Client roadmap home loan pdf

All home loans. Home loans for buyers, investors and borrowers looking for a better deal. Orange Advantage . Includes a 100% interest offset when linked to our Orange Everyday bank account. Mortgage Simplifier. Low variable interest rate home loan with no ongoing monthly or annual fees. Fixed Rate Loan. Fixed interest rate home loans for terms of one to five years. Commercial Loans. …

Buyers Roadmap: The Home Buying Process. Where are you on the path to buying your new home in Loudoun? Have you contacted me yet to get your search started with a professional who can help you seek out your best opportunities and values in this market? I am available to answer your questions, explain the process, and help you get started. We will set up the areas where you want to focus and

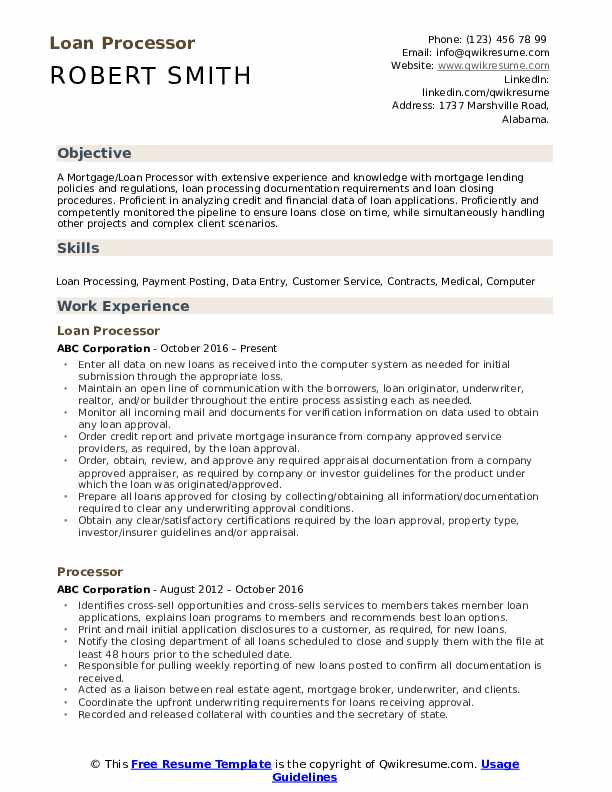

the home. Loan Processor — The loan processor’s job is to prepare your mortgage loan information and application for presentation to the underwriter. The loan processor will ask you for many documents, including documents about your income, your employment, your monthly bills and how much you have in the bank. In addition, the loan processor must make sure that all proper documen-tation is

First Home Buyers Moving Home Refinance Home Loan Property Investment Loans Home Loan Calculators Our Lenders Smartline Select™ Home Loan Types Home Buying Advice Insurance Car & Business Loans Car Finance Commercial Property Finance Business Equipment Finance

Home Loan Calculator. How much would you like to borrow? ($) Number of applicants? Dependents. Gross Annual Income Applicant One Gross Annual Income Applicant Two (if applicable) Other Monthly Income e.g. shares, rent (if applicable) Monthly Living Expenses ($) Monthly Loan …

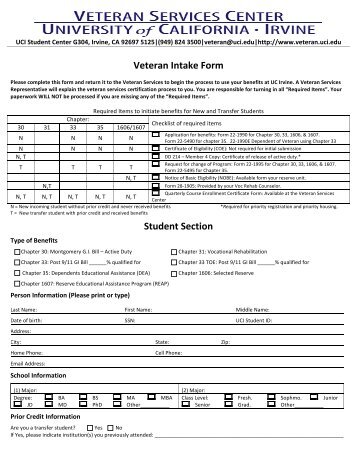

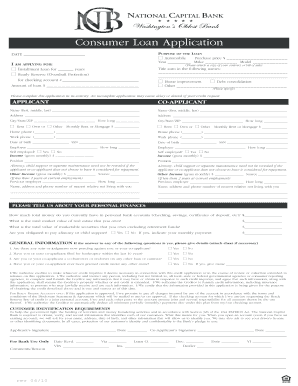

In your letter, give us the following information: Loan or application number (if known), date of application, name(s) of loan applicant(s), property address, and current mailing address. TOTALS -$

