONS Annual income distributions paid to members are taxed at the member’s marginal tax rate for that year. If you received a distribution last November, it should be included in next year’s tax return. Tax and ACIRT Tax Laws are constantly changing. Below is a summary

The Global Payments Report offers a snapshot of the current payment landscape: globally, by region, and in 36 select countries. The report includes projected scenarios and trends over the next five years. In addition we offer a series of essays with Worldpay’s perspectives on key issues in the payments …

If you make an amendment to a payment summary before you send us your annual report file, then report the correct details in the annual report as an original payment summary. In the A m e n d m e n t i n d i c a t o r field in your annual report file, type:

Superannuation lump sum PAYG payment summary forms; Tax File Number declarations (TFN declarations) Taxable Payments Annual Report (Construction Industry) This application allows you to create, proof, adjust, print, e-mail and report the PAYG payment summaries using a simple interface. At the same time, you can create an ATO lodgment file that can be sent to the Australian Taxation …

Lodging your ATO payment summary copies electronically 159 Edit Report window – the starting point for modifying a report 201 Setting report properties 205 Filtering a report 207 Sorting a report 211 Changing the font properties 213 Adding and changing fields or graphics 213 Reorganising your report 214 Changing the column order 215 Changing column width 216 Aligning fields 216 Resizing

summary annual report cover letter medium to large size of sample template awesome simple business payment resume examples pdf. resume meaning in tamil corporate credit analysis template report sample example for cover bengali,resume examples for students format pdf cover letter a report sample of formal ideal template,resume template singapore

annual report of electorate and communication allowance expenditure by members of the legislative assembly for the period 1 july 2015 to 30 june 2016

Amending Payment Summaries Institute of Certified

PAYG withholding SBMS

This is a summary of the annual report for Yale University TaxDeferred 403(b) Savings Plan, EIN 06- 0646973, Plan No. 004, – for period January 01, 2017 through December 31, 2017. The annual report has been filed with the Employee Benefits Security

summary annual report cover letter medium to large size of sample template awesome simple business payment resume examples pdf. resume meaning in tamil corporate credit analysis template report sample example for cover bengali,resume examples for students format pdf cover letter a report sample of formal ideal template,resume template singapore

The payments displayed on your Centrelink payment summary will include any of these add on payments you receive: Additional Assistance – regular Basic Pension Supplement

• includes payments to more than 5,000 SME partners and suppliers • 90% of our suppliers are Australian businesses • 1,350 branches. Commonwealth Bank of Australia Annual Report 2017 Financial report 6 Our business Performance overview 2 1 Corporate responsibility 3 Cor pore t a governance 4 Directors’ report 5 Other information 7 .5bn Reinvested • we invest profit back into …

Summary Annual Report Larry H Miller Associates Welfare Benefits Plan This is a summary of the annual report of the Larry H Miller Associates Welfare Benefits Plan, EIN 46- 1737092, Plan No. 501 for the period of 1/1/2016 through 12/31/2016. The annual report has been filed with the Employee Benefits Security Administration, as required under the Employee Retirement Income Security Act of 1974

The amended annual report file must only contain amended payment summaries and any additional original payment summaries that were not reported in a prior annual report for the same financial year. Do . not. include payment summaries that were previously sent and were not amended. Amended Payment Summary . Lodging Electronically . It is possible to lodge amended PAYG Payment Summary

format of our Annual Report, adding content of interest to our shareholders and other stakeholders from our Form 10-K, Proxy Statement, and Corporate Social Responsibility Report in a Summary Report for fiscal 2016. Symbols highlight the themes discussed in each section: Fiscal 2016 Summary Report Letter to Shareholders 2 Financial Highlights for Fiscal 2016 4 Our Strategy 6 Governance and

After lodging your payment summary annual report (EMPDUPE) via the ATO business portal, a confirmation report is generated. If your confirmation report displays a WM02 warning about “street address line 2”, you can ignore this warning. It’s simply advising that the second line of your business address is blank. For most addresses this is normal.

How to complete the PAYG payment summary – individual non

ANNUAL REPORT OF ELECTORATE AND COMMUNICATION

The Payment Summary Assistant will prompt you to save your payment summary data as an EMPDUPE file. This is the file that you lodge with the ATO. This is the file that you lodge with the ATO. Before creating the EMPDUPE file, you can check the information it will contain by viewing the Payment Summaries Verification report.