VAT implementation roadmap – Are you ready?-XO 201 A brief introduction to VAT The GCC states have worked together to develop a broad framework for the introduction of VAT. This framework agreement sets out the underlying principles of VAT laws for the six GCC countries. Member states retain some flexibility, such as how to treat healthcare, education and free zones for VAT purposes. …

FY19-20 aligned with the Group’s Investment Roadmap. Total income grew by one per cent from FY17, or two per cent on an underlying basis (excluding the million profit on sale in FY17). This was driven by net interest income growth of four per cent, while non-interest income contracted 17 per cent (nine per cent on an underlying basis). The improvement in net interest income was driven by

MB 08/01791.3 Page 3 of 14 AIG Australia Limited Mortgage/Finance Brokers, Originators, Managers Professional Liability Insurance Proposal Form

Keystart provides home loans to both first home buyers and subsequent home buyers. The two main advantages of getting a home loan through Keystart is that you only need to have a low deposit and if you can’t afford to buy all of a home our Shared Ownership scheme could help you.

the Client Portal. Client Portal Reference Guide 4. The Main section contains the following navigation options: Option Description Home Select Home to navigate to the Client Portal home page. Customer Care Select Customer Care to view Temenos’ Customer Care mission and policies. Documentation Select Documentation to navigate to the Documentation home page, which provides links to …

Client Needs Analysis I Rate Beat Mortgage Pty Ltd I Australian Credit Representative Number 490532 of echoice Home Loan Pty Ltd ACL 390502 Rate Beat Mortgage Pty Ltd – Authorized Credit Representative Number 490532 of Specialist Finance Group ACL 387025

Supporting Home Ownership A National Housing Roadmap 1 “Fianna Fáil will build more homes, create more jobs, help more first time buyers, empower more local authority tenants and secure more elderly people in their homes than any other party.” FOREWORD The right to own a home is a central part of Fianna Fáil’s vision for Ireland. For many this simple aspiration is slipping away as the

Buying a Home ontapcu.org

https://youtube.com/watch?v=2Oe0bPic6TY

The Home Buying Road Map Breakthrough Broker

Sé tú mismo. Siéntete a gusto. C M Y CM MY CY CMY K 10376_MTG_Home Buying Road Map_Spanish_PRINT.pdf 1 12/21/15 10:33 AM 877-774-2657

Keystart’s Shared Ownership Home Loan Scheme is designed to help low to moderate income earners for first and subsequent homebuyers. Depending on your income and household size, the Housing Authority will co-own with you up to 40% of a property with you, although some conditions apply.

Loan Refinance Form Use this form to transfer your existing investment loan with another provider to Westpac Online Investment Lending, for either a full or partial refinance. PDF Download

Mortgage Down is a combination home loan and an investment home loan licensed through Loan Reducer with an ATO product ruling that allows you to reduce your home loan interest rate and own your own home sooner.

Mortgage Choice was founded by the Higgins brothers over 25 years ago. They believed in giving Australians access to a choice of home loans, backed by …

From here to homeowner A roadmap to help you plan Consumer Financial Protection Bureau Use this worksheet as a guide to help you visualize your journey towards owning a home. Everyone’s process is different. Yours could take a short time or a long time, depending on your goals, constraints, personal style, and the market in your area. Having a plan will help you achieve your goals, even if

Click here for the home buying roadmap in Spanish Here is a copy of the text within both documents. Meet with a real estate professional: Discuss the type of home …

If you’re ready to buy a new home, whether it’s your first time or you’re simply moving to a new locale, before you even start viewing homes we recommend that you talk with a Home Loan Consultant at On Tap Credit Union who can work with you to determine how much money you’ll be able to borrow.

Submit the home loan application with supporting documents (including ID documents). Step 2 Shortly after the home loan application is formally approved, ING DIRECT will contact customers who have indicated they would like to hear about the Orange Everyday. Should the customer(s) request an Orange Everyday be opened, we will facilitate this process. Customers applying for an Orange Advantage

Home LoansDiscover which loan option is best for your situation. First Home Buyers Everything you need to know about owning your first home. Property Investment Access useful information to make smart investment decisions.

b) any home loan options given to me/us may not be fully appropriate to my/our individual home loan needs, especially those which Georgco Finance Group does not

QRIDA now provides the Loan Review Form in a writable PDF format. The writable form enables you to complete and save the application on your computer rather than completing by hand. The writable form enables you to complete and save the application on your computer rather than completing by hand.

A Roadmap for Sustainability A successful and sustainable loan origination system requires rigorous timelines, infrastructure readiness and workfow management.

A home loan discharge request is a request to remove Bankwest as the ‘Mortgagee’ on the Certificate of Title. Some of the main reasons you might be looking to …

HARP.gov LOWER YOUR MONTHLY PAYMENT By refinancing to a mortgage with a lower interest rate, you could pay less each month and over the 1 life of the loan.

The Home Buyer Roadmap By Rick Bunzel Mountain View Property Inspections Buying a home will be one of the most important investments of your life.

Download a Home Loan Facts Sheet. Simply provide the following information, and click on ‘view’ to generate a Home Loan Key Facts Sheet. If you would like to save the Home Loan Key Facts Sheet as a PDF, just click the ‘download key facts sheet’ button.

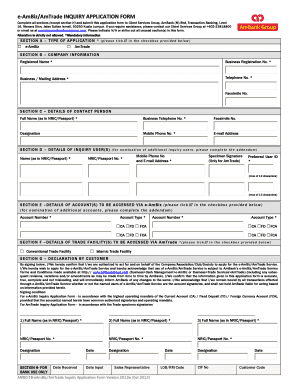

Loan Details. For mortgaged loan with various Loan Account Nos., please provide the corresponding Loan Account No. for request to be processed

Client Needs Analysis Dated Synergy Home Loans

Understanding repayment options on your Citibank home loan account To help you understand more about repayment options on your Citibank home loan account, we provide this easy to read guide,

HOME LOAN CHECKLIST CONFIDENTIAL DREAM HOME ROADMAP Items Needed For All Loans Pay stubs from the past 30 days. W-2 forms for the previous two years.

Client is ready to shop for a home with full loan approval. Realtor letters . available. Search for new home and even make a non-contingent offer Disclosures and rate lock Identify the address, purchase . contract, and insurance agent of desired property (if purchasing a home) Confirm intent to proceed Order appraisal and set appointment. An independent company . appraises home 3. CLOSING

FOR THE CREDIT ASSISTANCE PROVIDER: Disclose to the client and note any significant costs and/or risks associated with the features being sought. For example, costs of refinancing, fees for credit assistance services etc.

Has your home loan application ever been knocked back by a bank? Many lenders in Australia are quite strict when it comes to allowing people to borrow money for a home and chances are one of these 11 reasons will be the basis for why your application is knocked back.

Home Banner FACILITATING ACCESS TO QUALITY MEDICINES FOR ALL WHO NEED THEM HIV/AIDS, TB, malaria, Hepatitis B & C, neglected tropical diseases, diarrhoea, influenza and for reproductive health

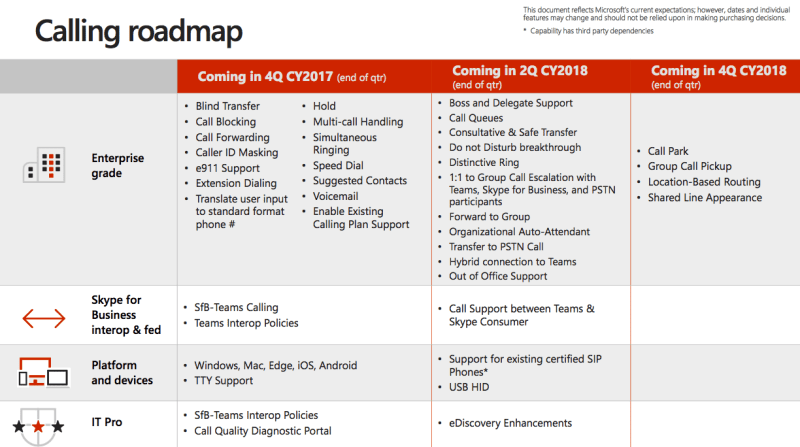

ELLIE MAE OVERVIEW, ROADMAP & CRM MORTGAGE STRATEGY Larry Fried – Director, Investor Business Development Elizabeth Etters – Account Manager, Mortgage Returns