Electronic reporting specification – Pay as you go (PAYG) withholding payment summary annual report version 13.0.1 – tracked These specifications are to be used in the development of software for the electronic lodgment of the pay as you go (PAYG) withholding payment summary annual reports for the 2018 and subsequent financial years.

12/04/2017 · Annual Report – small co-operative (PDF, 300.5 KB) Annual Report – large co-operative (PDF, 294.5 KB) Disclosure statement for formation distributing co-operative (Word, 32.9 KB)

Lodging your ATO payment summary copies electronically 159 Edit Report window – the starting point for modifying a report 201 Setting report properties 205 Filtering a report 207 Sorting a report 211 Changing the font properties 213 Adding and changing fields or graphics 213 Reorganising your report 214 Changing the column order 215 Changing column width 216 Aligning fields 216 Resizing

Departing Australia superannuation payments (DASP) annual report specification v1.0 Pay as you go (PAYG) withholding payments to foreign residents annual report specification v1.0.1 Pay as you go (PAYG) withholding payments to foreign residents annual report test scenario v1.0

Summary Annual Report Larry H Miller Associates Welfare Benefits Plan This is a summary of the annual report of the Larry H Miller Associates Welfare Benefits Plan, EIN 46- 1737092, Plan No. 501 for the period of 1/1/2016 through 12/31/2016. The annual report has been filed with the Employee Benefits Security Administration, as required under the Employee Retirement Income Security Act of 1974

When you send the payment summary to us as part of your PAYG withholding annual report , send the ‘Tax Office original’. We cannot accept photocopies or duplicates.

format of our Annual Report, adding content of interest to our shareholders and other stakeholders from our Form 10-K, Proxy Statement, and Corporate Social Responsibility Report in a Summary Report for fiscal 2016. Symbols highlight the themes discussed in each section: Fiscal 2016 Summary Report Letter to Shareholders 2 Financial Highlights for Fiscal 2016 4 Our Strategy 6 Governance and

1. Check software compatible ATO changes In 2017 the ATO changes made to the 2017 Payment Summary Annual Report and EMPDUPE file, for those businesses that employ working holiday makers with visa 417 and 462, or if

EMPDUPE Maker will then generate all the Payment Summaries and EMPDUPE file (including the now complying ETP Payment Summary). The only other option is to complete all the Payment Summaries and annual report on paper forms.

AnnuAl RepoRt & FinAnciAl StAtementS 2011 Annu A l Repo R t & Fin A nci A l St A tement S 2011 For more information www.informa.com

• includes payments to more than 5,000 SME partners and suppliers • 90% of our suppliers are Australian businesses • 1,350 branches. Commonwealth Bank of Australia Annual Report 2017 Financial report 6 Our business Performance overview 2 1 Corporate responsibility 3 Cor pore t a governance 4 Directors’ report 5 Other information 7 .5bn Reinvested • we invest profit back into …

The Global Payments Report offers a snapshot of the current payment landscape: globally, by region, and in 36 select countries. The report includes projected scenarios and trends over the next five years. In addition we offer a series of essays with Worldpay’s perspectives on key issues in the payments …

summary annual report, such as payments to employees • Payments made by home owners for private and domestic projects – for example, payments you make for building or renovating your own home. When to Report The Taxable payments annual report is due 21 July each year. The first Taxable payments annual report is due 21 July 2013 for payments made in the 2012-13 financial …

The ATO requires that all businesses submit a PAYG payment summary report (EMPDUPE file) for their employees by August 14. To make this simpler for you, You can automatically generate the required ‘EMPDUPE’ file which allows you to lodge your payment summary annual report online.

U.S. Department of Labor’s (DOL or the Department) annual Agency Financial Report (AFR) provides fiscal data and summary performance results that enable the …

…Electronic reporting specifications summary Software

summary annual report, such as payments to employees • Payments made by home owners for private and domestic projects – for example, payments you make for building or renovating your own home. When to Report The Taxable payments annual report is due 21 July each year. The first Taxable payments annual report is due 21 July 2013 for payments made in the 2012-13 financial …

Downloads AHPRA Annual Report 2016/17

SUMMARY ANNUAL REPORT FOR LOYOLA UNIVERSITY LONG

Performance reporting ATO Annual Report 2015-16