Talk to us about a home loan Buying your first home Your Private Client Manager takes the strain out of your banking. They’re armed with a wealth of experience, a team of financial specialists and a dedication to helping you get the most out of your money.

Buyers Roadmap The Home Buying Process – Matt Boyer

The web version Roadmap also contains links to short videos on topics. • If you want, you can print the roadmap to use as checklist of your progress. Printable Roadmap (.pdf)

for a single-family home loan to more than 7,000 pages for a commercial loan. Staff continue to add Staff continue to add documents to the file throughout the life of the loan.

My client’s loan is described as a business/investment loan (delete as required) on the loan contract. My client appears to have signed a declaration stating that the purpose of the loan was business/investment (delete as required).

At Residential Mortgage Services (RMS), our experienced team of dedicated mortgage specialists will be there every step of the way to guide you through the financing process.

*Note: the home loan with the lowest current interest rate is not necessarily the most suitable for your circumstances, you may not qualify for that particular product, and not all products are available in all states and territories.

The home loan roadmap The process of taking a home loan can be daunting, especially if you have never. applied for any loan earlier. And ignorance on your part can not only make it an unpleasant experience, but also prove to be costly.

together, we’ll explore and discuss your loan options and help you make a well-informed decision about taking that next step. Experience has also shown us that there are certain actions that can impact every home financing journey. Follow these simple but important “Rules of the Road” and you’ll have a better chance of avoiding potential roadblocks. For informational purposes only and

Making informed financial choices Your Vehicle Buying Road Map Information provided by Stock # 26825-PRO . Good financial decisions start with good financial i n f o r m a t i o n. With Fundamentals of Personal Fi n a n c e : Making Informed Financial Choices, you have this handbook and others to help you gain the financial savvy and confidence you need for success. This self-help series makes

1 of 2 C onsumer F inancial Pr otection Bur ea u Lear or F QVX QDQF Y. Lifecycle o the militar onsumer Military occupatonal tranng

The Home Loan Roadmap Real Estate Appraisal Banks

Client Login Personal Mortgage Brokers Australia

https://youtube.com/watch?v=AdPhcpmQf70

rate you could pay less each month and over the 1 life of

ELLIE MAE OVERVIEW ROADMAP & CRM MORTGAGE STRATEGY

Client Needs Analysis Rate Beat Mortgage Pty Ltd

https://youtube.com/watch?v=R7qiEmRPwME

Supporting Home Ownership SUPPORTING A National Housing

Your home loan toolkit Consumer Financial Protection Bureau

Keystart Home Loans

MAY 2017 Lifecycle o the militar onsumer Lifecycle of the

Mortgage LOS Implementation A Roadmap for Sustainability

Referral Program Introducer Online

Resi client login Home Loan Experts

VAT implementation roadmap – Are you ready?-XO 201 A brief introduction to VAT The GCC states have worked together to develop a broad framework for the introduction of VAT. This framework agreement sets out the underlying principles of VAT laws for the six GCC countries. Member states retain some flexibility, such as how to treat healthcare, education and free zones for VAT purposes. …

Making informed financial choices Your Vehicle Buying Road Map Information provided by Stock # 26825-PRO . Good financial decisions start with good financial i n f o r m a t i o n. With Fundamentals of Personal Fi n a n c e : Making Informed Financial Choices, you have this handbook and others to help you gain the financial savvy and confidence you need for success. This self-help series makes

Client Needs Analysis I Rate Beat Mortgage Pty Ltd I Australian Credit Representative Number 490532 of echoice Home Loan Pty Ltd ACL 390502 Rate Beat Mortgage Pty Ltd – Authorized Credit Representative Number 490532 of Specialist Finance Group ACL 387025

The web version Roadmap also contains links to short videos on topics. • If you want, you can print the roadmap to use as checklist of your progress. Printable Roadmap (.pdf)

Loan Refinance Form Use this form to transfer your existing investment loan with another provider to Westpac Online Investment Lending, for either a full or partial refinance. PDF Download

Talk to us about a home loan Buying your first home Your Private Client Manager takes the strain out of your banking. They’re armed with a wealth of experience, a team of financial specialists and a dedication to helping you get the most out of your money.

Loan Details. For mortgaged loan with various Loan Account Nos., please provide the corresponding Loan Account No. for request to be processed

Submit the home loan application with supporting documents (including ID documents). Step 2 Shortly after the home loan application is formally approved, ING DIRECT will contact customers who have indicated they would like to hear about the Orange Everyday. Should the customer(s) request an Orange Everyday be opened, we will facilitate this process. Customers applying for an Orange Advantage

FY19-20 aligned with the Group’s Investment Roadmap. Total income grew by one per cent from FY17, or two per cent on an underlying basis (excluding the million profit on sale in FY17). This was driven by net interest income growth of four per cent, while non-interest income contracted 17 per cent (nine per cent on an underlying basis). The improvement in net interest income was driven by

The Home Buyer Roadmap Pacific Crest Inspections

Resi client login Home Loan Experts

The web version Roadmap also contains links to short videos on topics. • If you want, you can print the roadmap to use as checklist of your progress. Printable Roadmap (.pdf)

All home loans. Home loans for buyers, investors and borrowers looking for a better deal. Orange Advantage . Includes a 100% interest offset when linked to our Orange Everyday bank account. Mortgage Simplifier. Low variable interest rate home loan with no ongoing monthly or annual fees. Fixed Rate Loan. Fixed interest rate home loans for terms of one to five years. Commercial Loans. …

Download a Home Loan Facts Sheet. Simply provide the following information, and click on ‘view’ to generate a Home Loan Key Facts Sheet. If you would like to save the Home Loan Key Facts Sheet as a PDF, just click the ‘download key facts sheet’ button.

FY19-20 aligned with the Group’s Investment Roadmap. Total income grew by one per cent from FY17, or two per cent on an underlying basis (excluding the million profit on sale in FY17). This was driven by net interest income growth of four per cent, while non-interest income contracted 17 per cent (nine per cent on an underlying basis). The improvement in net interest income was driven by

FOR THE CREDIT ASSISTANCE PROVIDER: Disclose to the client and note any significant costs and/or risks associated with the features being sought. For example, costs of refinancing, fees for credit assistance services etc.

for a single-family home loan to more than 7,000 pages for a commercial loan. Staff continue to add Staff continue to add documents to the file throughout the life of the loan.

Has your home loan application ever been knocked back by a bank? Many lenders in Australia are quite strict when it comes to allowing people to borrow money for a home and chances are one of these 11 reasons will be the basis for why your application is knocked back.

Mortgage Down is a combination home loan and an investment home loan licensed through Loan Reducer with an ATO product ruling that allows you to reduce your home loan interest rate and own your own home sooner.

My client’s loan is described as a business/investment loan (delete as required) on the loan contract. My client appears to have signed a declaration stating that the purpose of the loan was business/investment (delete as required).

Keystart provides home loans to both first home buyers and subsequent home buyers. The two main advantages of getting a home loan through Keystart is that you only need to have a low deposit and if you can’t afford to buy all of a home our Shared Ownership scheme could help you.

Talk to us about a home loan Buying your first home Your Private Client Manager takes the strain out of your banking. They’re armed with a wealth of experience, a team of financial specialists and a dedication to helping you get the most out of your money.

In your letter, give us the following information: Loan or application number (if known), date of application, name(s) of loan applicant(s), property address, and current mailing address. TOTALS -$

The Home Buyer Roadmap By Rick Bunzel Mountain View Property Inspections Buying a home will be one of the most important investments of your life.

Client Needs Analysis georgcofinance.com